Introduction: Navigating the Global Market for metal casting mold

Metal casting molds stand at the core of manufacturing operations across sectors, from heavy machinery and automotive components to intricate parts for aerospace and energy industries. For international B2B buyers—especially those navigating dynamic markets in Africa, South America, the Middle East, and Europe—the ability to source reliable, precise, and cost-effective metal casting molds is a strategic advantage. The stakes are high: a well-designed mold is not just a blueprint for a single part, but the foundation for consistent quality, operational efficiency, and long-term competitiveness.

In an era of globalized supply chains and rapidly evolving manufacturing requirements, understanding the nuances of metal casting molds is no longer optional. Buyers must navigate a complex landscape of mold types—such as sand, die, and investment casting molds—each offering unique advantages based on production volume, material choice, and design complexity. The decision extends beyond the mold itself; it covers a spectrum from selecting suitable raw materials (like foundry-grade sands, binders, and refractory coatings) to evaluating supplier capabilities in manufacturing precision, quality control, compliance, and post-casting support.

This guide delivers a comprehensive roadmap tailored to the unique challenges faced by buyers in international markets. It provides:

- Clear breakdowns of mold types and casting processes to align your sourcing with product application and end-use requirements

- Detailed analysis of essential materials and manufacturing techniques, crucial for both cost-efficiency and finished product quality

- Practical frameworks for assessing suppliers, ensuring transparency, reliability, and global compliance

- Insights into current pricing structures and market dynamics, with focus on regional sourcing nuances

- Answers to common B2B FAQs and key industry pain points

Armed with these insights, buyers from Brazil to South Africa, and from the Gulf states to European industrial hubs, will be well-equipped to make informed decisions, negotiate effectively, and forge lasting partnerships with trusted mold suppliers.

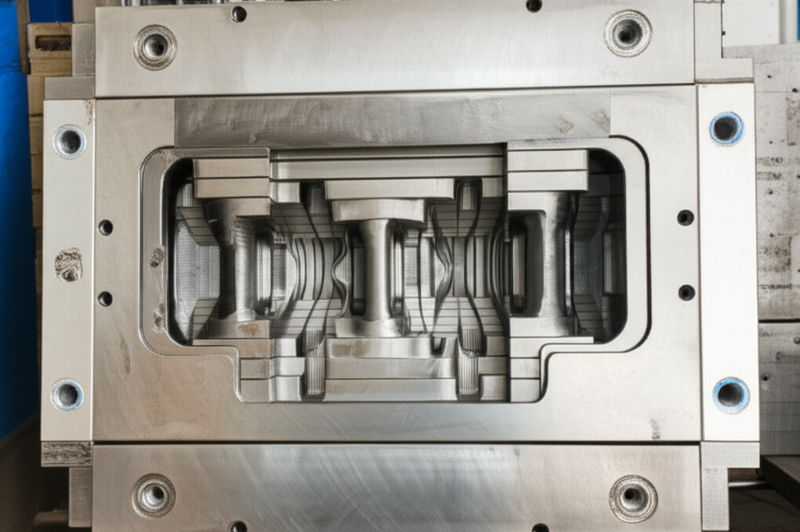

Understanding metal casting mold Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Sand Casting Mold | Single-use, formed from sand and binder around a pattern | Automotive, machinery, mining equipment | Affordable, flexible shapes; lower surface finish, less suitable for mass production |

| Die Casting Mold | Permanent, high-precision metal molds for repeated use | Automotive parts, consumer goods, electronics | Excellent precision, fast cycles; high upfront tooling cost, best for volume orders |

| Investment Casting (Lost Wax) Mold | Expendable ceramic shell built over wax pattern | Aerospace, energy, precision components | Tight tolerances, complex shapes; higher per-part cost, longer lead times |

| Permanent Mold (Gravity) Casting | Durable metal mold, can be reused many times | Pipe fittings, gear housings, valves | Good surface finish, medium complexity; shape/size limitations, higher mold cost |

| Shell Mold Casting | Thin sand-resin shell, precise and smooth cavities | Pump housings, small industrial parts | Fine details, neat surfaces; moderate cost, suited for small-to-medium runs |

Sand Casting Mold

Sand casting molds are crafted by packing sand and clay binders around a pattern, forming a cavity for molten metal. This method is well-suited for producing large components or custom parts with flexible shapes. For B2B buyers in sectors like mining, shipbuilding, and heavy industry, sand casting enables cost-effective prototyping or low-to-medium volume production. Key considerations include surface finish quality, dimensional tolerances, and transport logistics due to mold fragility and size. International buyers should also assess local sand quality and foundry expertise to ensure consistent results.

Die Casting Mold

Die casting utilizes permanent metal molds, often steel, to enable rapid, high-precision production of metal parts. Buyers in automotive, electronics, and consumer goods benefit from this method’s ability to deliver thousands of identical castings with excellent surface finish and dimensional control. However, substantial mold tooling investment is required, making die casting most cost-effective for high-volume orders. When sourcing internationally, buyers must carefully evaluate supplier track records in maintaining die life, mold maintenance, and compliance with export regulations.

Investment Casting (Lost Wax) Mold

Investment casting involves creating intricate wax models, encasing them in ceramic shells, and melting away the wax to form a precise mold cavity. This method is ideal for aerospace, energy, and industries requiring complex, lightweight, or highly-detailed parts. While investment casting offers superior shape complexity and accuracy, it comes at a higher per-part cost and needs longer lead times. B2B buyers should consider the trade-off between precision and overall cost, as well as suppliers’ experience with specialty alloys and quality assurance certifications.

Permanent Mold (Gravity) Casting

Permanent mold casting, or gravity die casting, uses robust metal molds to produce medium-volume runs of consistent components. Industries like valve manufacturing and transport benefit from this method’s improved surface finish and faster turnaround compared to sand casting. Although upfront mold costs are higher, per-part costs decrease with repeated use. Buyers should verify mold longevity, mold maintenance capabilities, and the supplier’s track record with custom geometries, especially when ordering for infrastructure or public works projects.

Shell Mold Casting

Shell mold casting forms a thin, sand-resin shell around a heated pattern, creating molds that provide finer tolerances and smoother finishes than traditional sand casting. This variation matches the needs of manufacturers producing pump parts, impellers, or other industrial equipment requiring intricate features and reliable repeatability. The process is moderately priced and suitable for small-to-medium batch sizes. For B2B buyers, selecting a supplier with advanced mold handling and resin technology expertise will directly impact casting consistency and surface integrity, essential for parts used in regulated or export-driven markets.

Related Video: What Are The Common Types Of Metal Casting Process In Engineering and Industry?

Key Industrial Applications of metal casting mold

| Industry/Sector | Specific Application of metal casting mold | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive | Engine block, transmission housing, brake system parts | High-volume, intricate part production; durability and consistency | Precision in mold design, alloy compatibility, quality control |

| Energy & Mining | Pump housings, turbine blades, drilling equipment parts | Superior strength, wear and heat resistance, complex geometries | Material strength, lead times, local climate adaptability |

| Agriculture | Machinery components, plowshares, irrigation valves | Cost-effective, scalable production of robust, tailored equipment | Mold life-span, corrosion resistance, after-sales support |

| Infrastructure & Construction | Pipe fittings, valve bodies, structural connectors | Custom designs, structural integrity, resistance to harsh conditions | Standards compliance, delivery reliability, environmental adaptation |

| Aerospace & Aviation | Turbine parts, landing gear components, brackets | Lightweight, high-precision, and complex-shaped parts | Stringent tolerances, certification, traceability |

Automotive

Metal casting molds are fundamental in producing critical automotive components such as engine blocks, transmission housings, and brake system parts. High-volume production requirements in this sector demand precision molds capable of delivering consistently accurate, intricate geometries. For international B2B buyers, particularly in rapidly growing markets like Brazil and South Africa, selecting a mold supplier with expertise in alloy compatibility and advanced quality control systems ensures longevity and performance of cast components—key for meeting both regulatory standards and market competitiveness.

Energy & Mining

This sector relies heavily on custom-cast pump housings, turbine blades, and drilling equipment, all requiring molds that withstand extreme wear, heat, and abrasive environments. For buyers in the Middle East or regions with challenging climates, sourcing partners adept at material science and capable of rapid turnaround is crucial. Molds must be engineered for durability, supporting the efficiency and lifespan of equipment in demanding operations, and suppliers should demonstrate robust logistics and climate adaptability for timely deliveries and optimal performance.

Agriculture

Farming and irrigation systems depend on cast metal parts like machinery components, plowshares, and irrigation valves, often exposed to corrosive environments, soil abrasion, and high workloads. Efficient mold design enables scalable, affordable production of durable, application-specific parts. International buyers in Africa or Australia should focus on suppliers who offer extended mold lifespans, corrosion-resistant coatings, and reliable after-sales support, ensuring continuity of essential agricultural operations and minimizing downtime.

Infrastructure & Construction

Reliable metal casting molds are indispensable in producing pipe fittings, valve bodies, and structural connectors for building and infrastructure projects. These applications call for custom solutions that deliver high structural integrity and can withstand harsh environmental factors—from extreme weather to aggressive chemicals. B2B buyers in rapidly urbanizing regions benefit most from partners who meet international standards, offer responsive delivery schedules, and adapt to varied local environmental requirements, ensuring compliance and project success.

Aerospace & Aviation

In aerospace, casting molds produce lightweight, high-precision components such as turbine parts and landing gear brackets, where tolerances are especially tight. The sector’s stringent regulatory and quality standards demand molds manufactured with advanced techniques and full material traceability. Buyers, particularly in Europe and South America, must prioritize suppliers with proven certification, technical capabilities, and established track records in supplying to aerospace OEMs—safeguarding both supply chain reliability and in-flight safety standards.

Related Video: Metal Casting (Part 1: Definitions and process overview)

Strategic Material Selection Guide for metal casting mold

Understanding Common Mold Materials for Metal Casting: A B2B Perspective

Selecting the right material for metal casting molds is critical for optimal product quality, manufacturing efficiency, and overall cost-effectiveness. For international B2B buyers, especially across Africa, South America, the Middle East, and Europe, making informed choices about mold materials means balancing regional availability, regulatory standards, and the specific needs of diverse casting applications. Below, we analyze four commonly used materials in metal casting molds: sand, ceramic, metal (steel and cast iron), and graphite.

1. Sand Mold

Key Properties:

Sand molds, primarily using silica or zircon sand combined with clays (e.g., bentonite), offer good thermal resistance and shape conformability. They efficiently withstand temperatures of 800-1000°C below the melting point of most commonly cast metals.

Pros:

– Cost-effective and readily available in most markets.

– Suitable for complex and large geometries.

– Flexible design and rapid prototyping.

Cons:

– Limited durability; sand molds are typically single-use (expendable).

– Surface finish and dimensional accuracy can be lower than with permanent mold methods.

– Moisture sensitivity requires careful handling and storage.

Impact on Application:

Ideal for low to moderate production runs and ferrous/non-ferrous metal castings across sectors like automotive, construction, and machinery.

International Considerations:

– Compliance: Widely accepted under major standards (ASTM, DIN, JIS).

– Regional Note: Locally sourced sand quality may vary, affecting casting outcomes (e.g., silica availability in Africa/Brazil or environmental controls in Europe).

– Logistics: Bulk shipping is costly; sourcing locally is preferred to minimize costs and delays.

2. Ceramic Mold

Key Properties:

Ceramic molds, often made from zircon, alumina, or fused silica, provide exceptional thermal stability and can withstand casting of metals at extremely high temperatures.

Pros:

– High dimensional accuracy and smooth surface finish (especially for investment/lost wax casting).

– Supports casting of high-performance alloys and complex parts.

Cons:

– Higher raw material and production costs.

– More fragile compared to metal molds; requires careful handling.

Impact on Application:

Favored for aerospace, energy, and precision engineering sectors requiring intricate components and tight tolerances.

International Considerations:

– Compliance: Producing to tight international standards (ASTM E132, ISO 12677) is essential for global supply chains.

– Regional Note: May be preferred in Europe and the Gulf for high-spec engineered components.

– Supply Chain: Material import/export restrictions and customs considerations (like REACH compliance in the EU) may affect sourcing.

3. Metal Mold (Steel and Cast Iron)

Key Properties:

Steel or cast iron molds (permanent/semipermanent molds) are robust and have high heat capacity, enabling repeated use for high-volume production.

Pros:

– Superior durability and reusability.

– Enables consistent casting quality over long runs.

– Short cycle times increase throughput.

Cons:

– High upfront tooling costs and significant manufacturing complexity.

– Limited adaptability for design changes; not suitable for prototyping.

Impact on Application:

Well-suited for automotive, plumbing, and high-volume industrial parts, especially when long production runs justify mold investment.

International Considerations:

– Standards: Global acceptance; ensure molds comply with DIN EN 1561/1563 (iron castings) or ASTM A681 (tool steels).

– Regional Note: Infrastructure and maintenance capability are factors—countries with mature manufacturing sectors (e.g., Germany, Brazil, Australia) more readily adopt permanent molds.

– Cost: Transport of finished molds can be significant due to weight.

4. Graphite Mold

Key Properties:

Graphite’s non-wettable nature, high thermal conductivity, and chemical inertness make it exceptional for precision casting, especially of non-ferrous metals and precious alloys.

Pros:

– Yields clean, easily-released castings with fine finishes.

– Resists thermal shock and suitable for metals like gold, silver, and copper.

Cons:

– Material is expensive and subject to supply fluctuations.

– Gradual erosion with repeated use limits lifecycle in high-volume settings.

Impact on Application:

Highly valued in electronics, jewelry, and specialty applications demanding high purity and precision.

International Considerations:

– Standards: Compliance with purity and performance standards (ASTM C781, ISO 20203) may be required.

– Regional Note: Import restrictions or supply concerns may affect cost—buyers may need to source from established graphite suppliers (common in Europe/Asia-Pacific).

– Sustainability: Environmental or traceability requirements (notably in the EU) must be checked.

Summary Comparison Table

| Material | Typical Use Case for metal casting mold | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Sand | General foundry work; large, complex, or prototype parts | Low cost and wide availability | Single-use; limited accuracy, surface finish | Low |

| Ceramic | Precision castings for aerospace, energy, or engineering components | High accuracy and temperature resistance | Fragile; higher cost and handling complexity | High |

| Metal (Steel/Cast Iron) | High-volume production of industrial and automotive parts | Long mold life and repeatability | High upfront and transport costs | High |

| Graphite | Precision casting of non-ferrous/precious metals, electronics, jewelry | Excellent finish and chemical inertness | Erosion limits lifecycle; supply fluctuations | High |

In-depth Look: Manufacturing Processes and Quality Assurance for metal casting mold

Metal casting molds are fundamental to the production of high-precision parts across numerous industries. In B2B contexts, especially for buyers in markets across Africa, South America, the Middle East, and Europe, understanding both the intricacies of the mold manufacturing process and the standards of quality assurance is crucial for making informed sourcing decisions. Below is a comprehensive walkthrough designed for international B2B buyers, covering the key stages of mold production and actionable strategies for validating quality assurance.

Key Stages of Metal Casting Mold Manufacturing

1. Material Preparation

The manufacturing process begins with the selection and preparation of both pattern and mold materials. Common choices for patterns include wood, aluminum, steel, or resin, with the final material determined by production volume and required dimensional accuracy. For the mold itself, options include:

- Sand (with clay or chemical binders): Used for versatility and cost efficiency in sand casting.

- Die steel: Preferred in die casting for its hardness and repeatability.

- Ceramic or investment materials: Employed in investment/lost-wax casting for fine detail replication.

Each material is thoroughly inspected for impurities or inconsistencies, ensuring the mold will withstand the high thermal and mechanical stresses of molten metal pouring.

2. Pattern Design and Mold Forming

Pattern-making is a critical stage where the desired part is first realized, typically through CAD modeling to ensure all features, tolerances, and shrinkage allowances are accurately incorporated. For high-volume production, CNC machining or additive manufacturing is used to fabricate master patterns with micron-level precision. Forming techniques are then chosen based on the casting method:

- Hand or mechanical sand packing for sand molds.

- Wax injection and shell building in investment casting.

- Precision machining of die blocks in die casting.

Careful forming ensures that all intricate features of the final part are represented.

3. Mold Assembly

Once individual mold components are finished, they are assembled—aligning cores, inserts, and gating systems as per design. This step includes application of refractory coatings to critical surfaces, improving heat resistance and metal flow qualities. Assembly must be performed in controlled environments to prevent contamination, which could lead to casting defects.

4. Finishing and Inspection of Molds

The assembled molds undergo mechanical finishing, which may involve trimming, grinding, sanding, or the addition of surface coatings to optimize the release and surface quality of the cast part. Final dimensional checks and visual inspections are executed, ensuring the mold cavity is free from cracks, debris, or surface irregularities.

Essential Quality Assurance (QA) and Control (QC) Practices

Adherence to International Standards

Globally recognized certifications and standards form the backbone of effective quality control:

- ISO 9001: The cornerstone quality management system standard for consistent process execution and continual improvement.

- ISO 8062: Pertinent to casting dimensional tolerances, often referenced in technical agreements.

- CE Marking (Europe): Mandatory for cast parts in regulated sectors.

- API (American Petroleum Institute) Standards: Required for molds and castings serving the oil & gas industry.

Core QC Checkpoints for Mold Fabrication

A robust quality control framework spans multiple stages:

- Incoming Quality Control (IQC): Verifies the chemical, mechanical, and thermal properties of raw materials and pattern supplies using material certificates, spectrometers, or sample testing.

- In-Process Quality Control (IPQC): Monitors key parameters during mold forming and assembly. Common checks include:

- Dimensional measurement using CMM (coordinate measuring machines)

- Core alignment verification

- Surface finish and roughness testing

- Hardness and strength assessment (especially for metallic molds)

- Final Quality Control (FQC):

- Visual inspection for surface defects, cracks, or inclusions

- Dimensional conformity to CAD model/specifications

- Fit-up and assembly confirmation (where applicable)

- Functional simulation or trial runs (for complex or high-value molds)

Common Testing Methods

- Non-destructive testing (NDT): Dye penetrant, magnetic particle, or ultrasonic inspection identifies subsurface cracks or porosity.

- Thermal cycling: Simulates mold exposure to operational temperatures, verifying resistance to thermal shock or deformation.

- Material analysis: Laboratories use spectroscopic analysis to verify alloy composition for critical components.

How B2B Buyers Can Verify Supplier Quality

Supplier Evaluation and Auditing

B2B buyers should conduct thorough initial and periodic supplier assessments. Key steps include:

- On-site audits: Review the manufacturer’s workflow, documentation, and compliance with stated standards.

- Document review: Request and analyze ISO9001 certificates, process flowcharts, and recent internal/external audit reports.

- Sample evaluation: Order trial molds or request retained samples from previous production for independent review.

Quality Documentation and Process Transparency

- Inspection reports: Suppliers should furnish detailed inspection and test reports corresponding to each batch or lot.

- Traceability records: For traceability, ensure suppliers record all raw materials, batch numbers, and inspection outcomes.

- 3rd-party inspections: Engage internationally recognized inspection agencies (e.g., SGS, Bureau Veritas, TUV) for end-to-end oversight, especially for large orders or unfamiliar suppliers.

Regional Nuances and Best Practices for International Buyers

- Africa & South America: Importers in these regions should emphasize validation of international certifications and, where possible, supplement supplier QC with independent 3rd-party inspection, due to variable local infrastructure and regulatory oversight.

- Middle East: Buyers often require compliance with both ISO and sector-specific standards (API, ASME), particularly for energy or heavy industry applications. Confirm supplier familiarity with regional documentation and logistics requirements.

- Europe (e.g., Brazil, Australia): Compliance with CE and RoHS/EU REACH standards may be mandatory, particularly for molds used in equipment destined for regulated sectors. European buyers should seek suppliers capable of providing EC declarations and comprehensive technical files.

Actionable Takeaways for International B2B Buyers

- Demand Transparency: Clarify credential verification, QC process descriptions, and batch-wise inspection data at the RFQ stage.

- Build-in QC Gateways: Align expectations on IQC, IPQC, and FQC checkpoints within contractual agreements and technical specifications.

- Third-Party Verification: For critical molds, especially where shipping lead times or import barriers are high, always budget for 3rd-party inspections and consider pre-shipment sample approval.

- Continuous Communication: Maintain proactive, documented communication with suppliers for rapid problem resolution and corrective action if QC issues are detected.

B2B buyers equipped with a solid grasp of both the technical manufacturing process and the layered approach to quality assurance will be well-placed to source metal casting molds reliably, mitigate risk, and ensure compliance with both global and local market requirements.

Related Video: China’s Top 5 Manufacturing and Mass Production Videos | by @miracleprocess

Comprehensive Cost and Pricing Analysis for metal casting mold Sourcing

Key Cost Components in Metal Casting Mold Sourcing

Approaching metal casting mold sourcing from a B2B perspective requires careful breakdown of the total cost structure. Understanding each cost component empowers buyers to negotiate effectively, benchmark suppliers, and anticipate downstream impacts on their operations. Major cost elements include:

- Raw Materials: The primary drivers are mold materials (e.g., high-quality silica sand, specialty clays, refractories for coatings), core inserts, and pattern-making supplies. Costs fluctuate based on input quality and global commodity prices.

- Labor: Skilled pattern-makers, mold technicians, and foundry operators contribute a significant labor cost, especially where manual processes or highly customized molds are involved. Labor rates vary by geography, so sourcing from lower-cost labor markets can result in savings, but may pose issues with skills or quality control.

- Manufacturing Overheads: This covers equipment depreciation, utility consumption (e.g., high-energy ovens), floor space, and environmental control. Efficient foundries may leverage automation or energy-efficient processes to reduce this component.

- Tooling and Pattern Costs: For custom molds, especially in die casting or investment casting, up-front tooling and master pattern creation can be substantial. These are usually amortized over the production run but must be factored into overall project pricing.

- Quality Control (QC) & Testing: Advanced molds require non-destructive testing, dimensional verification, and sample runs to ensure precision and repeatability—all of which add to the per-unit mold cost.

- Logistics & Packaging: Molds, especially large industrial ones, incur significant freight costs—ocean, air, or ground—plus export crating, insurance, and customs duties. Remote destinations (e.g., Africa, South America, parts of the Middle East) may see increased costs due to limited direct shipping routes.

- Supplier Margin: Suppliers bake in profit margin influenced by company size, value-added services, and local competition.

Principal Price Influencers

Several key factors drive the quoted price for metal casting molds on the international stage:

- Order Volume / Minimum Order Quantity (MOQ): Higher volumes reduce per-unit cost due to economies of scale, spreading tooling and setup over more units.

- Technical Specifications & Customization: Tight tolerances, complex geometries, and unique features (e.g., cooling channels, inserts) escalate both material and labor expenses.

- Material Selection: Specialty alloys or demanding mold materials boost both raw material and handling costs.

- Quality Requirements & Certification: International buyers often stipulate ISO, ASTM, or sector-specific certifications, which can raise supplier quality assurance and compliance investment.

- Supplier Capabilities & Location: Experienced suppliers or those in major manufacturing hubs (e.g., China, India, Eastern Europe) can offer more competitive rates but may differ in lead times, logistics, and after-sales support.

- Commercial Terms (Incoterms): EXW (Ex-Works) versus DDP (Delivered Duty Paid) can dramatically influence total landed cost, especially where buyers need comprehensive shipping and customs handling.

- Fluctuating Input Costs: Global energy prices, exchange rates, and regulatory shifts can affect both short-term quotes and long-term contract pricing.

Practical Buyer Strategies: Achieving Cost Optimization

For international buyers—whether sourcing from Brazil, Nigeria, Saudi Arabia, or Australia—robust cost management extends beyond the initial mold price. Consider the following actionable tactics:

- Negotiate for Transparent Cost Breakdown: Request itemized quotes to identify high-cost drivers and negotiate favorable terms (e.g., tooling amortization, sample discounts).

- Leverage Total Cost of Ownership (TCO): Don’t focus exclusively on unit price; factor in logistics, customs, potential rework, replacement lead time, and after-sales service. Sometimes a marginally higher upfront price yields lower lifetime costs.

- Optimize Volume and Consolidate Orders: Pooling requirements across projects or divisions improves bargaining power and reduces per-mold costs via higher volumes.

- Evaluate Local vs. Overseas Suppliers: While overseas manufacturing may offer price advantages, analyze lead times, IP protection, risk of delays, and ability to support urgent after-sales issues.

- Scrutinize Incoterms and Logistics: Clarify responsibility points and seek clarity on insurance and import duties. For Africa and remote markets, ensure suppliers are experienced with local shipping and documentation requirements.

- Assess Supplier Track Record and Certifications: Insist on verifiable references, prior export experience, and documentation that aligns with your compliance needs.

Disclaimer: Prices for metal casting molds are highly variable and influenced by global market conditions, material prices, and project complexity. The insights above should be used as a guide; always seek current quotations and consult with logistics and legal experts for a comprehensive sourcing strategy.

By systematically analyzing each pricing component and leveraging targeted negotiation strategies, B2B buyers can achieve cost efficiency while maintaining quality and delivery reliability in their metal casting mold sourcing operations.

Spotlight on Potential metal casting mold Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘metal casting mold’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

15 Metal Casting Companies Globally (dawangmetals.com)

15 Metal Casting Companies Globally is recognized as a major player in the global metal casting mold industry, representing a collective of top-tier foundries and manufacturers spanning multiple regions. The group offers a broad spectrum of material specializations, including steel, cast iron, copper, aluminum, zinc, and titanium castings—accommodating the diverse needs of international buyers. Noted for strong comprehensive strength, these companies prioritize supply chain stability and high manufacturing capacity, enabling them to meet demanding delivery schedules and large-volume orders. Their continuous investment in new casting technologies underscores a commitment to efficient production, cost competitiveness, and consistent product quality. Operating in a market characterized by both global and regional expertise, this group is well-positioned to serve B2B clients across Africa, South America, the Middle East, and Europe, providing reliable sourcing for custom mold and casting requirements.

10 Metal Casting Manufacturers and Suppliers in 2025 (www.bessercasting.com)

10 Metal Casting Manufacturers and Suppliers in 2025 is featured as a premier listing and resource hub connecting global buyers with leading-edge metal casting specialists. The platform highlights companies with extensive expertise in custom metal casting mold production for a vast range of industries—including automotive, aerospace, and heavy equipment sectors. While they do not manufacture directly, 10 Metal Casting Manufacturers and Suppliers in 2025 meticulously curates a shortlist of top-performing suppliers recognized for robust quality systems (e.g., ISO-certified operations), advanced casting technologies (sand, investment, die casting), and proven export experience serving Africa, South America, the Middle East, and Europe.

Key advantages for B2B buyers include access to both high-volume and bespoke casting partners, verified supplier credentials, and a streamlined sourcing process for specialized requirements. This resource is particularly valuable for businesses seeking reliable, internationally seasoned manufacturers with demonstrated track records in complex casting mold projects.

20 Top Metal Casting Companies in the World (hdcmfg.com)

Reliance Foundry Co. Ltd., established in 1925, is recognized as a longstanding leader in metal casting, serving a broad range of B2B clients from infrastructure, construction, and manufacturing sectors. The company demonstrates continuous innovation by adopting cutting-edge casting practices such as lost wax and sand casting, and integrates advanced technologies like simulation software and additive manufacturing to enhance mold precision and efficiency. Its focus on sustainability, resource optimization, and modern quality control aligns with international buyer expectations, including those from Africa, South America, the Middle East, and Europe. While specific quality certifications are not publicly detailed, Reliance Foundry’s reputation for reliability and versatile manufacturing capabilities positions it as a robust partner for global metal casting mold requirements.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| 15 Metal Casting Companies Globally | Top-tier global foundry network, diverse materials | dawangmetals.com |

| 10 Metal Casting Manufacturers and Suppliers in 2025 | Curated global hub for top casting suppliers | www.bessercasting.com |

| 20 Top Metal Casting Companies in the World | Legacy supplier with modern, tech-driven molding solutions | hdcmfg.com |

Essential Technical Properties and Trade Terminology for metal casting mold

Key Technical Properties for Metal Casting Mold Procurement

Selecting the right metal casting mold is fundamental to the performance and cost-effectiveness of your finished parts. For international B2B buyers, particularly those sourcing from or supplying into Africa, South America, the Middle East, and Europe, understanding these technical properties empowers more informed negotiation, specification, and quality assurance. Below are the critical specifications to consider:

1. Material Composition/Grade

The choice of material—such as silica sand, chromite, alumina, or specific alloy grades—directly impacts mold durability, maximum operating temperature, and compatibility with the molten metal being cast. High-quality grades ensure fewer casting defects, reduced scrap rates, and optimal mold performance in demanding industrial settings. Communicate clear material standards with suppliers to avoid unexpected downtime or quality issues in your operations.

2. Dimensional Tolerance

Dimensional tolerance refers to the permissible deviation from a specified measurement in your casting. Tighter tolerances lead to higher precision, reduced post-processing, and improved assembly compatibility. For B2B contracts, specifying required tolerances up front is crucial, especially if parts demand interchangeability or must fit into complex systems; failure to do so may result in non-conformant deliveries.

3. Thermal Resistance

This property measures a mold’s capacity to withstand molten metal temperatures without warping or degrading. High thermal resistance ensures consistent shape retention, less frequent mold replacements, and minimized interruptions. In markets where operational efficiency is paramount, this spec directly influences cost per part and overall production reliability.

4. Finish Quality (Surface Roughness)

Surface roughness, typically measured in microns (Ra), dictates the smoothness of the final cast product. Molds that deliver finer surface finishes reduce the need for costly secondary machining or finishing steps. For industries like automotive or aerospace, surface quality can also have functional and regulatory implications.

5. Life Cycle/Number of Uses

Mold lifespan, often expressed in number of cycles or casts before failure, is essential for cost forecasting and production planning. Permanent molds (e.g., die casting) will differ significantly from expendable ones (e.g., sand casting) in longevity—factor this in when comparing supplier offers or total cost of ownership.

6. Binder and Additive Content

The type and concentration of binders (organic or inorganic) and additives (like refractory coatings) influence mold strength and heat resistance. Higher-quality binder systems translate into better dimensional stability and fewer casting flaws, which is particularly vital in high-volume or mission-critical applications.

Common Industry and Trade Terminology

To streamline global procurement and communication, it’s essential for B2B buyers to be familiar with the following terms:

– OEM (Original Equipment Manufacturer)

An OEM is a company that produces parts or molds either to be used in its own assembly operations or sold to other manufacturers. Understanding whether you’re dealing with an OEM or a trading company affects negotiations, customization possibilities, and after-sales support.

– MOQ (Minimum Order Quantity)

MOQ specifies the smallest batch or volume a supplier is willing to sell. Knowing the MOQ is critical for budget forecasting, especially if you’re piloting new product lines or working with constrained capital.

– RFQ (Request for Quotation)

An RFQ is a formal procurement document sent to suppliers to solicit price quotes and lead times based on your precise specifications. Issuing a thorough RFQ ensures apples-to-apples comparison and more competitive supplier bidding.

– Incoterms (International Commercial Terms)

Incoterms define responsibilities between buyer and seller for shipping, insurance, customs clearance, and associated risks. Familiarity with terms like FOB (Free on Board), CIF (Cost, Insurance, and Freight), or DDP (Delivered Duty Paid) guards against hidden costs and ensures smoother cross-border transactions.

– Lead Time

This is the duration from order confirmation to delivery. In B2B casting mold sourcing, realistic lead time estimates are vital for project planning and inventory management, especially when factoring in international shipping and customs processing.

– TDS (Technical Data Sheet)

A TDS is a supplier-provided document that details the mold’s technical specifications, including recommended operating conditions, material properties, and maintenance requirements. Always request and review the TDS before finalizing any purchase to validate product suitability.

Actionable Insight for Buyers:

Clarity on both technical specifications and trade terminology enables robust supplier vetting, mitigates risk of miscommunication, and helps buyers negotiate strategic terms that align with operational needs and international standards. Always include your required properties and relevant terminology in contracts and RFQs to safeguard quality and ensure successful procurement from global partners.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the metal casting mold Sector

Global Market Dynamics and Sourcing Trends

The metal casting mold sector has transformed into a strategically crucial link in manufacturing supply chains worldwide. International B2B buyers from Africa, South America, the Middle East, and Europe face a rapidly shifting landscape shaped by economic, technological, and regulatory changes. Strong demand from automotive, infrastructure, mining, and machinery industries continues to fuel investment, while supply chain complexity has increased due to fluctuating raw material costs and logistics disruptions.

Key trends include:

– Precision and Customization: Advances in CAD/CAM technologies and 3D printing are enabling more complex, customized mold designs at greater speed and lower cost. International buyers now seek suppliers capable of rapid prototyping and agile design iterations, shortening go-to-market timelines.

– Regional Diversification: Buyers from Brazil, South Africa, UAE, Turkey, and Australia are looking beyond traditional sourcing regions (e.g., China, India) toward emerging partners in Eastern Europe, Southeast Asia, and domestically to reduce dependence and mitigate geopolitical risks. Shortened supply chains improve both resilience and lead time reliability.

– Quality and Compliance: Growing emphasis on international quality certifications (ISO 9001, IATF 16949 for automotive) is influencing procurement strategies. Buyers want traceability across the mold supply chain to ensure durability, part repeatability, and regulatory conformity.

– Digital Integration: Adoption of Industry 4.0 solutions—such as digital twins, remote monitoring, and smart sensors—in both mold design and production is on the rise. Suppliers offering real-time data sharing and co-engineering are gaining a competitive edge, especially for customers in Europe and high-growth African markets seeking technical transparency and efficiency.

– Cost Containment: Currency volatility, freight rate swings, and regional availability of foundry minerals (e.g., silica sand, bentonite) require sophisticated sourcing tactics. Strategic partnerships with suppliers who demonstrate cost stability and value-add services (such as on-site technical support) are increasingly critical.

For international buyers, success relies on building multi-shore sourcing models, proactively monitoring local market developments, and leveraging digital procurement tools to compare supplier capabilities, cost structures, and risk profiles.

Sustainability and Ethical Sourcing Considerations

Environmental responsibility is now a defining requirement in the global sourcing of metal casting molds. Regulatory frameworks—like the EU Green Deal, extended producer responsibility laws in Brazil, and green procurement mandates in the Middle East—are driving both buyers and suppliers toward more sustainable practices. The environmental impacts of mold production include energy and water use, emissions from foundries, and end-of-life mold disposal challenges.

Key actionable points for B2B buyers:

– Green Materials and Processes: Prioritize suppliers using recycled metals, environmentally friendly sand binders (e.g., water-based, low-toxic resins), and minimizing hazardous byproducts. Seek clear documentation of cradle-to-grave environmental impact and evidence of resource-efficient manufacturing.

– Certifications and Audits: Look for partners holding ISO 14001 (environmental management), EcoVadis, or local environmental certifications. Onsite and remote sustainability audits can assess supplier compliance with best practices and regulatory standards.

– Ethical Supply Chains: Insist on transparency regarding labor practices and mineral sourcing. Some regions—like Africa and South America—must guard against supply chains tainted by illicit mining or unfair labor; reputable suppliers increasingly provide chain-of-custody documentation.

– Innovation in Waste Reduction: Evaluate adoption of circular economy principles, such as recycling mold sand, reclaiming scrap metal, or developing reusable/permanent mold technologies. Suppliers that invest in these approaches can deliver both sustainability benefits and long-term cost savings.

Positioning sustainability as a core procurement criterion not only aligns with regulatory requirements but also boosts brand reputation and reduces operational risk for B2B buyers.

Brief Historical Evolution and Strategic Relevance

Metal casting and its mold-making techniques have evolved from rudimentary sand impressions used in early civilizations to today’s digitally engineered, precision-built molds. The transition from wood and clay patterns to advanced alloys, high-performance ceramics, and digitized pattern-making has vastly expanded the sector’s capabilities. In recent decades, the adoption of computer-aided design and automated molding lines has profoundly improved consistency and speed in mass production.

For B2B buyers, understanding this evolution is critical—those who leverage cutting-edge mold technologies, embrace new materials, and prioritize sustainability are best positioned to secure high-quality cast products and maintain resilient, future-proof supply chains in the global metal casting market.

Related Video: Incoterms for beginners | Global Trade Explained

Frequently Asked Questions (FAQs) for B2B Buyers of metal casting mold

-

How should we vet and select reliable metal casting mold suppliers, especially from overseas markets?

Thorough supplier vetting begins with assessing certifications (e.g., ISO 9001 for quality management, specific industry credentials), reviewing company history, and requesting recent client references. Evaluate manufacturing capabilities, R&D capacity for mold customization, and inspect sample molds for quality standards. For buyers in regions like Africa, South America, the Middle East, and Europe, consider conducting video audits or commissioning third-party inspection agencies to assess facilities before placing orders. Prioritize suppliers with transparent communication and established export experience to ensure smoother transactions and compliance with international trade practices. -

Can we request customized molds based on our unique designs or processes, and what is the typical workflow?

Yes, reputable suppliers routinely offer custom mold manufacturing. Share detailed CAD files, technical drawings, or product samples with the supplier. Expect an initial design consultation, feasibility assessment, and prototyping phase prior to mass production. Clear communication of technical specifications, tolerances, and intended usage is critical. The best suppliers provide digital prototypes or samples for approval, minimizing the risk of errors. Building a collaborative workflow and arranging regular progress updates leads to efficient customization and ensures alignment with your business objectives. -

What minimum order quantities (MOQ) and lead times are standard for international buyers?

MOQs typically vary by mold complexity, material, and supplier capabilities—ranging from single units for high-value, large molds to larger batches for more common types. Lead times generally span 4–12 weeks, factoring in design approval, manufacturing, and quality control. For custom or high-specification molds, longer lead times are likely. Engage the supplier early about your project timeline, and clarify whether expedited production is available if needed. Always factor in additional time for international shipping and customs clearance, especially for buyers outside major trade hubs. -

What payment terms are common, and how can international buyers protect their financial interests?

Standard payment terms include 30% upfront deposit (prior to production) and 70% balance upon shipment or receipt of inspection reports. Letters of Credit (L/C), bank transfers, and escrow services provide added security for large overseas transactions. Request a proforma invoice and ensure all costs, including tooling and incidental fees, are itemized. For buyers in emerging markets, prioritize suppliers open to secure, traceable payment methods, and consider staged payments linked to project milestones to mitigate non-delivery risk. -

What quality assurance (QA) measures and certifications should we require when sourcing molds globally?

Request evidence of ISO 9001 or similar quality certifications and inquire about the supplier’s QA process—from raw material sourcing to dimensional inspection and final testing. Suppliers should provide inspection reports, hardness/chemical composition data, and, for critical molds, detailed quality documentation. Consider third-party pre-shipment inspections to verify compliance with your specifications before shipping. For regulated industries, ensure the supplier can conform to local standards (e.g., CE, ASTM, or EN) relevant to your production locale. -

How should we manage logistics, shipping arrangements, and import requirements for metal casting molds?

Negotiate shipping Incoterms (e.g., FOB, CIF, DAP) up front and clearly define responsibility for freight, insurance, and customs procedures. Partner with reputable freight forwarders with experience in transporting heavy industrial goods. Confirm packaging compliance for international transit and ensure all documentation—including invoices, packing lists, and certificates of origin—is in order. Be proactive about local import duties, taxes, and any country-specific mold material restrictions, as these factors vary widely across Africa, the Middle East, South America, and Europe. -

What actions can we take if molds arrive defective or do not meet agreed specifications?

Clearly define warranty and dispute resolution terms in your purchase agreement. Upon delivery, inspect molds immediately and document all discrepancies with photos and written reports. Notify the supplier within the agreed warranty period and invoke contractually agreed remedies, such as repair, replacement, or refund. For larger transactions, consider mediation or arbitration clauses enforceable in neutral jurisdictions. Maintaining structured records of communications and agreements provides a strong foundation for resolving cross-border disputes. -

Are there advantages to building long-term relationships with mold suppliers versus spot purchasing?

Developing long-term partnerships typically yields more favorable pricing, higher customization flexibility, and priority in production schedules. Reliable suppliers may offer improved payment terms, ongoing technical support, and advance insight into material or process innovations. In markets with challenging logistics or volatile trade conditions (e.g., certain regions in Africa or South America), trusted supplier relationships are invaluable in minimizing supply chain disruptions and ensuring consistent mold quality for future growth.

Strategic Sourcing Conclusion and Outlook for metal casting mold

International B2B buyers in regions such as Africa, South America, the Middle East, and Europe can unlock significant value by embracing a strategic approach to sourcing metal casting molds. Key takeaways include the importance of aligning mold selection with your specific casting processes, application requirements, and regional supply chain realities. Leveraging advanced design and material innovations, as well as building strong supplier partnerships, can help secure molds that optimize product quality, life cycle, and overall project cost.

Strategic sourcing goes beyond simply choosing a vendor—it means engaging collaboratively with mold manufacturers, thoroughly evaluating their capabilities, certifications, and consistency, and insisting on rigorous quality controls. For buyers in emerging and established markets alike, this also involves assessing sustainability practices and ensuring raw material traceability, which is increasingly critical for global compliance and reputation management.

Looking ahead, future demands for more complex components, precision, and sustainability will only intensify the need for reliable, innovative mold suppliers. Now is the time for procurement leaders to prioritize supplier relationships, invest in knowledge of evolving casting technologies, and leverage digital platforms for more efficient sourcing. By taking a proactive and informed approach, B2B buyers can position their organizations at the forefront of quality, competitiveness, and sustainable growth in the global metal casting industry.