Introduction: Navigating the Global Market for sla 3d

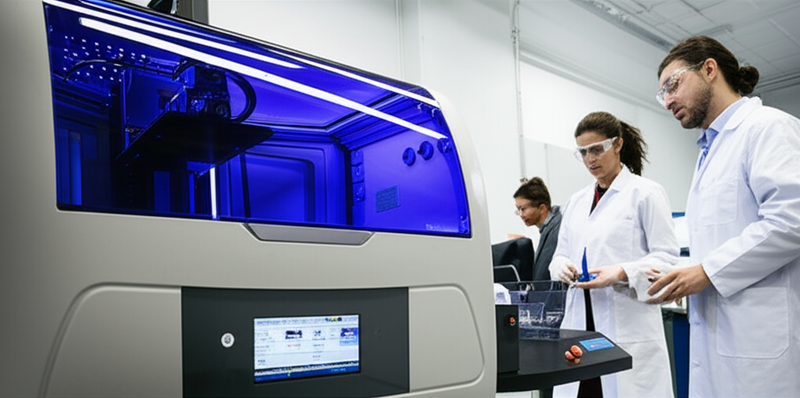

Stereolithography (SLA) 3D printing has emerged as a transformative force across global manufacturing—enabling the creation of highly precise, intricate, and production-grade parts from digital designs. From automotive prototyping in Germany to rapid tooling in the Middle East and healthcare applications in South America, SLA technology empowers organizations to accelerate product development and achieve new standards of quality and efficiency. For B2B buyers operating in rapidly evolving markets—including Africa and Europe—the ability to leverage the right SLA solutions can define the pace of innovation and ensure long-term competitiveness.

However, tapping into the full potential of SLA 3D printing requires more than just technical understanding. International buyers must navigate a complex landscape of machine types, resin chemistries, manufacturing standards, and supplier capabilities that vary by region and application. Factors such as build size, part accuracy, material selection, and post-processing requirements all directly impact project outcomes and cost-efficiency. Additionally, sourcing strategies differ based on market maturity, logistical considerations, and growth trends—making informed decision-making critical for long-term success.

This B2B guide delivers a comprehensive roadmap for buyers seeking clarity and confidence in the global SLA 3D printing market. Readers will discover:

- Core SLA technologies and machine variants

- Material properties and selection best practices

- Key manufacturing and quality control benchmarks

- Supplier ecosystems, shortlisting, and evaluation tips

- Cost structures, pricing models, and negotiation insights

- Regional market trends and strategic sourcing considerations

- Frequently asked questions and actionable expert advice

With focused insights tailored to the unique challenges of African, South American, Middle Eastern, and European buyers, this guide equips procurement teams and technical managers to make well-informed investments, reduce sourcing risks, and unlock new growth opportunities in their respective industries.

Understanding sla 3d Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard SLA | Uses precise UV laser, prioritizes dimensional accuracy and fine detail | Prototyping, modeling, tooling | Superior detail and accuracy; post-processing needed |

| Large-Format SLA | Enlarged build area for bigger components | Automotive, aerospace, architecture | Enables large parts, higher costs and longer print times |

| Top-Down SLA | Laser above vat; moves build platform downward | Industrial production, medical devices | Stable printing for deep vats; higher resin usage and cost |

| Bottom-Up SLA | Laser below vat; part builds upside down | Dental, jewelry, small part manufacturing | Efficient resin use, cost-effective; adhesion can be an issue |

| Digital Light Processing (DLP) SLA | Projects entire layer via digital projector for faster curing | Batch production, rapid prototyping | High speed, good for multiple small parts; slightly lower Z resolution |

Standard SLA

Standard SLA employs a UV laser to cure photopolymer resin, producing parts with exceptional surface finishes and fine details. This type is best for applications demanding precision, such as prototypes, high-fidelity models, and detailed tooling. For B2B buyers, particularly those in regions where supply chains may be variable, the reliability and versatility of standard SLA make it a compelling baseline choice. However, total cost of ownership must consider expenses for post-processing, resin handling, and operator skill requirements.

Large-Format SLA

Large-format SLA systems are engineered with expanded build volumes to accommodate bigger parts or multiple items in a single print cycle. Industries such as automotive, aerospace, and architecture benefit from their ability to create complex, large-scale prototypes, functional components, or architectural models in one piece. Buyers should evaluate their space, logistics, and maintenance capacity, as large-unit machines require significant investment, dedicated floorspace, and higher resin volumes, which may impact transportation and downstream supply chain planning, especially in emerging markets.

Top-Down SLA

The top-down SLA mechanism positions the laser above the vat, lowering the build platform as each layer is completed. This method improves layer consistency and is suitable for deep vats and higher-volume industrial printing, making it valuable for medical, engineering, and heavy manufacturing uses. Key considerations for buyers include higher resin consumption—unused resin cannot always be readily recovered—and the need for regular vat maintenance. For buyers in cost-sensitive regions, resin waste management and equipment support capabilities are crucial decision factors.

Bottom-Up SLA

Bottom-up SLA inverts the build process, with the laser under the vat and the part building upside down. This configuration minimizes resin requirements, as only a thin layer is needed between the vat base and the part. It serves industries such as dental, jewelry, and batch manufacturing of small, intricate parts where resin conservation is important. Buyers benefit from lower operating costs and efficient material usage; however, they must be aware of potential challenges with part adhesion and detachment from the build surface, which may affect throughput and require skilled operators or reliable after-sales support.

Digital Light Processing (DLP) SLA

DLP SLA uses a digital projector to cure whole layers at once, drastically reducing print times. This variant is ideal for batch production and applications needing rapid cycles, such as dental aligners, jewelry casting, or small industrial components. While DLP SLA offers outstanding speed and productivity, its slightly lower resolution on the Z axis may be a consideration for those needing ultra-fine detail. B2B buyers should factor in not only the time savings and throughput but also the compatibility of available resins and the supplier’s ability to provide consumables and technical support in their region.

Related Video: SLA 3D Printing – What Is It And How Does It Work?

Key Industrial Applications of sla 3d

| Industry/Sector | Specific Application of sla 3d | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Healthcare & Dental | Custom dental aligners, surgical guides, medical models | High precision, patient-specific solutions, reduced lead times | Biocompatibility, regulatory compliance (e.g., CE, FDA), print accuracy, validated materials |

| Automotive & Transport | Rapid prototyping of functional parts and assemblies | Accelerated R&D cycles, lower prototyping costs, design flexibility | Part accuracy, material strength, post-processing capabilities, supplier lead times |

| Consumer Electronics | Enclosures and housings for small-batch electronics | Excellent surface finish, rapid iteration, small-batch feasibility | Resin durability, tolerances, ability to integrate with secondary operations |

| Industrial Equipment | Jigs, fixtures, and tooling for production lines | Customization, reduced downtime, improved efficiency | Wear resistance, dimensional stability, material properties, service turnaround time |

| Education & Research | Complex teaching aids, scientific models, laboratory devices | Enhanced visualization, support for complex structures, fostering innovation | Availability of safe resins, repeatability, cost-effectiveness, technical support |

Healthcare & Dental

SLA 3D printing is extensively used to manufacture custom dental aligners, surgical guides, and anatomical models tailored to individual patients. Its high resolution and accuracy enable the creation of devices that fit precisely, which is crucial for clinical success and patient safety. For B2B healthcare buyers, especially those serving diverse populations in Europe, Africa, or the Middle East, key requirements include validated biocompatible materials, strong supplier documentation, and compliance with local health regulations. Rigorous sourcing ensures both product quality and regulatory approval.

Automotive & Transport

Automotive OEMs and suppliers rely on SLA 3D printing for rapid prototyping of complex parts—such as brackets, lamp housings, and fluid flow components. This enables quick design changes, functional testing, and even small-batch production, significantly reducing development cycles. Buyers in regions like Germany, South America, and the Middle East should prioritize suppliers with proven material strength, precision, and reliable post-processing options to ensure rapid turnaround and compatibility with downstream integration.

Consumer Electronics

For the consumer electronics sector, SLA is ideal for producing detailed enclosures, button panels, and housing prototypes in small batches. The technology delivers exceptional surface finish, enabling functional and aesthetic parts to be evaluated quickly before advancing to mass production. B2B buyers should look for suppliers with experience in delivering high-tolerance prototypes, utilizing durable and impact-resistant resins, and offering flexibility for secondary finishing or assembly steps—particularly important for fast-paced markets in Europe, Africa, and South America.

Industrial Equipment

Manufacturers leverage SLA to produce customized assembly jigs, inspection fixtures, and specialized tooling. These components, tailored to specific machinery and workflows, help reduce manual errors, accelerate production ramp-up, and minimize equipment downtime. International buyers must ensure their partners can supply high-strength, stable resins and offer rapid delivery cycles. Long-term reliability, abrasion resistance, and the ability to support revisions based on operator feedback are critical sourcing criteria.

Education & Research

Universities and research institutions utilize SLA 3D printing to fabricate complex teaching aids, scientific models, and experimental apparatus not feasible with conventional methods. This supports advanced learning and rapid prototyping of research tools. For buyers across Africa, Spain, and the Middle East, it is vital to select suppliers who offer accessible technical support, cost-effective print runs, and safe, non-toxic resin options to facilitate ongoing educational innovation and experimentation.

Strategic Material Selection Guide for sla 3d

When sourcing parts produced using SLA 3D printing for business, choosing the proper resin is fundamental to project success and compliance with regional regulations. International B2B buyers from Africa, South America, the Middle East, and Europe each face unique challenges—be it climate variation, supply chain reliability, or adherence to strict local standards such as DIN in Germany or the EU’s REACH directives. Below is a practical analysis of four of the most widely used SLA 3D printing materials, along with actionable considerations related to each.

Standard (General Purpose) Resin

Key Properties:

Standard SLA resins produce parts with a smooth, high-resolution surface, excellent for visual prototypes and parts where aesthetics are critical. They typically have low to moderate mechanical strength, with heat deflection temperatures around 45-55°C and limited impact resistance. Chemical resistance is average; standard resins may degrade in aggressive solvent or UV-rich environments.

Pros & Cons:

Pros: Cost-effective, short lead times, quick prototyping.

Cons: Brittle under stress, low thermal resistance, and generally not suitable for end-use items exposed to mechanical or environmental wear.

Impact on Application:

These resins are best for conceptual models, display parts, and low-stress tooling. Not recommended for functional prototypes under load or outdoor products.

International B2B Considerations:

Buyers in the EU (Germany, Spain) must check REACH compliance and local handling/safety standards. UV sensitivity poses transit/storage consideration for regions with intense sunlight (Middle East, Africa). For buyers with cost pressure and moderate product performance requirements, standard resin offers an economical and rapid option.

Tough Resin

Key Properties:

Tough resins are engineered to mimic the mechanical performance of ABS plastic—offering higher impact strength, improved elongation before fracture, and greater resistance to mechanical stress. Heat deflection temperatures range from 45–70°C, and chemical compatibility is slightly better than standard resins.

Pros & Cons:

Pros: Suitable for functional testing, snap-fit assemblies, housings, and jigs/fixtures.

Cons: More expensive than standard, may shrink slightly during curing, and can show reduced performance in very high-humidity environments.

Impact on Application:

Ideal for applications requiring durability and some flexibility, such as casings, operational prototypes, and fixtures that experience occasional knocks or drops.

International B2B Considerations:

For automotive and electronics buyers (Germany, Spain), ensure material data sheets mention compliance with EN ISO or ASTM mechanical property testing. Resilience to minor shipping shocks is relevant for parts traveling across multiple climate regions (Africa, South America). Consider sourcing from suppliers familiar with regional logistics and climate-specific packaging.

High-Temperature Resin

Key Properties:

These resins can withstand significantly higher temperatures—typical heat deflection temperatures (HDT) reach 180–238°C, making them suitable for molds, thermal tests, or electrical housing exposed to heat. Mechanical strength is moderate; brittleness can occur under shock or flex.

Pros & Cons:

Pros: Enables design and process verification for thermal applications; essential for rapid tooling, under-the-hood parts, or sterilization trays.

Cons: Cost is higher than general and tough resins; parts may be prone to cracking under strain or if improperly post-cured.

Impact on Application:

Best for heat-loading scenarios: component testing, hot fluidics, or short-run injection mold inserts. Not typically used for general-purpose parts.

International B2B Considerations:

Required in industries with rigorous safety/thermal standards (automotive, industrial, healthcare—particularly in European markets). Confirm material certifications such as RoHS, REACH, and adherence to country-specific safety protocols. Transit/storage in high-heat climates should be managed to avoid deformation pre-installation.

Flexible Resin

Key Properties:

Flexible SLA resins simulate the properties of synthetic rubbers, offering shore hardness from ~50A to 80A (depending on formula), high elongation, and strong tear resistance. Their HDT is low (often below 50°C), and they can degrade under oils or aggressive chemicals.

Pros & Cons:

Pros: Suited for seals, gaskets, soft grips, and ergonomic prototypes.

Cons: More complex to post-process, limited load-bearing, costlier than standard resin, potential supply constraints in certain emerging markets.

Impact on Application:

Common where tactile feedback, shock absorption, or functional simulation of rubber components is needed.

International B2B Considerations:

European buyers may prioritize biocompatibility or certification to DIN/ISO-10993 for some healthcare applications. Storage in humid/hot environments (Africa, Middle East) can accelerate aging; plan accordingly. Check availability, as not all suppliers in South America or Africa may stock newer flexible resin chemistries.

Summary Table

| Material | Typical Use Case for sla 3d | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Standard (General Purpose) | Visual prototypes, non-functional models | Cost-effective, fast turnaround | Brittle, poor thermal/mechanical performance | Low |

| Tough Resin | Functional prototypes, jigs/fixtures | Enhanced impact resistance, durability | More expensive, can shrink, humidity sensitive | Medium |

| High-Temperature Resin | Thermal testing, molds, electrical housings | Withstands high temperatures | High cost, can be brittle, special handling | High |

| Flexible Resin | Seals, gaskets, ergonomic soft-touch components | Simulates rubber, good elongation | Post-processing complexity, low HDT, availability varies | Medium–High |

In-depth Look: Manufacturing Processes and Quality Assurance for sla 3d

The production of SLA 3D printed components follows precise, technology-driven workflows designed to deliver highly detailed and accurate parts that meet the rigorous demands of B2B clients. For international buyers—especially those across Africa, South America, the Middle East, and Europe—understanding how these manufacturing processes and associated quality assurance (QA) frameworks function is crucial for sourcing reliable custom or production-grade components.

Overview of the SLA 3D Manufacturing Workflow

The manufacturing process for SLA 3D printing can be categorized into four key stages: material preparation, printing (forming), post-processing & finishing, and final assembly (if applicable). Each phase directly impacts the end-part’s functionality, tolerance, and cosmetic quality.

1. Material Preparation

- Resin Selection: The process begins with the selection of photopolymer resins adjusted for application—these may be standard, engineering-grade, or specialty resins (e.g., dental, high-temp, biocompatible).

- Resin Handling: Strict material handling protocols are followed to avoid contamination and to maintain consistent viscosity. For sensitive applications, suppliers must document the resin’s lot number and shelf life.

- Conditioning: Resin is stirred and sometimes temperature-stabilized per manufacturer instructions to ensure homogeneous curing and repeatable print quality.

2. Printing (Forming the Part)

- Machine Setup: SLA printers are calibrated for layer height, exposure time, and build orientation based on the part’s geometry.

- Layer-by-Layer Curing: Using a UV laser directed by high-precision galvo mirrors, the build platform is immersed in a resin vat, layer heights are typically set between 25–100 microns to balance detail and speed.

- Build Monitoring: Critical parameters—laser power, layer adhesion, vat temperature—are monitored in real time. Some advanced facilities log process data for each individual print batch, which can be shared with B2B buyers on request.

- Support Structures: Automated or manual support generation is applied for overhanging features. Their removal is carefully managed to prevent damage.

3. Post-processing and Finishing

- Resin Removal: Printed parts undergo a two-step washing process (usually in isopropyl alcohol) to eliminate residual uncured resin.

- Curing: A secondary UV curing step is performed to fully harden the part and achieve final mechanical and thermal properties. Cycle parameters are controlled per resin manufacturer guidelines.

- Support Removal & Surface Finishing: Mechanical removal of supports is performed manually or with specialized tools; for higher-volume B2B projects, automated systems may be deployed. Post-processing includes sanding, polishing, or secondary coatings as per contractual requirements.

- Customization: Parts intended for assemblies may undergo further finishing operations such as joining, painting, or insertion of fasteners.

4. Final Assembly and Inspection

Where products require assembly (e.g., for jigs, fixtures, or complex prototypes), the process includes:

– Component Fit-Check: Ensuring that all parts conform to dimensional tolerances for seamless assembly.

– Functional Testing: For assemblies, functional verification against buyer-supplied criteria is carried out, especially for moving or load-bearing components.

Quality Assurance and International Standards

Rigorous quality control (QC) ensures the repeatability and reliability of SLA 3D parts. International B2B buyers should assess how suppliers implement both universal and industry-specific QA frameworks.

Core International Standards

- ISO 9001: Many established SLA 3D printing providers are ISO 9001 certified. This standard guarantees that documented, audited quality management systems are in place, with defined processes for quality planning, traceability, risk management, and continual improvement.

- Industry-Specific Certifications:

- Medical Devices: ISO 13485, CE marking for EU (e.g., Germany, Spain), US FDA registration, and MDSAP may be relevant.

- Automotive/Aerospace: IATF 16949 or AS9100 for parts used in transport, especially important for European and Middle Eastern buyers.

- Others: RoHS compliance, UL listings, or customer-specific requirements can also apply.

Key QC Checkpoints Throughout Production

- Incoming Quality Control (IQC): Raw photopolymer resin is inspected for batch consistency, expiration, and contamination. Certificates of Analysis (CoA) may be requested by B2B buyers as proof.

- In-Process Quality Control (IPQC): During printing, operators or automated systems check for printer calibration, environmental stability, and print anomalies. Process logs and in-situ monitoring are good indicators of a mature QC process.

- Final Quality Control (FQC): All finished parts are inspected for dimensional accuracy (using calipers, coordinate measuring machines, or 3D scanning), surface finish, and absence of defects (e.g., layer delamination, warping, incomplete cure).

Common Testing and Verification Methods

- Dimensional Inspection: Random samples (or 100% inspection for critical parts) are measured against the buyer’s engineering drawings or digital models.

- Material Property Testing: Certain parts may undergo mechanical property validation—tensile, compression, or hardness tests—to verify that printing meets specified requirements.

- Visual Inspection: Each part is assessed for aesthetic defects, over-cure, or residue. Strict cosmetic criteria often apply for visible parts.

- Functional Testing: Where relevant (e.g., prototypes or end-use parts), fit, assembly, or operational testing confirms functionality.

Best Practices for B2B Buyers: Verifying Supplier Quality

International buyers must actively manage the QC relationship to ensure that purchased components meet both technical and regulatory expectations.

1. Supplier Audits

- Pre-Qualification Audits: Request on-site or virtual audits to review QA documentation, training records, equipment calibration logs, and process flows.

- Regular Re-Audits: For ongoing partnerships, periodic audits help ensure continued compliance, especially important for regulated industries in Germany, Spain, or the EU.

2. Documentation and Traceability

- QC Reports: Require detailed inspection reports that include measurement data, photos, and non-conformance records for each lot or shipment.

- Batch Records: For sensitive applications, ask for batch traceability back to resin lots and machine logs.

3. Third-Party Inspections

- Independent Inspectors: Especially valuable when buying from unfamiliar territories, employ third-party inspection agencies to validate quality before shipment.

- Sample Approvals: Request pre-shipment part samples for review, or set up system for “first article inspection” before release of mass production.

4. Regulatory and Regional Nuances

- Europe (Germany, Spain): Expect strict compliance with CE marking, REACH, and local safety/environmental directives for end-use parts. Buyers may be required to file product documentation for regulatory review.

- Middle East and Africa: Scrutinize supplier conformity to ISO standards, but also confirm adaptation to specific import standards or government certifications where applicable.

- South America: Consider logistics partner familiarity with local customs regulations, and insist on shipping documents that include all required compliance certificates.

- All Regions: Confirm that intellectual property (IP) is protected, particularly regarding custom designs or proprietary assemblies.

Actionable Takeaways

- Vet Supplier Certifications Carefully: Always obtain up-to-date ISO 9001 or industry-specific certificates.

- Demand Process Transparency: Secure process documentation and QC reports for every shipment.

- Insist on In-Process Monitoring: Require suppliers to share data or logs proving in-process quality control.

- Leverage Local Compliance Experts: Consult with local regulatory partners to address the nuances of CE, RoHS, or other region-specific requirements.

- Regular Communication: Maintain a direct line with supplier QA teams and use regular audits and reports to drive proactive improvement.

By focusing on these key aspects of SLA 3D manufacturing and quality assurance, international B2B buyers can confidently source high-performance components while minimizing compliance risks and supply chain disruptions.

Related Video: How Does SLA 3D Printing Work?

Comprehensive Cost and Pricing Analysis for sla 3d Sourcing

Understanding the Key Cost Components in SLA 3D Sourcing

When evaluating the overall cost structure of sourcing SLA 3D printing services, international B2B buyers need to break down expenses into several core components:

-

Materials: Resin is the main consumable, with varying prices depending on formulation, color, and special properties (e.g., engineering, biocompatibility, transparency). The cost per liter can differ significantly, especially when importing proprietary or specialty resins. Material utilization, support structures, and wastage rates must also be considered, as unused resin may not always be reclaimable.

-

Labor: This includes skilled operator time for machine setup, monitoring, part removal, resin handling, and post-processing (washing, curing, support removal). Labor rates can differ widely based on supplier location and expertise.

-

Manufacturing Overhead: Amortized costs of equipment, maintenance, energy usage, and facility expenses are apportioned per project. Higher throughputs and efficient scheduling help reduce per-part overheads.

-

Tooling/Setup: While SLA is generally tooling-free, complex parts may require custom supports or fixtures. Initial file preparation and print validation can add labor hours, especially for highly customized or intricate components.

-

Quality Control (QC): Inspection, measuring, and certifying parts add measurable costs—especially where compliance with stringent standards (ISO, CE) or industry certifications is required.

-

Logistics: Shipping finished SLA parts involves packaging, export/import documentation, customs duties, insurance, and potential time-in-transit fees. Resin-based parts may require special handling during shipping, which can add complexity and cost, particularly for transcontinental shipments.

-

Margin: Suppliers’ profit margins will be applied, influenced by their business model, competition, and perceived value add (such as engineering support or rapid turnaround).

Factors Influencing SLA 3D Printing Pricing in the International B2B Context

Several considerations shape final pricing when sourcing SLA 3D printed components across Africa, South America, the Middle East, and Europe:

-

Order Volume and Minimum Order Quantities (MOQ): Larger batch sizes typically benefit from economies of scale, resulting in lower per-unit pricing due to distributed setup and overhead costs. Low-volume or prototype orders tend to incur higher unit prices.

-

Specifications and Customization: Requirements for tight tolerances, complex geometries, or unique material properties (e.g., heat-resistance, medical-grade) will add to both material and labor costs. Repeat runs of the same design allow for cost optimization.

-

Material Selection: Engineering and specialty resins command premium prices. Easy-to-source general-purpose resins keep costs lower, while customized or regionally restricted materials may involve extra procurement or shipping costs.

-

Quality and Certification Demands: Buyers in regulated sectors or from markets such as Germany and Spain may require supplier adherence to international standards (ISO 9001, CE marking), driving up QC costs.

-

Supplier Capabilities and Location: Suppliers with advanced equipment, high throughput, or strong export track records may offer more competitive pricing and reliability. Domestic versus overseas sourcing decisions will impact lead times, logistics, and landed cost.

-

Incoterms and Payment Terms: The choice between EXW, FOB, CIF, or DDP significantly alters cost exposure for buyers. Favorable payment terms (e.g., net 60, L/C) can also influence the total procurement cost.

Actionable Tips for B2B Buyers to Optimize SLA 3D Sourcing Costs

-

Request Detailed, Itemized Quotes: Insist on breakdowns showing all cost components (materials, labor, QC, etc.). This enables precise benchmarking and negotiation.

-

Negotiate Based on Total Cost of Ownership (TCO): Include not just unit price but also shipping, customs, insurance, and post-processing factors relevant to your region. For example, buyers in Africa and South America should account for longer transit and customs clearance times.

-

Optimize Volume and Batch Runs: Where possible, pool orders or consolidate batch runs to meet supplier MOQs for improved pricing and priority service.

-

Standardize Specifications: Standardize materials and tolerances whenever feasible to leverage bulk pricing and reduce engineering change costs.

-

Vet Supplier Experience in Target Markets: Prioritize suppliers who already serve your region or have proven export history, which can reduce unforeseen delays and ensure smoother customs processes.

-

Clarify Incoterms Upfront: Avoid hidden costs by confirming who bears responsibility and cost for each shipping leg and customs process.

-

Factor Certification and Compliance Needs Early: Clearly communicate industry or country-specific certificate requirements, as last-minute compliance efforts can dramatically raise costs or cause shipment holds.

Disclaimer: All SLA 3D printing cost and price estimates are indicative. Actual pricing can fluctuate based on global resin market trends, exchange rates, supplier capabilities, and specific buyer requirements. Buyers are encouraged to source multiple quotes and leverage supplier relationships for the most accurate, up-to-date pricing.

Spotlight on Potential sla 3d Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘sla 3d’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Globalinforesearch (www.globalinforesearch.com)

Globalinforesearch operates as a global supplier and analyst in the SLA 3D printing market, with a focus on tracking industry trends, regional sales dynamics, and market share of leading SLA 3D printer manufacturers. By emphasizing detailed market segmentation and reporting, Globalinforesearch provides valuable insight for B2B buyers targeting high-precision, rapid prototyping, and production applications in sectors such as cosmetics, industrial manufacturing, and mold making. Their coverage extends across key regions—including Africa, South America, the Middle East, and Europe—making them a useful reference point for international procurement and market benchmarking. While direct manufacturing details are limited, their industry expertise and market intelligence can support sourcing strategies, supplier comparisons, and partnership assessment for buyers seeking reliable and current information on SLA 3D technology suppliers worldwide.

10 Sla printer manufacturers in the World 2025 (www.sourcifychina.com)

10 Sla printer manufacturers in the World 2025 is a curated, global collective featuring leading SLA 3D printer producers and solution providers sourced from markets such as China, Europe, and the US. The group showcases manufacturers offering extensive product lines—from precision-focused dental and jewelry SLA printers to large-format machines for industrial and prototyping applications. Notable strengths include high adaptability for complex geometries, advanced surface quality, and rapid processing capability. Participating brands are recognized for leveraging industrial-grade engineering and R&D, supporting customization and integration for B2B projects. While the list highlights technical leadership, details regarding certifications or compliance standards may vary across individual manufacturers. The comparative format assists international buyers from Africa, South America, the Middle East, and Europe by providing a consolidated starting point for sourcing, facilitating competitive assessment and direct engagement with multiple global suppliers.

14 Leading 3D Printing Companies As Of 2025 (www.rankred.com)

With over 38 years of industry leadership and annual revenues exceeding $440 million, this company is widely credited with inventing stereolithography (SLA) and commercializing advanced SLA 3D printing platforms. Their key products, including the SLA 750 and Figure 4 series, set industry benchmarks for precision and reliability, making them a trusted partner for demanding sectors such as automotive, aerospace, and healthcare. Extensive R&D investment has enabled ongoing innovation in SLA materials and processes, supporting consistent delivery of high-quality, production-grade parts with intricate geometries and smooth surface finishes.

Key Advantages for International Buyers

- Proven Track Record: Decades of expertise in global deployment, supporting clients across Europe, the Middle East, Africa, and South America.

- Comprehensive Portfolio: Offers both hardware and resin solutions tailored for industrial-scale applications.

- Scalable Solutions: Capable of supporting high-volume manufacturing as well as specialized, low-batch prototyping.

- Quality Assurance: Established reputation for robust quality controls and compliance with international manufacturing standards.

B2B buyers seeking mature, field-proven SLA 3D technology with strong technical support and deep sector experience will find this manufacturer a stable, long-term partner.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| Globalinforesearch | Market intelligence for global SLA 3D sourcing. | www.globalinforesearch.com |

| 10 Sla printer manufacturers in the World 2025 | Global platform for top SLA 3D suppliers. | www.sourcifychina.com |

| 14 Leading 3D Printing Companies As Of 2025 | SLA technology innovator, global industry leader. | www.rankred.com |

Essential Technical Properties and Trade Terminology for sla 3d

Key Technical Properties for B2B SLA 3D Printing Procurement

Selecting stereolithography (SLA) 3D printing solutions for B2B applications requires a strong understanding of their most critical technical properties. When evaluating suppliers or production partners, these specifications directly impact part performance, suitability for your industry, and supply chain efficiency.

1. Material Grade and Type

SLA uses photosensitive resins, each offering unique mechanical and chemical properties. Grades range from general-purpose resins (for concept models) to engineering-grade or specialty resins (for end-use parts or prototypes with high heat, strength, or chemical resistance). Always verify with suppliers which resins are certified for your sector (e.g., medical, automotive) and clarify documentation needs. This will ensure compliance with international standards and consistent product quality.

2. Dimensional Accuracy and Tolerance

Dimensional accuracy refers to how closely the printed part matches your original CAD model. Typical SLA tolerance ranges from ±0.05 mm to ±0.2 mm, depending on part size and geometry. This precision is crucial for components that must fit with others or meet regulatory requirements. When negotiating, request full tolerance data and ask for sample parts or third-party QA results.

3. Surface Finish

SLA is prized for its smooth surface finish—often achieving a finish of Ra 0.4–1.2 µm without significant post-processing. Smooth surfaces are essential for applications like dental devices, fluidics, or consumer products, where aesthetics or sealing functions are critical. Confirm with suppliers the standard finish as-printed and options for secondary finishing if required.

4. Build Volume/Size Limits

The maximum part size (build volume) an SLA printer can handle varies by equipment. Industrial machines offer build volumes up to 800 x 600 x 400 mm, while smaller units will be limited. For B2B buyers, knowing the feasible build size is essential to ensure your parts can be produced in one piece, reducing assembly needs and lead times.

5. Layer Height (Resolution)

Layer height defines the minimum vertical resolution—commonly 25–100 microns for SLA. Lower layer heights enhance fine details and curved surfaces but increase manufacturing cost and time. Adjust the layer setting to your application’s requirements, balancing aesthetics and efficiency.

6. Mechanical and Thermal Properties

Mechanical specs such as tensile strength, impact resistance, and thermal stability vary widely by resin. If your part faces ongoing stress, heat, or exposure to chemicals, request datasheets and, when possible, real-world test reports. Poor mechanical or thermal compatibility can result in early product failure or costly recalls.

SLA 3D Printing Industry and Trade Terminology

Navigating global B2B procurement for SLA-based solutions involves understanding several key terms used by manufacturers, distributors, and logistics partners:

– OEM (Original Equipment Manufacturer):

A company that produces SLA 3D parts/components as part of, or for integration into, your product line. Clarifying if you are sourcing from an OEM ensures you deal directly with the producer, often leading to better pricing, customization, and after-sales support.

– MOQ (Minimum Order Quantity):

The smallest batch size a supplier will accept. For SLA, this varies widely; some service bureaus have no MOQ (ideal for prototyping), while material suppliers may require bulk orders. Determine and negotiate MOQs early—especially relevant in African, Middle Eastern, and South American markets where cashflow and warehousing are key concerns.

– RFQ (Request for Quotation):

A formal invitation to suppliers to quote pricing and lead times based on your technical drawings or part requirements. RFQs should specify material, finish, tolerance, and volume to streamline the sourcing process and avoid ambiguity—vital for cross-border and multilingual operations.

– Incoterms (International Commercial Terms):

Trade clauses defining buyer and seller responsibilities during international shipping. Terms like EXW (Ex Works), FOB (Free on Board), and DDP (Delivered Duty Paid) directly impact total landed cost and customs clearance. Know the Incoterms used by your SLA provider to avoid unexpected charges or delivery issues.

– Lead Time:

The total period from order confirmation to part delivery. In SLA production, lead times include design review, printing, post-processing, QA, and logistics. Understanding each stage helps in planning procurement schedules, especially for urgent or time-sensitive projects across continents.

– QA/QC (Quality Assurance/Quality Control):

Processes ensuring all delivered SLA parts meet agreed standards. For international buyers, requesting detailed QA/QC protocols—including inspection certificates, conformity documents, and sample reports—minimizes the risk of non-compliance or rework.

By mastering these technical properties and trade terms, international B2B buyers will make more informed SLA 3D printing decisions—improving part quality, simplifying negotiations, and optimizing supply chain performance across diverse markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the sla 3d Sector

Global Market Overview and Sourcing Trends

Stereolithography (SLA) 3D printing continues to be a transformative force in industrial prototyping, low-volume manufacturing, and highly detailed component production. Globally, the SLA sector is experiencing accelerated adoption across industries such as automotive, healthcare, electronics, and consumer products. Key growth drivers include an increasing demand for rapid prototyping, the ability to achieve ultra-fine surface resolution, and steady improvements in large-format and high-speed SLA printer technology.

B2B buyers from regions such as Africa, South America, the Middle East, and Europe are increasingly leveraging SLA’s precision and flexibility. In Africa and South America, SLA technology is being explored to bypass traditional manufacturing infrastructure, offering agile entry into customized production—especially in sectors like dental, jewelry, and spare parts. For the Middle East, significant investment in technology parks and automotive-aviation sectors is fueling demand for SLA, particularly for functional prototyping and end-use parts. European buyers, notably from innovation-driven markets like Germany and Spain, are adopting SLA for intricate medical devices, rapid tooling, and ergonomically designed consumer goods.

Sourcing trends are evolving:

– Distributed Manufacturing: The shift toward decentralized production is enabling faster lead times and reduced shipping costs, especially relevant for African and South American operations seeking to minimize logistical barriers.

– Specialty Resin Development: Vendors are prioritizing advanced resins with improved mechanical, biological, or heat-resistant properties—to meet diverse industrial requirements.

– Supplier Diversification: There is a notable drive to source multiple machine and resin suppliers for risk mitigation and increased bargaining power.

– Integrated Service Models: More OEMs and contract manufacturers offer end-to-end SLA solutions, including design assistance, quality assurance, and global shipping, supporting buyers who lack in-house expertise.

– Price Transparency & Comparison Tools: Platforms and directories now enable buyers to benchmark SLA hardware, materials, and service providers globally, minimizing procurement risks.

International buyers should carefully evaluate not only the technical capabilities of suppliers but also their regional support networks, ability to deliver tailored materials, and alignment with local certifications or standards.

Sustainability and Ethical Supply Chains in SLA 3D

Environmental impact and social responsibility are becoming central to procurement decisions in the SLA 3D sector. The traditional challenge with SLA lies in the use of photopolymer resins, which often contain substances derived from non-renewable sources and may present complexities in post-consumer disposal. However, the sector is actively evolving toward greener solutions, with significant innovations reshaping sourcing priorities:

- Bio-based and Recyclable Resins: Leading suppliers now offer bio-based SLA resins made from renewable feedstocks such as plant-based polyols. These materials substantially lower the carbon footprint and enable end-of-life recyclability or safer disposal.

- Reduced Material Waste: SLA’s layer-by-layer additive approach inherently generates less scrap compared to subtractive manufacturing. Some vendors have also introduced closed-loop reclamation systems for unused resins, further minimizing environmental impact.

- Certifications and Compliance: Buyers should look for materials and suppliers with ISO 14001 (environmental management), RoHS (restriction of hazardous substances), and, where relevant, REACH-compliance labels. For critical sectors, verifying suppliers’ adherence to ethical sourcing—such as conflict mineral-free components—is advisable.

- Energy-Efficient Equipment: Modern SLA systems increasingly come with improved energy standards, lowering power consumption during the curing, post-processing, and washing phases.

From an ethical sourcing perspective, it’s crucial for buyers to assess their supplier’s labor practices, supply chain transparency, and commitment to local communities. Engaging with vendors who participate in take-back programs, are transparent about material sourcing, and can demonstrate life cycle assessments reflects a strategic move toward long-term risk reduction and brand integrity.

The Evolution and Industry Significance of SLA 3D

Since its invention in the mid-1980s, stereolithography has remained at the forefront of 3D printing evolution. Initially valued for rapid prototyping, SLA’s ability to produce highly complex, isotropic, and finely detailed parts secured its status as a pioneer in additive manufacturing. Over the past decade, SLA has evolved considerably: machine costs have dropped, materials portfolios have diversified, and system automation has improved.

For international B2B buyers, SLA’s maturity translates to a robust ecosystem of hardware vendors, material suppliers, and services—making it less risky and more predictable to integrate into industrial workflows. This trajectory also fosters open competition, ensures ongoing innovation, and offers buyers strategic choices tailored to their regional market demands. As SLA 3D continues to expand globally, staying informed about the latest technological and sustainability advances will be key to sustaining a competitive edge.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of sla 3d

-

How should international B2B buyers vet potential SLA 3D printing suppliers?

When evaluating suppliers, request detailed documentation on company history, production capacity, case studies, and references—especially from customers in your region. Visit trade shows or request virtual factory tours to assess real operations. Scrutinize certifications such as ISO 9001 and any relevant export licenses. Prioritize suppliers with clear quality control processes, transparent communication, and established international logistics partnerships. Leverage third-party inspections, and always cross-reference with independent industry platforms to validate reliability before committing. -

What customization options should B2B buyers expect from SLA 3D service providers?

Leading SLA 3D providers offer tailored solutions, from material selection (engineering resins, flexible, biocompatible, etc.) to print resolution, finishes, and part geometry. You should be able to specify tolerances, surface finishes, and post-processing (e.g., dyeing, coating, assembly). Reliable partners will support you through the prototyping phase, small-series production, or full-scale manufacturing, often providing design-for-manufacturing guidance. Clear communication regarding technical specifications and application needs is critical to ensure the end product meets your project requirements. -

What are typical MOQs, lead times, and payment terms for cross-border SLA 3D orders?

Minimum Order Quantities (MOQs) for SLA 3D parts are generally low compared to traditional manufacturing, often starting at single or low double digits. Custom projects may have higher MOQs to cover setup costs. Standard lead times range from 3–10 business days for prototypes to several weeks for large production runs, depending on complexity and order volume. International payment terms vary; reputable suppliers typically request 30–50% advance payment, with the balance due post-inspection or before shipping. Confirm whether your supplier accepts secure international payment methods such as bank transfer (SWIFT), letters of credit, or trade platforms with escrow services. -

How can B2B buyers ensure quality assurance and obtain necessary certifications for SLA 3D products?

Always request quality documentation such as Certificates of Conformity (CoC), dimensional reports, and material certifications. For critical applications, consider third-party inspection or in-process QA, often offered for an additional fee. If regulatory compliance is essential—such as for medical, automotive, or aerospace—verify that suppliers possess sector-specific certifications (e.g., ISO 13485 for medical, IATF 16949 for automotive). Prioritize suppliers with robust traceability and documentation practices, especially if your country enforces strict import standards. -

What logistics and shipping factors should international buyers consider when sourcing SLA 3D parts?

Clarify Incoterms (e.g., EXW, FOB, DAP) early to define responsibilities for shipping, insurance, customs clearance, and local delivery. Ensure the supplier can professionally package SLA 3D parts—resin-based items may require careful handling and protection from UV exposure during transit. Discuss express (air) versus economy (sea/road) freight options based on urgency and cost. Work with logistics providers experienced in handling tech products and be aware of any import duties, VAT, or customs documentation specific to your region. -

How should disputes or quality issues be resolved with international SLA 3D suppliers?

Establish clear terms in your contract regarding dispute resolution, outlining timelines for claims, required evidence (such as detailed photos, inspection reports), and remediation steps (replacement, refund, or credit). Favor suppliers open to third-party arbitration or mediation. Using international payment platforms with escrow or secure trade assurance features adds a layer of protection, lowering risk in the event of non-compliance. Always document all interactions and test initial orders before scaling up volume to minimize risk. -

Which technical parameters should B2B buyers prioritize to match SLA 3D parts with their end-use requirements?

Focus on resolving print resolution (layer thickness), material properties (tensile strength, heat resistance, biocompatibility), and build size limitations. Ask suppliers for data sheets and samples to evaluate part durability and surface finish for your application. Confirm the provider’s capabilities for advanced post-processing if a specific color, transparency, or texture is required. Matching technical requirements upfront prevents costly errors and ensures the end product functions as needed in your intended environment. -

Are there particular risks or opportunities to consider when sourcing SLA 3D from emerging markets (e.g., Africa, South America) versus established regions (e.g., Germany, Spain)?

Emerging markets can offer cost advantages and agile service but may pose risks regarding consistency, technology maturity, and logistics infrastructure. Established regions often guarantee higher quality standards, advanced technology access, and streamlined logistics—albeit at higher costs. Evaluate suppliers based on project criticality, leveraging pilot batches to test capabilities before committing to larger orders. Consider government incentives, local tariffs, or regional trade agreements that might affect total landed cost and supply chain flexibility in your sector.

Strategic Sourcing Conclusion and Outlook for sla 3d

With SLA 3D printing, international B2B buyers unlock high-precision manufacturing capabilities ideally suited for functional prototypes, intricate components, and end-use parts requiring superior surface resolution. Throughout this guide, we’ve emphasized the importance of understanding material properties, post-processing requirements, and supply chain factors to ensure projects are delivered on time and at competitive costs.

Strategic sourcing remains fundamental to maximizing SLA’s value in global operations. By evaluating credible manufacturers and service providers, scrutinizing lead times, pricing, and quality certifications, buyers can minimize risks and take full advantage of SLA technology’s versatility. Regions such as Africa, South America, the Middle East, and Europe each present unique opportunities and challenges—from local raw material availability to regulatory requirements and logistics networks. Building strong partnerships and leveraging local expertise are critical for optimizing procurement strategies and ensuring long-term success.

Looking ahead, as digital manufacturing ecosystems mature and SLA technology continues to evolve, B2B buyers stand to benefit from greater customization, shorter product cycles, and enhanced supply resilience. Now is the time to invest in strategic relationships, remain agile in sourcing decisions, and proactively explore new applications for SLA 3D printing. By doing so, organizations across diverse global markets can position themselves at the forefront of innovation, meeting customer demands with efficiency and quality.