Introduction: Navigating the Global Market for rockwell test

For manufacturers, quality controllers, and procurement leaders across Africa, South America, the Middle East, and Europe, accurate material assessment is non-negotiable. The Rockwell test stands as a cornerstone method in global hardness testing, prized for its speed, objectivity, and universal relevance in metals and polymers manufacturing. Its adoption extends far beyond mere compliance—understanding and leveraging Rockwell testing is paramount to ensuring product durability, validating suppliers, streamlining quality control, and optimizing cost across increasingly complex international supply chains.

In fast-evolving markets like Kenya and Poland, where global competition and local requirements intersect, many B2B buyers face unique challenges: identifying reliable test methods, navigating scale variations, and decoding supplier specifications in diverse regulatory environments. Missteps in equipment selection or test standardization can trigger costly disputes, shipment delays, or even production failures. To compete effectively, buyers must move beyond basic knowledge and develop a strategic perspective on Rockwell applications, from initial material sourcing to integrated manufacturing and QC workflows.

This guide is engineered to serve as a comprehensive decision-making resource for international B2B buyers. It demystifies the two main Rockwell test types (standard and superficial), explores suitability across key materials (including alloys and polymers), and details the operational nuances critical to manufacturing and quality control. B2B readers will gain guidance on evaluating suppliers, comparing machine offerings, and optimizing investment through an informed lens on global pricing dynamics. Robust market trends, cost considerations, and a practical FAQ section eliminate ambiguity, empowering you to negotiate confidently and source effectively, regardless of your region. With actionable insights tailored for your unique challenges, this guide positions you to unlock new value and reliability in every step of your Rockwell test procurement journey.

Understanding rockwell test Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard Rockwell Test | Utilizes major/minor loads; multiple scales (A, B, C, F); diamond/ball indenters | Steel, aluminum, general metals, industrial components | Widely accepted, easy procedure; may not suit thin or surface-coated parts |

| Superficial Rockwell Test | Lower test loads; uses specialized scales (N, T, W, X, Y); sensitive to surface | Thin materials, coatings, case-hardened parts | Ideal for delicate/small samples; may be less suitable for bulk materials |

| Twin/Multiple Indenter Systems | Can switch between different indenters for versatile testing | Laboratories, contract test houses, multi-material production lines | Extremely flexible; higher upfront cost and maintenance |

| Automated Rockwell Testing Systems | Integrated software for data capture, batch testing, and reduced manual input | High-volume manufacturing, quality control, automotive/aerospace | Boosts throughput, traceability; requires technical integration |

| Portable Rockwell Testers | Handheld or easily moved devices, sometimes with battery operation | On-site inspections, field testing, maintenance in remote locations | Highly mobile and convenient; lower precision than benchtop systems |

Standard Rockwell Test

The standard Rockwell test is the most recognized and widely utilized version, making use of different combinations of major (typically 100 or 150 kgf) and minor loads, and a selection of indenters appropriate to the material in question. Multiple distinct scales (such as A, B, C, and F) suit a range of metals—from hardened steel to softer alloys—making this test highly versatile. For B2B buyers, especially in sectors like automotive or structural steel, the standard test provides ease of use and straightforward calibration, with results that are globally comparable and recognized. Procurement considerations include verifying compatible scales for intended materials and ensuring local access to service and calibration support.

Superficial Rockwell Test

The superficial Rockwell variation is engineered for thin or surface-treated materials where traditional test loads would risk damage or inaccuracy. It employs smaller loads (e.g., 15, 30, or 45 kgf) and scale sets such as N, T, W, X, and Y, suitable for case-hardened parts, plating, or delicate sheet metals. This makes it invaluable for buyers in industries like electronics, medical devices, or any production environment working with thin materials. When sourcing, prioritize machines with stable low-load application and reliable, fine-tuned calibration, as even slight inaccuracies can impact quality control.

Twin/Multiple Indenter Systems

These systems allow rapid switching between indenters (diamond, carbide ball, etc.) and sometimes load settings, facilitating varied hardness tests on a single platform. This is a strategic advantage for B2B operations handling diverse materials or offering third-party testing services. Multi-indenter options improve lab flexibility and throughput but typically come at higher initial investment and maintenance costs. When purchasing, assess the ease of indenter changeover, system automation, and availability of spare parts or technical support—attributes crucial in African, Middle Eastern, or emerging market contexts where logistics can be challenging.

Automated Rockwell Testing Systems

Automated systems combine mechanical and software-based precision, boosting productivity and consistency in high-throughput environments. They manage tasks such as data capture, automated loading/unloading, and real-time reporting—crucial for quality-driven B2B buyers in automotive, aerospace, or electronics manufacturing. These systems reduce the reliance on operator skill and enable regulatory compliance through traceable documentation. When procuring, it is important to evaluate integration with existing ERP/QMS platforms and availability of on-site training or remote support, particularly for buyers scaling up in Europe or Latin America.

Portable Rockwell Testers

Portable testers enable on-the-spot hardness assessments, greatly benefiting maintenance teams or operations where transporting samples to a central lab is impractical. Their design prioritizes ruggedness and simplicity, making them ideal for field use across mining, construction, or energy sectors in Africa and South America. While they offer rapid, convenient results, it’s important to recognize their generally lower precision compared to benchtop systems. Buyers should ensure their chosen models are robust, easily recalibrated, and suitable for the local working environment, factoring in aspects such as battery life and resistance to dust or moisture.

Related Video: Large Language Models (LLMs) – Everything You NEED To Know

Key Industrial Applications of rockwell test

| Industry/Sector | Specific Application of rockwell test | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive & Transportation | Quality control of hardened steel components | Ensures component durability, safety compliance | Standards adherence (ASTM, ISO), tester accuracy, scale versatility |

| Metal Manufacturing | Verification of metal alloy hardness in production | Prevents material failure, ensures consistency | Scale range for alloys, operator training, aftersales support |

| Oil & Gas & Energy | Testing of valves, drill pipes, and equipment parts | Reduces risk of equipment failure, ensures field safety | Ability to test large/heavy parts, ruggedness, serviceability |

| Aerospace & Defense | Certification of critical structural components | Guarantees performance under extreme conditions | High-precision testing, documentation/traceability |

| Construction & Infrastructure | Assessment of rebar and structural steels | Maintains building integrity, meets regulatory standards | Field portability, reliable readings on-site, calibration options |

Automotive & Transportation

Rockwell testing is integral to the quality control of transmission gears, axle shafts, springs, and bearing components within the automotive sector. It determines whether metallic parts meet specified hardness ranges, which is crucial for achieving predictable wear resistance and safety standards. For B2B buyers from emerging markets or countries with stringent import regulations, such as Poland or Kenya, ensuring that suppliers adhere to recognized Rockwell scales and international testing standards (ASTM E-18, ISO) is vital. Flexibility in tester types (C scale for hardened parts, B scale for softer metals) and local support for instrument calibration should also be prioritized.

Metal Manufacturing

In metal production, the Rockwell test is used extensively to verify that different metal alloys—such as stainless steels, brass, and aluminum—meet their specified hardness values. This step helps manufacturers avoid downstream failures and ensures product consistency for end-users. International buyers should assess the compatibility of testers with multiple Rockwell scales, as cross-border trading often involves diverse alloys. Operator training, robust aftersales service, and seamless integration into quality control workflows are essential requirements to maintain productivity and traceability.

Oil & Gas & Energy

Equipment such as valves, casings, drill pipes, and rig components must withstand extreme operational pressures and corrosive environments. The Rockwell test enables suppliers and buyers to certify that these parts possess the necessary surface and core hardness, minimizing unplanned downtime and safety incidents. For energy companies and contractors operating in regions like the Middle East or Africa, selecting testers capable of handling large, irregularly shaped parts and withstanding harsh worksite conditions is critical. Portability, ease of calibration, and compliance with both local and global quality norms enhance sourcing confidence.

Aerospace & Defense

Precision and reliability are non-negotiable in aerospace and defense applications, where component failure can have severe consequences. The Rockwell test is often part of the certification protocol for structural metals, fasteners, and engine parts to ensure consistent hardness and performance under high-stress conditions. Buyers from Europe and other demanding markets should look for high-precision Rockwell testers offering comprehensive documentation, digital data export, and full traceability. Compliance with defense standards and the ability to certify parts for international supply chains are also crucial.

Construction & Infrastructure

For large-scale civil engineering projects, the Rockwell test provides a reliable way to assess the hardness of rebar, steel plates, and other key structural elements. This verification helps ensure that building materials will perform over decades of service and exposure. Since infrastructure projects often require on-site testing, buyers should seek Rockwell devices that are portable, rugged, and able to deliver reliable results in varying environmental conditions. Flexible calibration and aftersales service, particularly for remote or fast-developing markets, further reduce operational risks.

Related Video: Rockwell Hardness Test

Strategic Material Selection Guide for rockwell test

Analyzing Common Materials for Rockwell Test: B2B Insights

When applying the Rockwell test in industrial environments, selecting appropriate materials is crucial not only for quality assurance but also for achieving optimal product performance and lifecycle reliability. Below are detailed analyses of four widely encountered material categories from a B2B procurement perspective, with a focus on key properties, practical considerations, and region-specific factors for Africa, South America, the Middle East, and Europe.

Carbon Steel (e.g., ASTM A216 WCB)

Key Properties:

Carbon steel exhibits robust mechanical strength, moderate ductility, and good machinability, making it a popular choice for valves, fittings, and structural components. While it performs well in applications not requiring high corrosion resistance, its mechanical properties are significantly influenced by the carbon content and any additional alloying elements.

Pros:

– Highly cost-effective with readily available supplies in most global markets.

– Familiar manufacturing processes and global standards simplify procurement and compliance.

– Consistent results under routine Rockwell hardness testing.

Cons:

– Prone to corrosion in humid or corrosive media unless protected (e.g., via coatings or linings).

– Limited suitability for aggressive chemical environments or applications with strict hydrogen embrittlement requirements.

Impact on Application:

Well-suited for general service where cost and mechanical robustness are priorities—such as water supply systems or non-corrosive process fluids.

International Buyer Considerations:

Carbon steel grades conform to ASTM standards globally, often mirrored by EN and DIN in Europe and widely recognized in Africa, South America, and the Middle East. Buyers in coastal or high-humidity regions should assess additional corrosion protection requirements.

Stainless Steel (e.g., ASTM A351 CF8/CF8M, DIN 1.4301/1.4408)

Key Properties:

Stainless steels are characterized by excellent corrosion resistance, good temperature resistance, and varying mechanical strengths depending on the grade (e.g., 304/316). Their passivated surfaces prevent rust and chemical attack, making them indispensable for chemical, food, and pharmaceutical processing.

Pros:

– Excellent durability in corrosive environments and under a broad range of temperatures.

– Maintains hardness over time, facilitating consistent Rockwell test results.

– Extensive acceptance and certification by global standards bodies.

Cons:

– Higher initial material and manufacturing costs relative to carbon steel.

– More complex to machine and weld, particularly with higher-alloy grades.

Impact on Application:

Ideal for service with aggressive chemicals, potable water, or food-contact processes where hygiene, longevity, and regulatory compliance are key.

International Buyer Considerations:

Stainless steel is widely specified in ASTM, DIN, and JIS standards. Buyers from regions with strict food/pharmaceutical safety regimes or in coastal/industrial environments (e.g., Kenya, Middle East refineries, EU food processing) often mandate stainless use. Availability and price may fluctuate due to global nickel and chromium supply chains.

Aluminum Alloys (e.g., 6061, 7075 series)

Key Properties:

Aluminum alloys offer light weight combined with moderate to high strength, as well as good corrosion resistance particularly when anodized. Specific properties vary by alloy: 6061 is general-purpose with balanced strength, while 7075 provides higher strength for critical applications.

Pros:

– Low density, reducing handling and transportation costs.

– Good corrosion resistance, especially in atmospheric and marine exposures.

– Efficient thermal conductivity, suitable for heat exchange components.

Cons:

– Lower wear and heat resistance compared with high-alloy steels.

– Some grades can be more prone to surface denting and deformation under testing loads.

Impact on Application:

Best for lightweight structural products, aerospace, automotive, and heat transfer equipment where minimizing mass is advantageous.

International Buyer Considerations:

Compliant with ASTM, EN, and JIS standards. In Africa and South America, aluminum’s lightness aids in project logistics, especially in infrastructure projects with transport constraints. Be mindful of alloy selection to ensure the desired Rockwell test response and final mechanical attributes.

Alloy Tool Steel (e.g., ASTM A681, DIN 1.2510)

Key Properties:

Tool steels, alloyed with elements like chromium, vanadium, and tungsten, provide exceptionally high hardness, wear resistance, and dimensional stability. They are frequently used for dies, cutting tools, and molds—products that must retain precise tolerances under stress.

Pros:

– Superior hardness and wear resistance, especially after heat treatment.

– Maintains sharpness and dimension in high-load and high-temperature settings.

– Broad compatibility with Rockwell C-scale testing.

Cons:

– High material and processing costs.

– Heat treatment and complex alloying increase lead times and manufacturing complexity.

Impact on Application:

Vital for precision tooling, machining, and applications requiring high surface hardness and extended lifecycle.

International Buyer Considerations:

Conforms to international quality regimes (ASTM/DIN/JIS). In regions with limited access to advanced heat treatment facilities (certain parts of Africa/South America), sourcing pre-heat-treated or finished tool steel components may be necessary.

Comparative Summary Table

| Material | Typical Use Case for rockwell test | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Carbon Steel (e.g., A216 WCB) | General service, non-corrosive fluids, structural parts | Cost-effective, good strength | Susceptible to corrosion if not protected | Low |

| Stainless Steel (e.g., CF8/CF8M, 1.4301) | Chemical, food, water processing, corrosive environments | Superior corrosion resistance, global compliance | High material and processing cost | High |

| Aluminum Alloy (e.g., 6061, 7075) | Lightweight structures, transport, heat exchangers | Low density, good machinability | Lower wear/temperature resistance; susceptible to denting | Medium |

| Tool Steel (e.g., A681, 1.2510) | Cutting tools, dies, molds, precision equipment | Exceptional hardness and wear resistance | Expensive, requires heat treatment | High |

In-depth Look: Manufacturing Processes and Quality Assurance for rockwell test

Hardness testing instruments—especially those designed for the Rockwell method—play a critical role in industrial quality assessment, from metallurgy and automotive to aerospace and fabrication. Understanding both the typical manufacturing steps and rigorous quality assurance (QA) procedures is essential for international B2B buyers seeking dependable and compliant equipment. Here is a comprehensive analysis tailored to global sourcing concerns.

Key Manufacturing Stages for Rockwell Test Instruments

1. Material Selection and Preparation

The process begins with the careful selection of high-grade materials. Crucial components, such as the indenter (diamond or hardened steel ball), load actuator, and testing anvil, are manufactured using specific alloys for enhanced durability, stability, and precision. Prior to machining, raw materials undergo chemical and physical verification to ensure conformity with technical specifications and regulatory requirements—a critical checkpoint for buyers wanting assurance in both product quality and traceability.

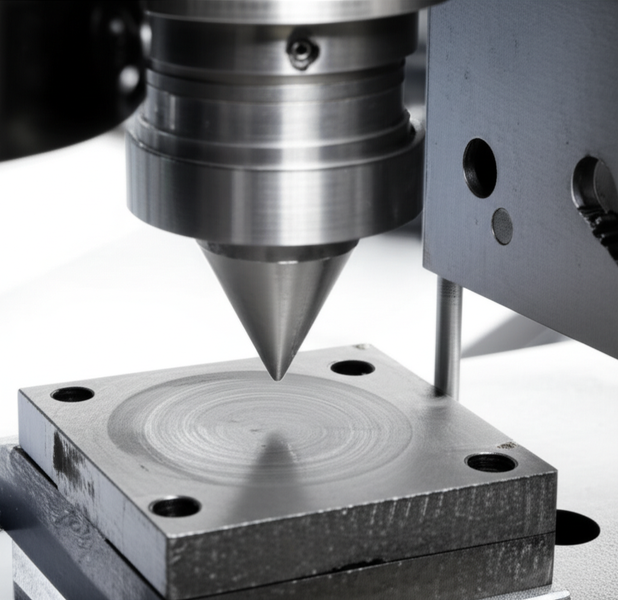

2. Precision Machining and Forming

The heart of Rockwell Hardness Tester manufacturing lies in high-precision machining. Computer Numerical Control (CNC) machines are employed to fabricate core parts, including the indenter housing, test frame, and loading mechanism, within micrometer (μm) tolerances. These processes are strictly monitored for consistency, as even minor deviations can undermine measurement accuracy.

Key aspects include:

– Surface finishing: Critical-contact surfaces are polished and ground to sub-micron smoothness to reduce friction and wear.

– Thermal treatment: Steel parts, especially for indenters and anvils, are heat-treated for optimal hardness and fatigue resistance.

3. Assembly and Integration

Once components are verified, skilled technicians assemble the Rockwell testers. This stage emphasizes:

– Alignment: Ensuring indenter axis and sample stage are perfectly perpendicular to avoid skewed readings.

– Load calibration: Integrating and calibrating load cells for consistent force application.

– Software/hardware checks: For automated or digital testers, integrating control software and electronic modules, followed by functional testing.

4. Finishing and Pre-Delivery Inspection

Units undergo several finishing steps, including corrosion-resistant coating, painting, and branding. Before shipment, each tester is subject to final alignment, cleaning, and load cycle verification to account for environmental effects—particularly important for buyers transporting equipment to regions with temperature extremes or different humidity profiles.

Quality Control: Standards, Methods, and Best Practices

1. Relevant International and Industry-Specific Standards

Manufacturers typically structure their QA systems on globally recognized frameworks:

– ISO 9001: Foundation for quality management systems. Ensures process discipline and documentation.

– ISO 6508 / ASTM E18: Standards specifically governing the Rockwell hardness test protocol, critical for ensuring inter-lab reproducibility.

– CE Marking/EU Compliance: Particularly relevant for buyers in the EU or importing into Europe.

– Sectoral Certifications: For buyers serving oil & gas, aerospace, automotive, or related sectors, verifying API, NADCAP, or IATF 16949 compliance adds a vital layer of confidence.

2. Control Points: IQC, IPQC, FQC

Effective QA relies on layered checks across production:

- Incoming Quality Control (IQC): Inspection of incoming raw materials and outsourced components, with a focus on the indenter and critical electronic modules. For high-volume buyers, supplier audit rights and materials traceability should be contractually secured.

- In-Process Quality Control (IPQC): Continuous oversight during machining, assembly, and calibration. Use of Statistical Process Control (SPC) and real-time monitoring enables early detection of non-conformities, which is especially important with precision test equipment.

- Final Quality Control (FQC): 100% inspection of finished testers, including multi-point hardness calibration checks and simulation runs with standard reference blocks.

Additional QA procedures may include environmental and transportation simulation tests, vital for buyers in regions with challenging logistics or climate conditions.

3. Core Testing & Verification Methods

To guarantee each instrument’s precision and durability, manufacturers commonly apply:

– Test repeatability and reproducibility assessments: Running multiple tests on certified reference materials to ensure the Rockwell readings are within error tolerances set by ISO 6508 or ASTM E18.

– Load accuracy verification: Periodic cross-checks using certified weights and load cells.

– Long-cycle endurance tests: Simulate years of use, crucial for buyers deploying equipment in high-throughput industrial settings.

– Software validation: For digital testers, remote and on-site validation protocols to harmonize with buyers’ regulatory or IT requirements.

How International B2B Buyers Can Assess and Confirm Supplier Quality

1. Pre-Contractual Due Diligence

- Factory audits: On-site or third-party audits to assess manufacturing capabilities, process control, and compliance certification.

- Review of test reports/certificates: Requesting recent calibration records, ISO/CE/API certificates, and product compliance declarations.

2. Ongoing Quality Assurance and Verification

- Third-party inspection: Engage recognized firms to perform pre-shipment inspection and witness calibration or operational tests. This is particularly valuable for buyers in regions with less-developed technical infrastructure.

- Sample testing protocol: Secure sample units for independent verification prior to mass order—a common practice to ensure systematic quality and functionality.

- Batch traceability and after-sales tracking: Require detailed batch and serial number documentation, facilitating warranty claims and future calibration service management.

3. Special Considerations by Region

Buyers from Africa, South America, the Middle East, and Europe should be especially aware of:

– Climatic adaptations: Specify if equipment must meet broader environmental standards, e.g., enhanced anti-corrosion for coastal Africa or load cell stability for desert heat in the Middle East.

– Customs/documentation: Confirm required certificates (such as CE, ISO, or local standards marks) for smoother customs clearance.

– After-sales support: Evaluate supplier capacity for remote support, local calibration, and parts provision in the buyer’s region. Opt for suppliers with established international distribution and support networks.

Actionable Insights for B2B Procurement Professionals

- Insist on transparent documentation and record-sharing throughout the supply chain: This extends from materials procurement to final calibration and delivery checklists.

- Negotiate clear service-level agreements (SLAs) for calibration, warranty, and training: Particularly for buyers operating in geographies with limited technical support.

- Evaluate suppliers’ responsiveness to technical queries and their willingness to customize: Such collaborative engagement often signals higher overall QA maturity.

- Prioritize suppliers with a proven track record of exporting to similar regions: Peer referrals and case studies in Africa, South America, the Middle East, and Europe reduce project risk.

By rigorously vetting manufacturing and QA processes—and choosing suppliers aligned with international standards—B2B buyers can confidently procure Rockwell test equipment that delivers dependable performance and long-term ROI across diverse industrial settings.

Related Video: Water Quality Testing

Comprehensive Cost and Pricing Analysis for rockwell test Sourcing

Key Cost Components in Rockwell Test Sourcing

When evaluating the cost of sourcing Rockwell hardness testing—whether procuring test equipment, outsourced testing services, or integrated factory solutions—buyers must understand the breakdown of pricing:

- Materials: For procuring Rockwell test machines, materials include the machine’s structural components (e.g., precision steel frames), indenters (diamond, carbide, or hardened steel), and digital/control electronics. Consumables such as test blocks and calibration sets should also be factored in for both machine and service sourcing.

- Labor: Labor costs can vary significantly between regions. For outsourced testing, charges will reflect technician expertise and hourly rates. For equipment purchases, consider installation, operator training, and routine maintenance.

- Manufacturing Overhead: This encompasses the allocation of factory utilities, depreciation of fabrication and finishing equipment, and quality assurance carried out during manufacturing.

- Tooling: While Rockwell test machines are primarily ready-made, some custom applications (e.g., specialized fixtures or bespoke indenters) may require additional tooling, influencing upfront costs.

- Quality Control & Certification: Costs for calibration, standards compliance (such as ASTM E18, ISO 6508), and certification are often passed onto the buyer. Demand for traceability and regular recalibration increases this cost component.

- Logistics: Freight costs are highly dependent on equipment size, packaging requirements, destination, and transportation mode (air, sea, or multimodal). Import duties, taxes, and local handling—especially relevant for Africa, South America, and the Middle East—can materially alter the landed cost.

- Supplier Margin: The supplier’s profit margin encapsulates their operational overhead, risk premium (especially for international shipments), and working capital costs.

Primary Price Influencers

Several factors will influence the final price quoted for Rockwell test sourcing:

- Order Volume and Minimum Order Quantity (MOQ): Bulk purchases of equipment or test services typically command volume discounts. However, some highly specialized machines may have low or even no MOQ flexibility.

- Technical Specifications & Customization: Machines tailored for specific industries (e.g., forging vs. plastics) or incorporating automation, multi-scale testing, or advanced data interfaces will cost more. Similarly, tests run to non-standard or client-specific procedures (e.g., exotic materials, special reporting formats) will see price premiums.

- Material Supply Chain: Fluctuations in the cost of high-grade steel, precision components, and diamond/carbide elements directly impact equipment pricing—especially for buyers in regions with volatile currency or supply chain disruptions.

- Quality, Standards, and Certification: Equipment and services validated to international standards—such as ISO or ASTM compliance and third-party calibration—demand higher pricing but improve reliability and downstream acceptance.

- Supplier Factors: Established brands or suppliers with in-region service partners (for faster support in places like Kenya, Poland, or the Middle East) may charge more, but reduce risk and downtime.

- Incoterms: Terms like EXW, FOB, CIF, or DDP significantly affect quoted pricing. For distant geographies, opting for DDP (Delivered Duty Paid) can de-risk imports but increases upfront costs; EXW (Ex Works) may appear cheaper but shifts logistics and customs burdens onto the buyer.

Actionable Buyer Tips for International Sourcing

- Negotiate for Value, Not Just Price: Request breakdowns of cost components and justify any custom or certification surcharges. Especially for buyers in Africa or South America, seek multi-year support or calibration packages for after-sales value.

- Assess Total Cost of Ownership (TCO): Don’t focus solely on equipment or test price. Account for consumables, calibration, maintenance, local technician availability, software updates, and anticipated shipping/customs fees.

- Optimize Volume and Service Bundling: Pooling orders across regional subsidiaries or bundling equipment with test blocks and consumables can attract better terms and reduce logistics charges.

- Verify Supplier Credibility: Insist on references from buyers in your region. For risk-prone corridors, engage only with suppliers who can demonstrate robust post-sale support and clear export experience.

- Clarify Quality Control and Certification Needs: Ensure suppliers specify which standards are met (ASTM, ISO, etc.), provide certification documents, and outline recalibration protocols—critical for export-oriented manufacturers and those serving global clients.

- Understand Pricing Nuances for Your Region: For instance, buyers in Poland or the EU may save on VAT via intra-community supply, while buyers in Kenya or Nigeria should factor in local taxes, port charges, and possible schedule delays impacting project timelines.

Disclaimer: All pricing, cost structures, and sourcing tips presented are indicative and subject to change due to market shifts, currency fluctuations, and evolving logistics or compliance requirements. Request up-to-date, detailed quotations from shortlisted suppliers to inform budgetary and purchasing decisions.

Spotlight on Potential rockwell test Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘rockwell test’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

7 Rockwell Hardness Tester Manufacturers (www.hardnessgauge.com)

Aoli Shenzhen Technology Limited is a well-regarded Chinese manufacturer specializing in Rockwell hardness testers and related material testing instruments. Headquartered in Shenzhen’s technology hub, the company focuses on robust, precision-engineered solutions for measuring material hardness across varied industrial applications. They serve both domestic and global markets, offering an extensive product range suitable for routine quality control and specialist research settings. Notable for their technological adaptability, Aoli provides both analog and digital Rockwell testers designed to accommodate metals, polymers, and composites. The company is oriented toward international business, supporting clients across Africa, South America, the Middle East, and Europe, and emphasizes responsive technical support and after-sales service—critical factors for B2B buyers managing dispersed production sites. While detailed public information on certifications and manufacturing processes is limited, Aoli’s ongoing presence among leading Rockwell tester suppliers attests to their reliability and commitment to industry standards.

Hardness Testers, Rockwell Providers (www.heattreatingdirectory.com)

Hardness Testers, Rockwell Providers is recognized for offering a diverse range of Rockwell-type hardness testers, catering to research laboratories and high-volume industrial environments alike. Their portfolio includes advanced models such as the CLC Series, designed with customizable settings ideal for R&D or specialized applications, as well as the robust CR Series focused on throughput and reliability for routine testing across standard and superficial Rockwell scales. While detailed information on certifications or global export operations is limited, their prominence in authoritative directories signals both sector relevance and established supply capability. International B2B buyers, especially in regions such as Africa, South America, the Middle East, and Europe, will benefit from their broad product range and adaptability to different materials and requirements. Buyers are encouraged to inquire directly regarding compliance with ISO or ASTM standards and support for local installation or training.

Rockwell Hardness Tester (www.globalspec.com)

Rockwell Hardness Tester is featured as a dedicated manufacturer/supplier within the global hardness testing sector, offering Rockwell hardness testers suitable for a diverse range of metallic materials. Their portfolio covers both standard and specialized equipment designed for quality control and metallurgical applications. While detailed public disclosures are limited, their presence on international B2B platforms such as GlobalSpec suggests a focus on industry-relevant standards and specifications, supporting informed procurement for buyers worldwide.

For B2B buyers in Africa, South America, the Middle East, and Europe, the company’s global visibility and supply network offer accessible sourcing opportunities. Their solutions address needs from basic quality inspection to advanced metallurgical testing, adaptable to varying scales of operation. This makes them a practical partner for organizations requiring reliable Rockwell testing technology across multiple markets.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| 7 Rockwell Hardness Tester Manufacturers | Chinese supplier, versatile Rockwell testers, global reach | www.hardnessgauge.com |

| Hardness Testers, Rockwell Providers | Versatile Rockwell testers; custom and high-volume solutions | www.heattreatingdirectory.com |

| Rockwell Hardness Tester | Broad portfolio for global Rockwell testing needs | www.globalspec.com |

Essential Technical Properties and Trade Terminology for rockwell test

Key Technical Specifications in Rockwell Hardness Testing

When sourcing Rockwell hardness testing equipment or services internationally, understanding the core technical properties is essential for making high-confidence procurement decisions. These specifications directly affect test reliability, compatibility with local standards, and the ability to meet end-customer expectations across diverse markets.

1. Rockwell Scale Type (A, B, C, etc.)

Each material requires specific Rockwell scales—commonly A, B, C for metals and M, R for plastics. The chosen scale dictates the indenter type and load used, impacting test accuracy for metals, polymers, or coated materials. For B2B buyers, specifying the correct scale ensures appropriate results for your industry and avoids miscommunication with suppliers.

2. Indenter Type (Diamond/Brale or Ball)

Indenters used in Rockwell testing are typically either a diamond cone (Brale) or hardened steel ball of defined diameter. The choice is material-dependent: diamond indenters are ideal for hard materials (e.g., hardened steel), while ball indenters suit softer metals. Clear communication about indenter requirements prevents costly errors when integrating testing into quality control.

3. Test Load (Minor/Major Load)

Rockwell testing involves applying two distinct loads: a minor load (typically 10 kgf) and a major load (totaling 60, 100, or 150 kgf, depending on the scale). The combination influences measurement sensitivity and is crucial for test repeatability across batches or suppliers in different regions. Specify if you require standard or superficial loads to match global manufacturing practices.

4. Sample Thickness & Minimum Spacing

Not all samples are fit for every kind of Rockwell test. Test reliability depends on adequate sample thickness (commonly at least 10 times the depth of indentation) and sufficient spacing between indents or edges. These parameters should be discussed upfront, especially with overseas manufacturers, to avoid non-compliant or failed tests.

5. Tolerance & Measurement Resolution

Tolerance refers to the permissible deviation in reported hardness values, often ±1 HR unit. High-resolution machines offer better repeatability—critical in sectors like automotive or aerospace. For B2B buyers, understanding equipment resolution and expected tolerances helps align quality expectations across supply chains from Africa to Europe.

6. Compliance to Standards (e.g., ASTM E18, ISO 6508)

International standards ensure consistency and comparability of results. ASTM E18 and ISO 6508 are widely recognized benchmarks. Verifying that suppliers’ equipment or testing services adhere to these standards is key to preventing disputes, especially in cross-border or multi-site manufacturing projects.

Common B2B Trade Terms and Industry Jargon

In addition to technical specs, several trade terms feature prominently in Rockwell test procurement and global supply arrangements. Familiarity with this vocabulary streamlines negotiations, reduces risk, and enhances clarity among stakeholders.

– OEM (Original Equipment Manufacturer):

A company that manufactures equipment, often under another firm’s brand or specification. In hardness testing, OEMs may provide equipment that is white-labeled or directly supplied to industrial end users.

– MOQ (Minimum Order Quantity):

The lowest quantity of equipment or test kits a supplier is willing to sell. Understanding MOQ is vital when negotiating with suppliers in emerging markets or when piloting new testing protocols.

– RFQ (Request for Quotation):

A formal solicitation sent to suppliers for price and delivery information. Providing detailed Rockwell test requirements in an RFQ (scale, load, tolerance, standards, etc.) ensures accurate and timely quotes from international vendors.

– Incoterms:

International Commercial Terms outlining buyer and seller responsibilities for shipping, insurance, and customs. Widely used Incoterms include FOB (Free On Board) and CIF (Cost, Insurance, Freight), which can substantially impact landed cost and risk-sharing.

– Calibration Certificate:

An official document verifying that the hardness tester has been calibrated to recognized standards. Requiring current calibration certificates (preferably traceable to ISO or national standards) is crucial for maintaining test validity and audit readiness.

– Lead Time:

The period between order placement and goods delivery. In the context of B2B international purchases, understanding lead times—including shipping, customs clearance, and installation—helps avoid production delays.

Summary:

For international B2B buyers evaluating Rockwell hardness testing solutions, attention to technical parameters (scale, indenter, load, standards, etc.) and fluency with key trade terms (OEM, MOQ, Incoterms) are foundational to both technical success and commercial risk mitigation. Ensuring precise communication of requirements and robust supplier vetting will drive consistent quality outcomes and enhance the efficiency of global procurement cycles.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the rockwell test Sector

Global Market Overview and Key Trends

The Rockwell test sector is witnessing significant transformation as it adapts to evolving industry requirements, digitalization, and heightened quality standards worldwide. Demand for reliable materials testing—led by sectors such as automotive, aerospace, construction, and energy—is propelling the adoption of Rockwell hardness testers across key economies in Africa, South America, the Middle East, and Europe. As new manufacturing centers emerge in countries like Poland, Kenya, and Brazil, access to advanced, user-friendly hardness testing is an essential criterion for raw material validation, in-process quality control, and finished goods certification.

Key drivers shaping market dynamics include:

- Globalization of Supply Chains: With cross-border manufacturing, consistent material standards are vital. Rockwell test devices equipped with multi-protocol data interfaces allow seamless integration into diverse quality assurance systems.

- Automation and Smart Testing: Manufacturers and buyers are increasingly favoring digital Rockwell testing systems with connectivity features, automated test cycles, and data logging for traceability. Such advancements reduce human error and allow for real-time analytics.

- Cost-Efficiency and Portability: Especially in regions with developing industrial infrastructure, there is high demand for durable, low-maintenance testers that can deliver reliable results even in challenging environments.

- Training and Certification Support: B2B buyers are prioritizing suppliers that offer comprehensive training, remote support, and equipment calibration aligned with international standards like ASTM E-18 and ISO 6508.

Emerging trends include:

- Remote and Cloud-Based Quality Control: Integration of Rockwell testers with cloud-based platforms for centralized data aggregation, analysis, and reporting—particularly relevant for decentralized supply chains in Africa and South America.

- Customization for Local Conditions: Vendors are tailoring solutions for unique regional requirements, such as voltage adaptations, multi-language interfaces, and additional technical support for buyers unfamiliar with standardized testing.

- Increased Collaboration: Strategic partnerships between equipment suppliers, government standards bodies, and large-scale manufacturers in the Middle East and Europe drive harmonization of testing protocols for export-oriented sectors.

To maximize return on investment, B2B buyers should focus not just on equipment performance but also on supplier reliability, post-sales service, and long-term technical support.

Sustainability and Ethical Sourcing

Sustainability considerations are becoming central in B2B procurement decisions across the Rockwell test sector. International buyers are under growing pressure to select suppliers whose manufacturing and operational practices minimize environmental impact and uphold ethical supply chain principles.

Core sustainability aspects in this sector:

- Eco-Design and Energy Efficiency: Modern Rockwell testers are being designed for lower energy consumption, reduced need for consumables, and longer service intervals. Choosing energy-efficient and robust models lessens both operational costs and carbon footprint over the instrument lifecycle.

- Recyclable Materials and Green Certifications: Equipment constructed from recyclable metals and minimal plastics is increasingly prioritized. Certifications like ISO 14001 (Environmental Management) and RoHS compliance are becoming standard requirements for B2B procurement, reassuring buyers of the product’s environmental credentials.

- Ethical Sourcing of Components: Responsible sourcing extends to the metals, electronics, and consumables used in Rockwell testers. Ensuring suppliers avoid conflict minerals and adhere to fair labor practices is essential for meeting global compliance obligations, especially for buyers exporting to markets with strict sustainability mandates.

- Waste Management and End-of-Life Solutions: Suppliers offering take-back schemes for outdated equipment, safe disposal of test coupons, and parts reuse are viewed favorably by buyers aiming for zero-waste operations.

Procurement strategies integrating environmental, social, and governance (ESG) criteria not only help meet regulatory requirements but also enhance brand reputation and market differentiation. B2B buyers should insist on full transparency regarding a supplier’s sustainability policies and request supporting documentation during the tender process.

Historical Evolution and Significance

The Rockwell hardness test originated in the early 20th century as a faster, more objective alternative to existing methods for assessing material hardness. Over the decades, it has evolved into one of the most widely adopted and standardized testing procedures in metals and plastics industries globally. The adoption of strict international standards (such as ASTM E-18 and ISO 6508) has cemented Rockwell testing’s role as a benchmark for quality assurance across diverse supply chains.

Today, the method’s rapid, non-destructive results and adaptability to various sample shapes and sizes make it indispensable for modern B2B operations. Its evolution underscores the growing need for precision, repeatability, and integration with digital quality management systems—reflecting broader industry movements toward traceability and supply chain accountability.

By understanding these market trends, sustainability imperatives, and the historical context of Rockwell testing, B2B buyers from regions such as Africa, South America, the Middle East, and Europe can make informed sourcing decisions that support both operational efficiency and responsible business practices.

Related Video: Global Trade & Logistics – What is Global Trade?

Frequently Asked Questions (FAQs) for B2B Buyers of rockwell test

-

How can I effectively vet and select reliable Rockwell test equipment suppliers internationally?

Start by checking the supplier’s track record, industry reputation, and client references—especially experiences from businesses in your region. Verify they have relevant certifications (ISO 9001, CE) and can demonstrate compliance with standards like ASTM E18. Request sample calibration reports, documentation, and service support information. Use platforms such as Alibaba, industry trade fairs, or B2B trade associations to shortlist partners. For added assurance, consider third-party audits or on-site inspections if possible, and prioritize suppliers with strong after-sales support and global service networks. -

What customization options should I request to ensure Rockwell test equipment meets my local requirements?

Clearly specify intended application—metals, polymers, or specialized alloys—to select appropriate Rockwell scales (A, B, C, F, etc.) and indenter types (diamond, ball). If your lab or production floor has unique voltage, environment, or space constraints, ask for custom power configurations or compact models. Request user interface language localization, data output integration (USB, Ethernet), and regional compliance certification. If testing samples of unusual shapes, thinness, or surface profiles, discuss special test anvils or superficial Rockwell adaptations with the supplier. -

What are the typical minimum order quantities (MOQs), lead times, and payment terms for Rockwell hardness testing systems?

MOQs for full Rockwell testers are commonly one unit, while consumables (indenters, test blocks, accessories) may have higher MOQs per order. Lead times vary by level of customization and inventory, ranging from 2-4 weeks for standard models to 8-12 weeks for customized builds. Payment terms depend on supplier and country risk: expect 30–50% down payment, with balance on shipment or delivery. Many reputable suppliers accept letters of credit (L/C), bank transfers (T/T), or secure escrow via trade platforms for international buyers. -

Which quality assurance measures and certifications should I require when sourcing Rockwell test equipment?

Always request proof of calibration to recognized standards (e.g., ASTM E18, ISO 6508). Ask for manufacturer certificates (ISO 9001), CE markings (for Europe/Middle East), and official test reports for each unit. Ensure traceability of reference hardness blocks and verify that recalibration and service support is available locally or regionally. Insist on a warranty (typically one year minimum) that covers parts, labor, and software updates. For extra assurance, ask about QA processes like incoming material checks and final inspection protocols at the supplier’s facility. -

What are the key logistics considerations for importing Rockwell test equipment into markets such as Africa, South America, or the Middle East?

Clarify incoterms with your supplier—FOB, CIF, or DDP options all affect risk and responsibility. Ensure appropriate export packaging (shock-resistant, moisture-proof) and request all necessary documentation (commercial invoice, packing list, certificate of origin, compliance certificates). Check if local import regulations require third-party testing or certification. Factor in customs duties, VAT/taxes, and potential port handling delays. Engage a logistics partner with experience in scientific equipment and, if possible, select suppliers who have a track record of successful shipments to your country or region. -

How should I handle disputes or warranty claims with overseas Rockwell test suppliers?

Establish clear terms in your purchase contract regarding dispute resolution—specify governing law, arbitration procedures (e.g., ICC, LCIA), and response timelines. Keep thorough records of all communications and ensure that warranty coverage terms are well defined in writing. In the event of faulty equipment, document the issue with photos or videos and request a joint inspection. Escalate through international trade mediation bodies or your chamber of commerce if resolution stalls. When working via a B2B marketplace, leverage their escrow and dispute resolution processes for additional security. -

What ongoing support and training can I expect from international Rockwell test equipment suppliers?

Reputable suppliers offer user manuals, online support, and sometimes onsite training during installation. For complex equipment, remote technical assistance, video tutorials, or multi-language training resources may be available. Some vendors provide periodic software updates and guidance on routine calibration or troubleshooting. Request details on the availability of spare parts and local service partners in your region, and clarify what support is included within the warranty period versus paid services. -

How can I ensure consistent and accurate Rockwell hardness results across multiple sites or international subsidiaries?

Standardize on equipment brands and models where possible and provide uniform operator training. Regularly recalibrate machines using traceable reference test blocks, and synchronize procedures to recognized standards (ASTM E18, ISO 6508). Implement routine internal audits and participate in inter-laboratory comparison programs to benchmark results. Establish protocols for environmental control (temperature, humidity) and sample preparation, particularly when operating in diverse climates common across Africa, South America, and the Middle East. Consider remote monitoring or data management software for central oversight of test results.

Strategic Sourcing Conclusion and Outlook for rockwell test

International B2B buyers evaluating the Rockwell hardness test for their supply chains should recognize its significant advantages in accuracy, efficiency, and adaptability across metals and polymers. This method stands out for its operational simplicity and ability to deliver precise material assessment, attributes especially valuable in diverse manufacturing contexts across Africa, South America, the Middle East, and Europe. By aligning procurement strategies with standardized practices—such as adherence to ASTM E-18—buyers can mitigate quality risks and strengthen their supplier relationships.

Key B2B takeaways include:

– Versatility: The Rockwell test accommodates a broad range of materials, supporting flexibility in sourcing decisions across industries.

– Reliability: Its standardized procedure enhances confidence in quality control, facilitating global trade and compliance with international standards.

– Cost-effectiveness: The method’s efficiency reduces overall testing costs, a crucial factor for buyers managing competitive sourcing in emerging and established markets.

Strategic sourcing anchored in robust quality assessment tools like the Rockwell test ensures consistency and trust in cross-border transactions. Looking ahead, as global markets demand higher quality and faster delivery, embracing the Rockwell hardness test within your procurement and verification processes will be pivotal. International buyers are encouraged to partner with suppliers who invest in such standardized testing protocols, driving both performance and competitiveness in their respective markets.