Introduction: Navigating the Global Market for sheet metal laser cutter

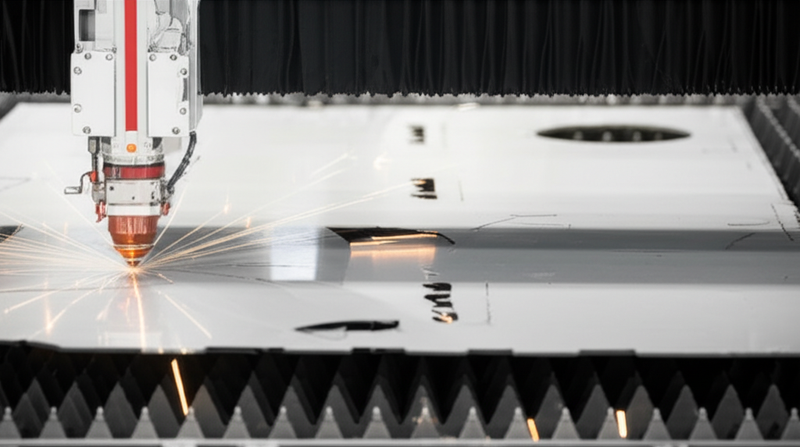

Sheet metal laser cutters have rapidly reshaped the manufacturing landscape, translating the demand for precision and flexibility into tangible business advantage. With global competition intensifying and industries such as automotive, construction, electronics, and custom fabrication pushing for greater productivity, these advanced machines have become strategic investments—not simple purchases. For B2B buyers across Africa, South America, the Middle East, and Europe, acquiring the right laser cutter is a pivotal decision that can unlock new markets, streamline operations, and elevate product quality to meet international standards.

The impact of sheet metal laser cutters goes far beyond their technical capabilities. Their integration delivers micron-level accuracy, minimal material waste, and unmatched repeatability—essentials for cost control and swift project delivery. Businesses leveraging this technology can meet rapidly changing client specifications, respond to market trends with agility, and optimize manufacturing workflows for local and export demands alike.

This guide is designed to serve as a comprehensive decision-making resource for international buyers. Key areas covered include:

- Comparison of laser cutter technologies: Detailed insights into CO₂, fiber, and hybrid systems—how they function, their strengths, and considerations for different production needs.

- Material versatility and applications: Guidance on processing a wide range of metals, from galvanized and stainless steel to aluminum, titanium, copper, and brass, with real-world use cases.

- Manufacturing and quality assurance: Best practices to maximize output efficiency, ensure consistent quality, and minimize downtime.

- Supplier evaluation and risk assessment: Strategies to identify, benchmark, and manage global suppliers for reliability, after-sales support, and compliance.

- Cost breakdown and ROI calculation: Uncover hidden costs, understand total cost of ownership, and assess long-term value to support sound capital investment.

- Market trends and essential FAQs: Stay ahead with the latest technological developments, regulatory considerations, and answers to pressing buyer queries.

Armed with this knowledge, B2B sourcing teams can confidently navigate the complexities of the international sheet metal laser cutter market, reduce procurement risks, and drive sustainable business growth—regardless of regional challenges or market maturity.

Understanding sheet metal laser cutter Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| CO₂ Laser Cutter | Uses CO₂ gas laser, suitable for various materials, excels with thicker sheets | General fabrication, signage, construction | Lower upfront cost, versatile, but higher maintenance and less efficient on thin metals |

| Fiber Laser Cutter | Employs solid-state fiber optics, high energy efficiency, excels at high speed, thin metal cutting | Automotive, aerospace, electronics, precision parts | Precision, fast, low operational cost; higher initial investment, limitations on extra-thick non-ferrous metals |

| Nd:YAG Laser Cutter | Utilizes neodymium-doped crystal lasers, effective for fine detail, supports pulsed/continuous operation | Medical, jewelry, electronics, micro-component manufacturing | Exceptional detail, engraving; higher maintenance, slower for standard sheet cutting |

| Hybrid Laser Cutter | Integrates more than one laser type (often CO₂ and fiber) for multi-material versatility | Flexible job shops, multi-material fabrication | Broad capability, adaptable, but complex system and higher capital cost |

| CNC Laser Cutting System | Advanced integration of laser (commonly fiber) with computer numerical control for automation | Mass production, repetitive parts, high-precision runs | Repeatability, automation, labor savings; upfront cost and tech expertise required |

CO₂ Laser Cutter

CO₂ laser cutters are a proven solution for handling a variety of sheet metals, including mild steel, stainless steel, and thicker materials where depth of cut is essential. Their adaptability extends to non-metals, making them suitable for general workshops and signage manufacturers. A key B2B advantage is their relatively lower purchase price, enabling market entry or expansion with manageable CAPEX. However, buyers should budget for maintenance, as these units require upkeep of gas components and optics, and anticipate additional training for routine calibrations—particularly relevant for businesses in regions where technical support may not be immediately accessible.

Fiber Laser Cutter

Fiber laser cutters are the modern benchmark for precision, speed, and efficiency in sheet metal cutting. Their solid-state construction yields minimal maintenance, superior reliability, and high-quality results, especially on thin metals and reflective materials such as aluminum and copper. For B2B buyers in sectors like automotive, aerospace, and electronics, fiber lasers enable scalable, high-throughput operations and fast changeovers—ideal for export-driven or just-in-time manufacturing. The higher upfront cost is offset by operational savings and productivity gains. Buyers should evaluate power requirements based on material mix and gauge the after-sales support network, especially when sourcing internationally.

Nd:YAG Laser Cutter

Nd:YAG laser cutters specialize in applications demanding ultra-fine detail, such as microelectronics, medical component fabrication, and jewelry. Their ability to operate in pulsed mode allows for intricate engraving and small-part processing where other laser types may struggle. These units are less common for standard sheet metal cutting due to slower speeds and higher maintenance, but they offer unmatched detail where required. B2B purchasers should assess their volume of fine-detail work to justify the investment and consider lifecycle support, as these systems may require skilled technicians and parts that are less readily available in emerging markets.

Hybrid Laser Cutter

Hybrid laser cutters merge the strengths of multiple laser technologies—typically CO₂ and fiber—within one machine, providing flexibility to handle a broader range of materials and thicknesses. This makes them attractive for job shops and manufacturers who process varied orders or serve diverse industries. They can quickly switch between tasks, reducing downtime. The complexity of these systems means a higher capital investment and increased footprint, so buyers should evaluate floor space and operational complexity. Ongoing training and robust supplier support are critical to maximize the ROI of such versatile equipment, especially when scaling operations internationally.

CNC Laser Cutting System

CNC laser cutting systems integrate advanced numerical control with fiber or CO₂ lasers for fully automated, highly repeatable fabrication. These systems are designed for high-volume production of precise, often complex parts—with minimal manual intervention. Automation delivers consistency, labor efficiency, and long-term cost savings, especially valuable for exporters needing to meet stringent quality standards. The initial investment can be substantial, and buyers should plan for both technical workforce development and integration with their existing digital manufacturing systems. Ensuring strong after-sales support and software compatibility is crucial, particularly when sourcing from overseas suppliers.

Related Video: BOSS FC Accu-CUT: Fiber Laser Sheet Metal Cutter – 4×4′ up to 2KW

Key Industrial Applications of sheet metal laser cutter

| Industry/Sector | Specific Application of sheet metal laser cutter | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive & Transport | Precision cutting of chassis parts, body panels, custom prototypes | High production speed, reduced manual rework, adaptability for new models | Cut quality range, equipment throughput, technical support, TCO |

| Construction & Infrastructure | Fabrication of structural elements, facade panels, HVAC ducts | Fast turnaround, flexibility in design, minimized waste | Material compatibility (galvanized, stainless), service access |

| Electrical & Electronics | Cutting enclosures, mounting plates, heat sinks, intricate components | Micron-level precision, ability to miniaturize parts, low defect rates | Machine tolerance, software integration, repeatability |

| Industrial Equipment | Manufacturing of machinery covers, gears, brackets | Streamlined prototyping, consistent quality across batches | Capacity for thick and thin metals, uptime, after-sales service |

| Renewable Energy | Cutting components for solar frames, wind turbine parts | Rapid scaling, lightweight designs, optimized material use | Versatility in metal types, energy efficiency, reliability |

Automotive & Transport

Sheet metal laser cutters are essential in automotive and transport manufacturing for producing chassis sections, body panels, and highly customized prototypes. The capability to cut complex geometries with high repeatability reduces dependency on manual processes and minimizes errors, supporting just-in-time production—a key demand in regions exporting globally or serving diverse markets like Europe and South America. For buyers, evaluating machine speed, cut quality on various steel types, and after-sales technical support is vital, especially where rapid model changes or customization is a competitive factor.

Construction & Infrastructure

In building and infrastructure projects, laser cutters enable the precise fabrication of structural elements (beams, brackets), facade panels, and ventilation ducts. These machines quickly handle large volumes of standardized and custom components, supporting both efficiency and architectural flexibility required in projects across Africa and the Middle East. Key considerations include ensuring the machine is compatible with common construction materials—such as galvanized and stainless steel—and that local service and spare parts availability are robust for uninterrupted operation.

Electrical & Electronics

Laser cutters are widely employed in electronics manufacturing for producing enclosures, mounting plates, and finely detailed parts. Their micron-level accuracy allows for very small features, enabling miniaturization and high-density layouts. For B2B buyers, especially in regions expanding electronics export (like Eastern Europe), selecting machines with tight tolerance specifications, advanced CAD/CAM integration, and cleanroom-compatible setups can drive significant value by reducing defect rates and supporting innovation in product design.

Industrial Equipment

Industrial machinery makers deploy sheet metal laser cutters for both prototyping and batch production of machine covers, gears, and mounting brackets. The technology accelerates design iterations and ensures high consistency between parts—a major advantage for exporters and equipment assemblers in South America and the UK. Buyers should assess machine flexibility to handle both thin and thick sheets, reliability under heavy cycles, and strength of after-sales support to maintain production continuity.

Renewable Energy

The renewable energy sector utilizes sheet metal laser cutters for fabricating solar panel frames, wind turbine components, and other elements where precision and lightweight design are essential. Rapid scaling of production—common in emerging solar markets in Africa or wind in Europe—is feasible due to the speed and versatility of these machines. To maximize ROI, buyers should look for energy-efficient systems that can process a range of metals (including aluminum and titanium) and maintain consistent output in demanding environments.

Related Video: Laser welding in Sheet Metal Production

Strategic Material Selection Guide for sheet metal laser cutter

Key Materials for Sheet Metal Laser Cutting: Properties, Suitability, and Regional Buyer Insights

Selecting the optimal material for sheet metal laser cutting is critical for international B2B buyers aiming for efficiency, compliance, and cost control. Below, we focus on four widely used materials—carbon steel, stainless steel, aluminum, and galvanized steel—highlighting their key properties, pros and cons, application impacts, and region-specific buyer considerations.

Carbon Steel

Key Properties:

Carbon steel is known for its strength, moderate toughness, and versatility. Grades range from low to high carbon, with mechanical properties tailored to application needs. It offers good machinability and is typically available in standards such as ASTM A36, EN 10025, or DIN 17100.

Pros & Cons:

Pros include affordability, widespread availability, and excellent strength, making it ideal for structural, automotive, and general fabrication. However, carbon steel is susceptible to rust and corrosion unless properly finished/coated.

Impact on Application:

Best suited for structural parts, enclosures, brackets, and load-bearing components where corrosion is not the primary concern. Laser cutting enables rapid and precise fabrication of custom shapes, supporting just-in-time manufacturing.

International Considerations:

Buyers in Africa and South America favor carbon steel for cost-sensitive projects, but must consider humidity-related corrosion risks. Europe and the Middle East may require materials certified to EN, DIN, or ASTM. Confirm mill certificates, compliance with local standards, and consider post-cutting treatments for export projects.

Stainless Steel

Key Properties:

Notable for its superior corrosion resistance, high strength-to-weight ratio, and good formability. The most common grades for sheet metal are 304, 316 (A2, A4 per DIN), and sometimes 430.

Pros & Cons:

Stainless steel’s primary advantage is its durability in aggressive environments (chemicals, moisture). It enables long-life products and meets stringent hygiene standards (important for food, pharma, medical). The downside is higher cost and, for some grades, more challenging laser processing due to reflectivity.

Impact on Application:

Essential in industries like food processing, medical, petrochemical, and high-end architecture. Laser cutting delivers clean, burr-free edges—a requirement for sanitary or exposed surfaces.

International Considerations:

Europe (especially France, UK) frequently requires stainless steel in compliance with EN 10088 or AISI/ASTM. Middle East demand is strong for 316/316L (chloride resistance). Logistics and cost management are more significant in Africa/South America due to sourcing and tariff impacts.

Aluminum

Key Properties:

Renowned for its low density, weight savings, and moderate corrosion resistance. 5052 and 6061 are typical sheet grades; it is soft and pliable, but can be reflective and conduct heat rapidly.

Pros & Cons:

Aluminum is highly sought for transportation, aerospace, HVAC, and electronics due to its light weight and energy-saving potential. Its main limitations are higher raw material cost, potential warping under high-heat laser cutting, and the technical skill required to minimize oxidation at the cut edge.

Impact on Application:

Optimal for any application where weight reduction is critical. Laser cutting is preferred for achieving intricate details and smooth finishes in thin to moderate gauges.

International Considerations:

For Africa and South America, verify that necessary power and gas supplies for clean cutting are available. European buyers often seek RoHS compliance. EN 485 and ASTM B209 are standard references. Buyers should anticipate slightly higher operating costs due to auxiliary systems (e.g., nitrogen supply).

Galvanized Steel

Key Properties:

Galvanized steel comprises a carbon steel base coated with zinc, enhancing corrosion resistance without major cost inflation. It is robust, widely used in construction and outdoor applications.

Pros & Cons:

Main advantage is its automatic corrosion resistance for modest uplift in cost compared to plain carbon steel. However, zinc fumes produced during laser cutting require efficient extraction, and edge protection after cutting is essential to avoid rust formation.

Impact on Application:

Ideal for HVAC, roofing, automotive body panels, and agriculture equipment. Laser processing allows quick fabrication of protective and structural components.

International Considerations:

Middle East and South America rely on galvanized steel for infrastructure projects exposed to harsh weather. EU projects should meet EN 10346; ASTM A653 is common for exports to the US. International buyers must ensure suppliers follow health and safety measures for fume management during cutting.

Summary Table: Sheet Metal Laser Cutting Materials

| Material | Typical Use Case for sheet metal laser cutter | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Carbon Steel (ASTM A36, EN 10025) | Structural parts, general fabrication, brackets | Cost-effective, strong, widely available | Rusts without protection, not suitable for corrosive media | Low |

| Stainless Steel (304, 316) | Food processing, medical equipment, architectural features | Excellent corrosion resistance, hygiene compliant | Higher cost, can require premium laser source | High |

| Aluminum (5052, 6061) | Aerospace, transport, electronics housings | Lightweight, doesn’t corrode easily | Expensive, cutting challenges (reflectivity, warping risk) | Medium to High |

| Galvanized Steel (EN 10346, ASTM A653) | HVAC ducts, outdoor enclosures, automotive panels | Corrosion resistant at moderate price | Need fume extraction when cutting, edge rust possible | Medium |

In-depth Look: Manufacturing Processes and Quality Assurance for sheet metal laser cutter

Key Stages in Manufacturing Sheet Metal Laser Cutters

The production of sheet metal laser cutters involves a sequence of precise, interdependent manufacturing steps. B2B buyers seeking robust, reliable machines should understand how these processes coalesce to ensure equipment meets international standards and performs optimally in demanding environments.

1. Material Selection and Preparation

Manufacturing begins with the careful sourcing of raw materials. Critical components—such as laser sources, optical elements, CNC controllers, sheet metal frames, and protective glass—are selected based on stringent quality and compliance criteria. Reputable manufacturers work with verified suppliers, often mandating certifications such as RoHS or REACH for electronics, and detailed mill certificates for metals and alloys. Prior to machining, these materials are inspected for composition, surface integrity, and dimensional conformity.

2. Precision Machining and Component Fabrication

Once approved, raw materials undergo various fabrication processes:

– Frame and Chassis Machining: Large CNC machines shape and drill the machine’s skeleton from steel or aluminum, ensuring high structural rigidity and minimal vibration.

– Optical & Laser Module Assembly: Clean rooms are used to assemble sensitive laser modules and lenses, where humidity, dust, and temperature are tightly controlled.

– Electronic Subsystems: Controllers and sensor arrays are installed following ESD protocols to safeguard against static damage.

Modern manufacturers utilize advanced bending, welding, and surface finish techniques. Automated robotic welding ensures repeatability and tensile strength at critical joints, while powder coating and anodizing protect metal surfaces from corrosion and wear.

3. Assembly and System Integration

Component modules are delivered to the main assembly line for integration. Key steps include:

– Mechanical Assembly: The machine frame, guides, and motion systems are aligned to micron tolerances.

– Installation of Laser Sources and Coolers: Cooling systems and fiber or CO2 lasers are precisely mounted, with routing for optimal heat dissipation and minimal energy loss.

– Control System Calibration: CNC software, touch panels, and safety interlocks are installed and subjected to exhaustive diagnostic checks.

At this stage, machine “dry runs” are performed to ensure mechanical fluidity prior to final commissioning.

4. Finishing and Protective Treatments

Surface finishing steps—such as powder coating, painting, and sealing—are executed in controlled environments to guarantee corrosion resistance and aesthetic consistency. All access panels, emergency stops, warning labels, and user-facing controls are meticulously checked, since these are highly scrutinized in export destination inspections, especially in Europe and the Middle East.

5. Final Inspection, Testing, and Packaging

The entire machine undergoes functional testing, where sample jobs (e.g., cutting various metal samples) assess:

– Cut accuracy, edge smoothness, and heat-affected zones

– System stability over extended run periods

– Emergency stop and safety subsystem response time

Only after documented pass of every parameter does the unit proceed to precision packaging—employing anti-shock foams and moisture barriers for long-haul international shipping.

Quality Control Mechanisms and Compliance Landscape

Maintaining rigorous quality assurance throughout manufacture is both a legal obligation and a key differentiator for international buyers. The following approaches and standards are central to supplier credibility and machinery reliability.

International and Industry-Specific Certifications

Buyers should require and verify compliance with the following certifications and standards:

– ISO 9001: Globally recognized for quality management systems, it confirms systematic process control from design to after-sales service.

– CE Marking: Mandatory for the EU, indicating adherence to health, safety, and environmental requirements. For buyers in France, the UK (via UKCA), and other EU/EEA nations, this is non-negotiable.

– RoHS and REACH: Certify electrical and electronic safety—essential for buyers concerned about hazardous substances.

– API/ASME or local equivalents: In sectors like oil & gas or pressure vessel production, additional certifications may be required for relevant machinery components.

Buyers in Africa, the Middle East, and South America should note that customs clearance and local regulations may reference CE or ISO documents even if not strictly mandated by domestic law, so aligning with these standards streamlines importation and futureproofs equipment.

Key Quality Control Checkpoints

Quality inspection is not a single event but a continuous process spanning multiple checkpoints:

- Inbound Quality Control (IQC): Verification of all incoming materials, subassemblies, and critical components. For example, each laser source batch is tested for output stability and conformity.

- In-Process Quality Control (IPQC): Regular monitoring during machining, welding, assembly, and wiring. Automated metrology (e.g., coordinate measuring machines) and digital process logs trace all operations, flagging deviations in real time.

- Final Quality Control (FQC): A full-system performance review before delivery. Includes cut tests on various metals, load/thermal cycling, and validation of laser convergence and safety features.

Common Testing and Inspection Methods

The thoroughness of outgoing inspections is a key predictor of machine reliability. Common methods include:

– Optical and laser power measurement: Calibrated power meters confirm laser output meets specifications for each wavelength and mode.

– Dimensional inspection: High-precision tools (e.g., laser interferometers) check for geometric tolerances, essential for motion accuracy.

– Sample cutting and visual inspection: Assesses edge quality, burr formation, and kerf consistency across a range of materials and thicknesses.

– Electrical safety tests: Such as insulation resistance and earth continuity, to mitigate operator hazards.

– Functional and endurance testing: Long-duration runs verify not only performance, but also cooling and failsafe effectiveness.

How B2B Buyers Can Verify Supplier Quality Assurance

Given the stakes involved in acquiring a sheet metal laser cutter, robust verification is crucial. International B2B buyers are encouraged to:

- Conduct or commission factory audits: Physical or virtual audits check the manufacturer’s quality management system, process documentation, and technician qualifications. Many suppliers can accommodate real-time video walk-throughs for overseas buyers who cannot visit in person.

- Request comprehensive quality documentation: Insist on test reports for critical components (e.g., laser diodes, optics), complete assembly logs, and process validation evidence for each machine purchased.

- Utilize third-party inspections: Especially common in Africa, the Middle East, and South America, third-party agencies (SGS, TÜV, Intertek) can independently assess conformity prior to shipping, mitigating the risk of receiving sub-standard or non-compliant equipment.

Navigating Regional Certification and QC Nuances

- Europe (France, UK): Expect strict enforcement of CE certification and import controls. Machines must carry full technical files—including risk assessments, EMC/labelling conformity, and user documentation in local languages.

- Middle East: While CE is valued for cross-border standardization, some markets also require local type approval or additional safety/dust resistance measures due to harsh environmental conditions.

- Africa/South America: Quality assurance obligations are increasing, particularly where machinery is destined for multinational or export-oriented manufacturers. Insist on modular documentation (specifically, ISO and CE) to simplify local registration and after-sales technical support.

Action Points for International B2B Buyers

- Clarify all certification and compliance needs up front: Specify destination market requirements during RFQ stage to avoid shipment delays or costly retrofits.

- Scrutinize supplier QC protocols and audit findings: Unwillingness to provide detailed QC documentation or accommodate inspections should be considered a red flag.

- Prioritize end-to-end traceability: Sixty percent of B2B laser cutter buyers report that transparent documentation and traceability impact maintenance and warranty claims.

- Leverage peer networks and references: Solicit feedback on actual performance, maintenance responsiveness, and reliability from organizations in your region or sector.

- Negotiate clear terms for defects and post-delivery issues: Secure contractual guarantees on response times, spare parts logistics, and warranty enforcement—critical when importing from distant suppliers.

A deep understanding of manufacturing processes and rigorous quality control remains fundamental for international buyers pursuing high-performance sheet metal laser cutters. By focusing on end-to-end process transparency, certifications, and verifiable testing standards, buyers can mitigate risks, ensure compliance, and protect long-term value from their capital investments.

Comprehensive Cost and Pricing Analysis for sheet metal laser cutter Sourcing

Key Components of Sheet Metal Laser Cutter Costs

When sourcing a sheet metal laser cutter for industrial applications, buyers must break down the full cost structure to make informed decisions and control budget overruns. Here are the main contributors to the total cost:

- Materials and Core Components: The cost of high-quality laser sources (e.g., fiber or CO₂), precision optics, cutting heads, motors, and drive systems significantly impacts base price. Fiber lasers, although more expensive upfront than CO₂, offer enhanced speed, operational efficiency, and lower long-term maintenance.

- Labor and Assembly: Manufacturing complexity, local labor costs, and the degree of automation (manual loading vs. robotic handling) shape the price. European brands or suppliers with advanced assembly standards often have higher base labor costs than counterparts in Asia or emerging markets.

- Manufacturing Overhead: Factory infrastructure, R&D, quality management systems, and certifications (e.g., CE, ISO, UL) all feed into overhead. Machines produced in facilities with robust process controls typically command a premium.

- Tooling and Customization: Custom fixtures, worktables, dust extraction, or specialized software integration for industry-specific needs (automotive, aerospace, etc.) can add 10–30% or more to initial costs.

- Quality Control and Testing: Thorough inspection, calibration, and acceptance testing prior to shipment—often required for export to the EU or Middle East—increase both direct cost and reliability.

- Logistics and Duties: International freight (ocean/air), insurance, in-country delivery, and import tariffs vary by region. For Africa or South America, limited port infrastructure or inland transportation can drive up landed costs.

- Supplier Margin: Final pricing includes manufacturer and distributor profit margins, which can differ based on brand strength, after-sales service, and regional competition.

Factors That Influence Price

Understanding the variables that move sheet metal laser cutter prices up or down enables buyers to adapt their sourcing strategies:

- Order Volume and Minimum Order Quantity (MOQ): Larger orders (multi-machine or annual deals) often unlock significant discounts or value-added services (e.g., free training, installation support), especially from top-tier OEMs.

- Machine Specifications and Customization: Power level (wattage), table size, automation options, and ability to process multiple materials all affect cost. High-wattage fiber lasers for thick or high-speed cutting are priced at a premium.

- Input Material Compatibility: Machines designed for a wider range of materials (including non-ferrous metals like copper or titanium) feature advanced optics and controls—raising upfront investment.

- Quality Standards and Certifications: EU buyers (France, UK) or those in regulated sectors may require CE/ISO certification, traceability, or specific documentation, affecting supplier qualification and unit costs.

- Supplier Reputation and Service Network: Established brands or those with local service partners may command higher prices but offer lower lifecycle risk and downtime—a critical consideration for remote locations in Africa or Latin America.

- Incoterms (EXW, FOB, CIF, DDP): The division of shipping and insurance responsibilities shapes the final landed cost. DDP terms, while convenient, might bundle hidden markups compared to sourcing with FOB and arranging third-party shipping.

- Currency Fluctuations and Payment Terms: The volatility of local currencies against the dollar or euro can impact cost projections, especially for buyers in the Middle East or Africa.

Strategic Tips for Cost-Efficient Procurement

B2B buyers can optimize costs and strengthen negotiation leverage with these best practices:

- Request Detailed Quotations: Break down all cost components—core machine, options/accessories, installation, training, spare parts, logistics, and after-sales support—to identify negotiable areas and avoid hidden charges.

- Assess Total Cost of Ownership (TCO): Evaluate not just purchase price but ongoing consumables, energy use, maintenance schedules, spare part availability, and software licensing. Fiber lasers, while a higher initial investment, yield lower TCO through efficiency and minimal maintenance.

- Negotiate on Value-Added Services: Installation, local training, and spare parts kits can often be included at reduced or no cost for larger or repeat orders. For buyers in Africa or South America, prioritize suppliers offering remote diagnostics and responsive technical support.

- Benchmark Prices Internationally: Compare quotes from suppliers in key manufacturing hubs (China, Europe, Turkey) to understand regional pricing trends. Factor in shipping, duties, and service accessibility to assess true value.

- Leverage Group Purchasing or Trade Associations: Collaborate with industry peers or through buying groups (especially in emerging markets) to achieve better MOQs and price breaks.

- Clarify Warranty Coverage: Ensure warranty terms are comprehensive and backed by local service capability, especially in regions with less-developed technical infrastructure.

Disclaimer: All prices, cost structures, and market practices referenced are indicative and may vary greatly based on supplier, location, order specifics, and prevailing market conditions. Always seek up-to-date, itemized quotations and consider engaging a procurement consultant or local agent to mitigate cross-border sourcing risks.

By strategically analyzing both the visible and hidden costs—and tailoring negotiations for regional realities—international B2B buyers can source sheet metal laser cutters that deliver reliable performance and maximum value over their operational lifespan.

Spotlight on Potential sheet metal laser cutter Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘sheet metal laser cutter’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

10 Laser Cutting Machine Manufacturers in 2024 (www.machinemfg.com)

10 Laser Cutting Machine Manufacturers in 2024 is a curated compendium spotlighting the world’s top producers of sheet metal laser cutters, synthesizing insights on established leaders and emerging innovators. The listed manufacturers are recognized for their advanced laser cutting technologies, offering devices that deliver high-speed, precision cutting for a spectrum of industrial applications. Buyers benefit from exposure to a diverse array of systems—from robust fiber lasers to versatile CO₂ models—catering to various production scales and material requirements. Several of these manufacturers emphasize robust quality control, international certifications (often ISO 9001), and automation compatibility, key for operational efficiency. The focus on global market reach, including significant export histories to Europe, the Middle East, Africa, and South America, makes this list invaluable for cross-border buyers seeking proven suppliers with robust after-sales and technical support infrastructures.

15 Laser Cutting Machine Manufacturers 2024 (www.mytcnc.com)

Jinan Bond Laser Co., Ltd. (“Bond Laser”) is recognized as one of China’s leading manufacturers in the laser processing equipment sector, with a dedicated focus on fiber laser cutting machines. The company has evolved from CO₂ laser production to specialize in advanced fiber laser solutions for sheet metal cutting. Bond Laser emphasizes R&D-driven manufacturing, aiming to offer efficient, precise, and scalable equipment tailored to diverse industrial needs. Their product range suits applications across automotive, construction, and general fabrication, appealing to international B2B buyers seeking reliability and productivity. While specific certification details are not publicly highlighted, Bond Laser’s standing among top industry players suggests a robust commitment to quality and export readiness, making them a noteworthy partner for businesses in Africa, South America, the Middle East, and Europe.

The Top Laser Cutter Manufacturers in 2024 (www.cncsourced.com)

Raycus, established in China in 2007, has become a leading industrial supplier of fiber laser sources and integrated laser systems, serving medium-to-large manufacturers worldwide. With a workforce of over 1,000 employees and a product range exceeding 50 models, Raycus focuses on delivering robust, high-efficiency fiber laser technology specifically optimized for sheet metal laser cutting across a range of thicknesses and materials. The company is renowned for its engineering reliability, scalable power options, and user-centric control systems, making it a preferred choice for automotive, aerospace, and heavy fabrication sectors. Raycus’ commitment to international quality standards and export readiness is reflected in its global footprint, with established distribution channels and after-sales support for B2B clients in Europe, the Middle East, Africa, and South America.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| 10 Laser Cutting Machine Manufacturers in 2024 | Top global brands, wide range, strong export record. | www.machinemfg.com |

| 15 Laser Cutting Machine Manufacturers 2024 | Advanced fiber laser cutters; strong R&D focus. | www.mytcnc.com |

| The Top Laser Cutter Manufacturers in 2024 | Global fiber laser supplier, strong for sheet metal. | www.cncsourced.com |

Essential Technical Properties and Trade Terminology for sheet metal laser cutter

Key Technical Specifications for Sheet Metal Laser Cutters

When evaluating sheet metal laser cutters for your B2B operations, understanding critical technical properties is vital to making the right investment—especially for buyers in diverse regions like Africa, South America, the Middle East, and Europe. Focus on these essential specifications to ensure the machine aligns with your production needs and market demands:

1. Laser Power (Wattage)

Measured in watts (W), laser power determines the thickness and types of metal the machine can cut efficiently. Common commercial systems range from 1,000W to over 20,000W. Higher power enables faster cutting speeds and the ability to process thicker materials but comes at a higher capital and operational cost. Assessing the optimal wattage allows you to balance productivity, power consumption, and purchase price for your primary material requirements.

2. Cutting Tolerance (Precision)

Tolerance—often denoted as ±0.05mm or similar—refers to the allowable dimensional variation in finished parts. Tight tolerances are crucial for industries requiring intricate designs or automated assembly, such as automotive or electronics. Knowing the minimum and maximum tolerance levels achievable by a machine ensures your finished components meet customer or regulatory standards, reducing rework and scrap costs.

3. Supported Material Types and Thickness

Sheet metal laser cutters differ in their capacity to process various metals (e.g., stainless steel, aluminum, carbon steel, brass, copper) and thickness ranges. For instance, fiber lasers excel with thin, reflective metals but may have thickness limitations compared to CO₂ lasers. Confirming a machine’s material compatibility and maximum sheet thickness directly impacts the breadth of projects you can undertake and the versatility of your production line.

4. Cutting Speed

Measured in meters per minute (m/min), cutting speed defines how quickly the machine can process a set length or piece of material. High-speed cutting improves cycle times and overall productivity, which is especially valuable for large-batch production or tight delivery schedules. However, actual speeds vary depending on material type, thickness, and part geometry.

5. Bed Size (Work Area)

The bed size, or the maximum sheet size the laser cutter can handle (e.g., 1500mm x 3000mm), impacts both the scale of individual components and overall throughput. Larger beds allow processing of substantial workpieces or multiple smaller parts in one cycle, reducing handling time and maximizing efficiency in high-volume or varied-order environments.

6. Automation Features and CNC Integration

Modern sheet metal laser cutters often integrate with computer numeric control (CNC) systems and include automation elements such as material loading/unloading, nesting software, or real-time monitoring. These features reduce manual labor, minimize error, and enable 24/7 operation, offering a strong value proposition for B2B buyers targeting consistent quality and scalability.

Common Industry and Trade Terms Explained

For international buyers, mastering key industry and trade terminology helps streamline communication, reduce misunderstandings, and foster effective negotiations with suppliers and logistics partners. Here are prominent terms to recognize:

OEM (Original Equipment Manufacturer):

Refers to a company that manufactures products or components that are purchased by another company and retailed under the purchasing company’s brand name. In laser cutting, OEM status may imply greater control over specification and after-sales support.

MOQ (Minimum Order Quantity):

The smallest quantity of products that a supplier is willing to produce or sell per order. For capital equipment or spare parts, understanding MOQ helps forecast inventory needs and prevents unnecessary capital lock-up—especially important for buyers managing budgets or importing equipment overseas.

RFQ (Request for Quotation):

An RFQ is a formal invitation sent to suppliers to submit price quotes for specified products or services. Providing detailed technical requirements in your RFQ (such as laser power, tolerance, and bed size) ensures you receive accurate pricing and avoids costly specification mismatches.

Incoterms (International Commercial Terms):

A set of globally recognized rules that define the responsibilities of buyers and sellers for the delivery of goods under sales contracts. Common Incoterms like FOB (Free on Board), CIF (Cost, Insurance, and Freight), and DAP (Delivered at Place) clarify who pays for shipping, insurance, and customs duties—vital for international B2B transactions to avoid disputes and manage shipping risk.

After-sales Support:

This covers the technical and operational assistance provided by suppliers post-purchase, including installation, training, maintenance, and spare parts availability. Reliable after-sales support minimizes downtime and extends equipment lifecycle, factors that are particularly significant when importing technology to regions with limited local expertise.

Lead Time:

The period between placing an order and receiving the laser cutter or spare parts. Clear understanding of lead time is vital for production planning and meeting contractual delivery schedules, especially when accounting for international shipping and customs clearance.

By grasping these technical properties and trade terms, international B2B buyers can confidently specify, negotiate, and source sheet metal laser cutters suitable for diverse market and operational requirements. This foundation is crucial for reducing risk, maximizing ROI, and ensuring competitiveness in an evolving global manufacturing landscape.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the sheet metal laser cutter Sector

Market Overview and Key Trends

The global sheet metal laser cutter market continues to be shaped by robust industrial demand, technological breakthroughs, and strategic sourcing trends. Across Africa, South America, the Middle East, and Europe, manufacturers are accelerating investment in laser cutting technology to modernize operations, boost productivity, and unlock new market opportunities. This growth is driven by major industries such as automotive, construction, electronics, and renewable energy, all of which require increasingly complex, precision-cut sheet metal components delivered quickly and cost-effectively.

Several critical trends define today’s B2B sourcing landscape:

- Shift to Fiber Lasers: Fiber laser cutters are rapidly overtaking CO₂ systems thanks to their superior precision, efficiency, and lower operating costs, particularly for thin metals and intricate designs. This is enabling mid-sized and even smaller enterprises in emerging markets to access advanced manufacturing capabilities previously reserved for global leaders.

- Automation and Digital Integration: Across Europe and mature economies in the Middle East, demand is surging for fully automated, CNC-integrated laser systems. These solutions dramatically streamline workflow, minimize operator error, and support seamless integration with Industry 4.0 initiatives—including digital twinning and remote system diagnostics.

- Decentralized Sourcing and Local Customization: International B2B buyers are strategically diversifying their supply bases to mitigate geopolitical risk and logistics challenges. There’s a growing preference for regional suppliers who offer flexible contract manufacturing, short lead times, and tailored after-sales support—particularly across African and South American markets.

- Rising Material Versatility: Modern machines are engineered for versatility—capable of processing galvanized steel, carbon steel, titanium, aluminum, brass, and more. This enables buyers across construction, automotive, and precision engineering sectors to consolidate suppliers and simplify procurement cycles.

- Cost and ROI Focus: Buyers now require deeper visibility into lifetime value, not just capital expenditure. Decision criteria include energy consumption, uptime, servicing needs, consumables costs, and anticipated productivity gains. Access to transparent total-cost-of-ownership models is increasingly critical.

For international buyers, it is essential to balance technological fit, supplier reliability, and regulatory requirements—particularly as standards for quality, traceability, and environmental compliance continue to rise globally.

Sustainability and Ethical Sourcing

Environmental stewardship and ethical supply chains are now central considerations in sourcing sheet metal laser cutters. Increasing regulatory scrutiny—such as the EU’s Green Deal framework and similar initiatives across the Middle East and Africa—places pressure on manufacturers and buyers to reduce energy consumption, minimize waste, and prioritize ethical procurement.

Key areas of impact and best practice include:

- Energy Efficiency: Fiber laser cutters typically offer significantly lower energy consumption compared to older CO₂ models, directly translating to reduced carbon footprint per unit produced. Opting for machines with certified high energy efficiency is increasingly a baseline procurement requirement for buyers aiming to meet internal and external sustainability targets.

- Waste Minimization and Material Optimization: The precision of modern laser cutters means less scrap, reduced need for secondary operations, and more sustainable material usage—an especially critical factor for sectors operating in regions with high input material costs or supply chain volatility.

- Supply Chain Transparency: B2B buyers are expected to scrutinize supply chain ethics, ensuring that equipment manufacturers adhere to responsible sourcing, fair labor practices, and environmental management standards. This includes requiring internationally recognized certifications such as ISO 14001, RoHS (Restriction of Hazardous Substances), and local equivalents.

- Eco-Friendly Materials and Green Manufacturing: Vendors offering recyclable machine components, the use of low-impact coolants, and take-back or refurbishment programs distinguish themselves in a crowded supplier market. Additionally, some manufacturers are now providing carbon-neutral production processes or offsets as part of their value proposition.

International buyers who prioritize sustainability not only future-proof their operations against tightening regulations but also enhance their brand value in partner markets increasingly attuned to green credentials.

Brief Historical Evolution and B2B Relevance

The evolution of sheet metal laser cutting traces back to the late 20th century, with early systems primarily deployed in aerospace and specialized manufacturing. The 1980s saw increased adoption as machines became more versatile and efficient. Developments in fiber optics and digital control in the past two decades revolutionized the sector, democratizing access for manufacturers worldwide.

This maturation means today’s B2B buyers have access to high-precision, energy-efficient, and scalable machines no matter their region. The modular nature of modern laser cutters, along with enhanced after-sales support and global parts availability, empowers both emerging and established companies in Africa, South America, the Middle East, and Europe to compete at a global level—serving diverse domestic needs while reaching export markets with high-quality, customized metal products.

Related Video: Sheet metal laser cutting machine LS5 | BLM GROUP

Frequently Asked Questions (FAQs) for B2B Buyers of sheet metal laser cutter

-

How can I effectively vet and select an international supplier for sheet metal laser cutters?

Start by requesting detailed company credentials, manufacturing certifications (such as ISO 9001), and customer references—ideally from buyers in your own or similar markets. Audit the supplier’s manufacturing capabilities, onsite quality control, and after-sales support through virtual or in-person visits where feasible. Assess communication responsiveness, willingness to provide samples, and transparency on business terms. Use trade portals and local trade offices to verify business legitimacy. Evaluate language proficiency and cultural compatibility to minimize misunderstandings during negotiation and support. -

What customization options are available, and how can I ensure my requirements are fully met?

Most reputable laser cutter manufacturers offer extensive customization, covering laser wattage, bed size, control systems, compatible materials, auto-loader integration, and software options. Provide clear technical drawings or a detailed specification sheet. Insist on a pre-production approval process, such as digital mockups, videos, or physical samples. Agree on unambiguous technical documentation in your contract. Arrange regular project updates and milestone approvals to proactively address any discrepancies before final shipment. -

What is the typical minimum order quantity (MOQ), and how do MOQs and lead times affect my procurement strategy?

Sheet metal laser cutters are generally high-value capital equipment, so MOQs are typically low—often just one unit per order. However, customizations or bundled accessory orders may impose higher MOQs or longer lead times (often 30–90 days for customized models). Plan for these timelines in your CAPEX strategy and align orders with project schedules. Confirm all payment milestones and production schedules in writing, and seek staggered deliveries for multi-unit purchases to manage cash flow and optimize deployment. -

What international payment terms and methods are safest for both parties in B2B laser cutter transactions?

Standard options include Telegraphic Transfer (T/T), Irrevocable Letters of Credit (LC), and, occasionally, escrow services through reputable platforms. For first-time transactions, opt for LCs or escrow to limit exposure. Negotiate progressive payments—deposit on order, interim payment at key milestones (e.g., Factory Acceptance Test), and balance upon Bill of Lading issuance. All terms—including currency, payment windows, and responsibility for bank charges—should be contractually defined to avoid disputes. -

Which quality assurance standards and certifications should I require from sheet metal laser cutter suppliers?

Insist on internationally recognized manufacturing and safety certifications—ISO 9001 for quality management systems, CE (Europe) or UKCA (UK) marking, and applicable national marks for your region. For electrical safety and EMC compliance, demand official test reports. Review documentation for laser source brand, software origin, and component sourcing. Request a Factory Acceptance Test (FAT) protocol and video, and—where possible—third-party inspection prior to shipment. Keep all certifications on file for customs, insurance, and warranty claims. -

How can I manage shipping logistics, customs, and delivery timelines when importing a laser cutter?

Clarify Incoterms (e.g., FOB, CIF, DAP) to delineate responsibilities and risk transfer points. Engage with freight forwarders experienced in handling industrial machinery, and confirm packaging standards for marine or air transport. Prepare all customs paperwork in advance—commercial invoice, packing list, certificate of origin, and technical documentation. Factor in local port handling, inland transport, and installation lead times. Anticipate possible delays due to customs inspections, and build a buffer into your project planning. -

What steps can I take to resolve disputes or address defects if issues arise after delivery?

Establish a clear written contract outlining warranty terms, maintenance obligations, dispute resolution procedures, and governing law/jurisdiction—ideally with arbitration clauses. Document the receipt process thoroughly with photos and installation videos. Report any defects promptly and formally, providing evidence for claims. Maintain open communication with both supplier and logistics provider. In case of disputes, use mediation or arbitration through recognized trade bodies or local chambers of commerce, particularly if international courts enforcement is uncertain or costly. -

How can I ensure reliable after-sales service, installation, and technical support from overseas suppliers?

Prioritize suppliers with established service networks or local agents in your region. Seek training packages for operators and technicians, and confirm availability of spare parts and remote diagnostic support. Require detailed user manuals and multi-language technical documentation. For new technologies, negotiate for an initial onsite installation and commissioning visit. Ensure the supplier offers remote assistance (video, phone, or VR support), and establish Service Level Agreements (SLAs) for response times and parts replacement turnaround.

Strategic Sourcing Conclusion and Outlook for sheet metal laser cutter

Global B2B procurement of sheet metal laser cutters demands a nuanced approach—balancing technology selection, supplier reliability, and operational ROI. Buyers in Africa, South America, the Middle East, and Europe now have access to diverse machine types, from robust CO₂ systems ideal for heavier gauges to rapid, high-efficiency fiber lasers driving productivity in advanced manufacturing sectors. Understanding material compatibility, total cost of ownership, and maintenance needs empowers companies to align investments with production goals and market expansion plans.

Key takeaways include:

– Evaluate technology fit: Match laser cutter types to your primary materials and throughput requirements to ensure scalability and flexibility.

– Vet international suppliers: Prioritize partners with proven after-sales support and transparent quality protocols, especially across time zones and regulatory environments.

– Calculate true ROI: Look beyond upfront costs, factoring energy efficiency, machine longevity, and service availability to safeguard long-term profitability.

– Leverage regional strengths: Harness global advancements, but also consider local installation, training, and support resources for smoother adoption.

As global market competition intensifies and customization becomes key, agile manufacturing powered by advanced laser cutting will differentiate leading B2B organizations. Now is the time to adopt a strategic sourcing mindset—positioning your business for operational efficiency, market responsiveness, and future-ready growth. Build partnerships that drive not just cost savings, but innovation, resilience, and lasting value in the metalworking supply chain.