Introduction: Navigating the Global Market for living hinges

Living hinges—those slim, integrated connectors found in an array of plastic products—have become unsung heroes in modern manufacturing. They elegantly join rigid sections within a single part, eliminating the need for complex hardware or extra assembly steps. For B2B buyers seeking durability, cost efficiency, and streamlined production, the true potential of living hinges extends far beyond their traditional use in containers and caps. Whether incorporated in industrial enclosures, laboratory equipment, automotive components, or packaging solutions, living hinges are reshaping how goods are designed and produced worldwide.

As global supply chains evolve and regions like Africa, South America, the Middle East, and Europe pursue more integrated manufacturing strategies, understanding the capabilities and nuances of living hinges is critical. These mechanisms offer not only mechanical reliability but also significant advantages in terms of simplified assembly, reduced part count, maintenance-free operation, and chemical resistance—attributes especially valuable in demanding markets or where infrastructure challenges demand robust, low-maintenance solutions.

This guide provides an in-depth exploration aimed at empowering international B2B buyers with actionable insights to make confident sourcing decisions. Key areas covered include:

– Types of living hinges and their distinct applications

– Material selection tailored to performance, environment, and regulatory needs

– Manufacturing processes and quality control considerations crucial for reliable, scalable production

– Supplier evaluation, including strategies for vetting trusted global partners

– Cost factors and pricing trends for both standard and custom hinge solutions

– Regional and global market dynamics

– Practical FAQs to address common pain points and procurement challenges

Armed with this intelligence, buyers are positioned to optimize product performance, negotiate more effectively, and foster stronger supplier relationships—unlocking new opportunities and efficiencies in their living hinge procurement strategy.

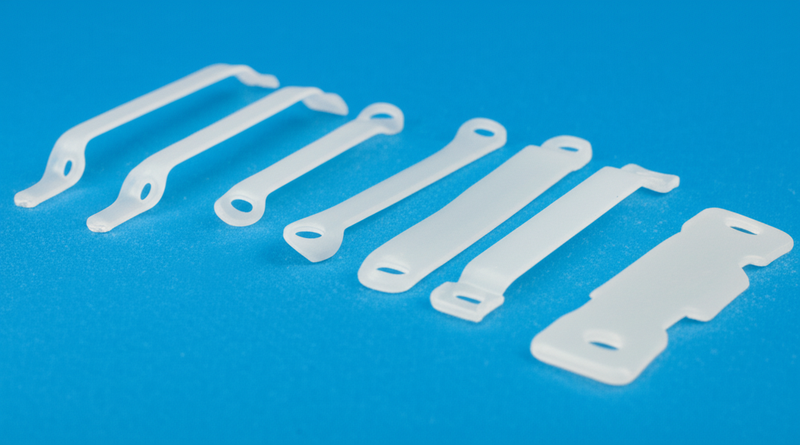

Understanding living hinges Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Flat Hinge | Straight, thin web connecting two rigid sections | Packaging, containers, small electronic enclosures | Cost-effective, durable for frequent use; limited to simple motion |

| Double Hinge | Two parallel webs, allowing multi-directional folding | Medical devices, advanced packaging, instrument lids | Increased flexibility and range of motion; marginally higher complexity & cost |

| Butterfly Hinge | Symmetrical, arched hinge shape for enhanced flexibility | Food packaging, high-use lids, consumer goods | Superior resilience, handles misalignment; can require more precise tooling |

| Bi-stable Hinge | Snaps between two stable states (open/closed) | Electronics, portable devices, snap-action products | Enables tactile feedback, self-locking actions; design is more complex |

| Curved Hinge | Pre-molded arc or curve, enabling rotational or bending motion | Automotive interior parts, specialized cases | Enables ergonomic motion, space-saving; may require custom design per application |

Flat Hinge

This is the most prevalent living hinge design, consisting of a straight, uniform thin section between two rigid bodies. Flat hinges excel in applications where simple opening and closing actions are required, such as in product packaging (e.g., flip-top lids) and simple enclosures. For B2B buyers, the flat hinge offers reliability, high cycle life, and extremely low manufacturing costs, making it ideal for large-volume orders across industries with basic motion requirements. The simplicity, however, limits the hinge to unidirectional flexing and may not suit designs needing complex articulation.

Double Hinge

A double hinge integrates two thin sections in parallel, facilitating both inward and outward folding or two-stage movement. This feature is advantageous in medical, laboratory, or industrial settings, where devices may need to open, close, and lock in multiple positions. While the double hinge provides enhanced flexibility and greater functional range, B2B buyers should weigh the slightly increased complexity in injection molding and assembly. The investment pays off for projects requiring robust mechanisms with repeatable multi-axis movement.

Butterfly Hinge

Distinguished by its symmetrical and arched profile, the butterfly hinge provides superior elastic performance, making it suitable for products subjected to frequent use or potential misalignment—common in consumer packaging and food containers. For B2B procurement teams, the butterfly hinge offers the benefit of enduring repeated flex cycles without material fatigue, reducing warranty claims and product returns. However, achieving the desired geometry demands more refined tooling and close collaboration with manufacturing partners to maintain quality at scale.

Bi-stable Hinge

The bi-stable hinge design is engineered to maintain two distinct positions—typically fully open and fully closed—akin to a snap-action mechanism. This is highly valued in electronics, portable or handheld devices, and other products where clear user feedback and secure closure are priorities. B2B buyers seeking bi-stable functionality should anticipate higher upfront design costs and the need for precise material selection to guarantee consistent performance over thousands of cycles. This investment is justified when tactile response and safety matter.

Curved Hinge

With a pre-defined curve, the curved hinge allows for more complex rotational or ergonomic movement. Common in automotive interiors and custom instrument enclosures, this variation facilitates space-efficient layouts without additional hardware. For international buyers, curved hinges enable the creation of differentiated products tailored to local user preferences, especially where design aesthetics and functionality intersect. However, custom curvature often requires bespoke tooling and comprehensive prototyping to adapt to specific regional requirements or climate conditions, which can impact lead times and minimum order quantities.

Key B2B Considerations Across Types:

When selecting a living hinge type, buyers should prioritize compatibility with intended use, expected cycle life, and ease of integration into existing assembly lines. Consider the local regulatory environment on materials and product safety standards, especially in markets with stringent import controls. Assess the total cost of ownership—including maintenance, replacement rates, and warranty liabilities—to ensure the hinge solution aligns with both functional and financial objectives in your region. Close collaboration with vetted manufacturing partners is essential to optimize design, material sourcing, and production scalability to suit diverse international markets.

Related Video: Living Hinges Minimum Bend Radius with Swatches for Laser Cutting Bent Plywood

Key Industrial Applications of living hinges

| Industry/Sector | Specific Application of living hinges | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Packaging & Consumer Goods | Flip-top caps, clamshell packaging, dispensing lids | Cost-effective mass production, tamper-evidence, ease of use | Material suitability, hinge fatigue life, food safety compliance |

| Medical & Laboratory | Disposable containers, specimen boxes, pill dispensers | Single-piece sterile designs, reduced contamination risk | Bio-compatibility, sterility, resistance to chemicals and sterilants |

| Automotive & Industrial | Cable routing clips, sensor covers, access panels | Assembly simplification, robust repeated opening/closing | UV/chemical resistance, temperature range, part longevity |

| Electronics & Electrical | Battery compartments, device enclosures, connector covers | Precision fit, assembly speed, reliable performance | Flammability rating, precise tolerances, manufacturing scalability |

| Agriculture & Field Equipment | Field sample containers, dosing equipment, equipment covers | Withstands harsh conditions, reduces part failure rates | Durability, environmental resistance, supply continuity |

Packaging & Consumer Goods

Living hinges are widely employed in flip-top caps, clamshell packaging, and dispensing lids. They enable the creation of single-component packaging solutions that open and close repeatedly without degrading. This reduces assembly steps and ensures tamper-evidence for sensitive goods. For international buyers, especially in dynamic markets like Africa or the Middle East, selecting materials that comply with food safety standards and exhibit robust fatigue resistance under frequent handling is crucial to maintain both quality and cost-effectiveness.

Medical & Laboratory

Medical and laboratory environments use living hinges for disposable containers, sample boxes, and pill dispensers. The monolithic design supports sterility by eliminating crevices that can harbor contaminants, and enables one-handed operation—a vital requirement in clinical settings. Buyers should prioritize medical-grade, chemical-resistant plastics that endure repeated sterilization. Partnering with suppliers experienced in meeting EU or relevant health authority standards is pivotal for markets such as Europe, which have strict regulatory compliance requirements.

Automotive & Industrial

In automotive and industrial sectors, living hinges are integrated into cable management clips, sensor covers, and access panels, streamlining component attachment without complex mechanical fasteners. The durability of these hinges reduces maintenance needs and improves assembly efficiency, key for high-volume production across regions like South America or Eastern Europe. For these applications, sourcing hinges made from UV and chemical-resistant polymers ensures stable performance in variable climates and exposure to oils or cleaning agents.

Electronics & Electrical

Battery compartments, hinged access covers, and connector doors in consumer devices and industrial control equipment often rely on living hinges for repeated reliable operation. These applications demand precise molded tolerances for seamless functionality and protection against dust or moisture ingress. Buyers from the UK, Vietnam, or other developed electronics markets must ensure chosen materials meet flammability ratings and are compatible with automated manufacturing, while also considering local electrical safety regulations.

Agriculture & Field Equipment

Field conditions in agricultural and resource extraction sectors demand robust components. Living hinges are used in sealing lids for sample containers, dosing tools, and equipment covers, delivering longevity and weather resistance. The reduced possibility of hinge failure translates to fewer operational delays. For regions across Africa or the Middle East, where supply chain interruptions can have significant impacts, sourcing partners who guarantee consistent material performance and timely delivery is vital. Selecting hinges designed for prolonged exposure to sunlight, humidity, and dust ensures reliability in challenging outdoor environments.

Related Video: 5 Living Hinges for Mass Production 3D Printing

Strategic Material Selection Guide for living hinges

Selecting the Optimal Material for Living Hinges in Diverse Markets

Selecting the right material for living hinges has a direct impact on durability, product lifecycle, user experience, and compliance with local and international regulations. B2B buyers across Africa, South America, the Middle East, and Europe encounter unique demands, including variations in climate, supply chain stability, regulatory frameworks, and customer preferences. Below is an analysis of the most commonly used materials for living hinges, considering their performance and strategic fit for international applications.

Polypropylene (PP)

Key Properties:

Polypropylene is widely regarded as the preferred material for living hinges due to its excellent fatigue resistance, flexibility, low moisture absorption, and chemical inertness. It maintains functionality under repetitive flexing and offers good resistance to many acids, bases, and organic solvents. The material performs reliably between -20°C and 100°C, tolerating most daily-use environments.

Pros & Cons:

Pros include low cost, proven manufacturability via injection molding, and high fatigue endurance over millions of cycles. Cons involve limited performance at sub-zero temperatures (can become brittle), moderate impact resistance, and poorer UV resistance unless stabilized.

Application Impact:

Ideal for consumer packaging, dispensing caps, medical devices, and low-stress industrial parts. PP performs best in products that require repetitive flexing but are not continuously exposed to harsh mechanical loads or direct sunlight.

International Considerations:

Polypropylene’s global ubiquity supports supply chain consistency. Buyers should confirm compliance with ASTM D4101 for general PP resin grades and consider local preferences (e.g., ISO or DIN equivalents may be specified in Europe). UV-stabilized PP is advisable for regions with high solar exposure (Middle East, parts of Africa, South America).

Polyethylene (HDPE/LDPE)

Key Properties:

Both high-density (HDPE) and low-density (LDPE) polyethylene offer significant flexibility and good chemical resistance. LDPE is softer and more pliable, while HDPE is more rigid with slightly higher strength. Temperature stability ranges roughly from -50°C to 85°C, with excellent toughness at low temperatures.

Pros & Cons:

Pros are superior cold-weather performance (remains flexible at low temperatures), cost-effectiveness, and chemical resistance to a range of industrial substances. Cons include lower fatigue resistance versus PP, moderate mechanical strength, and higher permeability to gases.

Application Impact:

PE is suited for snap-fit lids, storage containers, and flexible enclosures, especially for products exposed to low temperatures or moderate mechanical demands.

International Considerations:

PE grades often conform to ASTM D4976 or DIN EN ISO 1872-1. Environmental conditions in cooler regions (parts of Europe, Andean South America) may drive preference for HDPE or LDPE. Buyers should review recyclability standards, as PE is widely accepted in recycling streams but may have regional restrictions for use in food-contact applications.

Acetal (Polyoxymethylene, POM)

Key Properties:

Acetal offers higher stiffness, good dimensional stability, and moderate fatigue resistance. It operates safely from -40°C to 120°C and handles many fuels, oils, and solvents without significant degradation. Unlike polyolefins, acetal is less flexible but delivers superior mechanical properties for stressed hinges.

Pros & Cons:

Pros include excellent mechanical strength, wear resistance, and low water absorption. Cons relate to higher cost, comparatively reduced flex-life (prone to cracking under continuous flexing), and greater complexity in both molding and quality control.

Application Impact:

Acetal’s best suited for precision hinges where dimensional accuracy, load, and stability are critical—such as premium enclosures, automotive clips, and industrial closures.

International Considerations:

Acetal must typically comply with ASTM D4181 or DIN EN ISO 2580 for engineering applications. Buyers should evaluate supply chains for consistent resin quality, particularly in regions with fewer established engineering plastics suppliers (portions of Africa, South America).

Thermoplastic Elastomers (TPE/TPU)

Key Properties:

TPEs and TPUs blend the elastic characteristics of rubber with thermoplastic processing. They typically perform between -40°C and 100°C, offering excellent flexibility, high elongation at break, and resistance to fatigue. Chemical resistance and UV stability can vary by formulation.

Pros & Cons:

Pros are outstanding flexibility, soft touch feel, and the option for overmolding onto rigid substrates. Cons include higher raw material cost, sensitivity to chemical degradation (especially for certain TPE grades), and sometimes lower mechanical strength.

Application Impact:

Used for ergonomic, tactile products, wearable electronics, and medical devices where a soft, flexible hinge is essential.

International Considerations:

TPE/TPU grades should meet regionally relevant standards (e.g., ISO 18064). They are preferred in applications demanding compliance to RoHS or medical device regulations. Buyers should clarify grade-specific features with suppliers—differences can be pronounced depending on market (e.g., flame retardancy requirements in Europe).

Summary Table: Comparative Overview of Living Hinge Materials

| Material | Typical Use Case for living hinges | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polypropylene (PP) | Flip-top caps, packaging, medical enclosures | Exceptional fatigue resistance, low cost | Brittle at low temps, moderate UV stability | Low |

| Polyethylene (HDPE/LDPE) | Storage lids, flexible containers, cold-environment applications | Flexibility at low temperatures | Lower fatigue resistance vs. PP | Low |

| Acetal (POM) | Precision hinges, automotive/industrial closures | High mechanical strength, dimensional stability | Reduced flex-life, higher cost | Medium |

| Thermoplastic Elastomer (TPE/TPU) | Wearable devices, ergonomic products, medical applications | Superior flexibility, soft touch | Raw material cost, variable chemical resistance | High |

This comparative guide should enable international B2B buyers to align material choice for living hinges with local requirements, regulatory expectations, and the many factors that shape product performance and ROI across global markets.

In-depth Look: Manufacturing Processes and Quality Assurance for living hinges

Living hinges present a unique set of manufacturing and quality assurance challenges due to their structural delicacy and essential functional demands. For international B2B buyers—from Africa and South America to the Middle East, Europe, and Southeast Asia—understanding the intricacies of production and QC is critical to sourcing reliable, cost-effective components that meet local regulations and end-user expectations.

Key Manufacturing Processes

1. Material Preparation

Selecting the correct polymer is foundational. Polypropylene (PP) remains the dominant material due to its high fatigue resistance and flexibility, but advanced applications may call for polyethylene or engineered plastics such as acetal or nylon. The resin is carefully dried and processed to ensure optimal flow and minimize inclusion of moisture or contaminants, which can severely affect hinge performance.

Buyers’ Insight:

Request detailed datasheets specifying resin grade, MFI (Melt Flow Index), and batch traceability to support downstream quality and regulatory requirements.

2. Forming: Manufacturing Techniques

-

Injection Molding

The most prevalent method for commercial-scale living hinge production. The process achieves the necessary micro-thin, flexible hinge by precisely controlling mold temperature, fill rate, and pressure. State-of-the-art molds incorporate specialized gating to avoid weld lines and maintain uniform hinge thickness—typically 0.2-0.5 mm for optimum flex life. -

CNC Machining & Urethane Casting

Used for prototyping or short production runs. CNC allows for high precision, though the mechanical properties can differ from injection-molded parts. Urethane casting replicates production geometry quickly for proof-of-concept or low to mid-volume pilot runs. -

3D Printing & Laser Cutting

Additive manufacturing is increasingly viable for complex or highly customized hinge geometries, though material choices remain limited compared to molding. Laser cutting enables rapid prototyping using sheets of compatible polymers.

Actionable Tip:

Buyers should clarify which manufacturing technique is used for their order, as it impacts consistency, repeatability, and long-term performance.

3. Assembly (If Applicable)

Many living hinge components are designed as single, monolithic parts. However, assemblies (such as multi-part packaging or enclosure systems) may require secondary operations—ultrasonic welding, snap-fit integration, or overmolding. These steps demand close process control to prevent stress cracking or alignment issues.

4. Finishing

This stage ensures the removal of flash, burrs, and gating residues. Surface treatments or coatings may be applied to enhance appearance or chemical resistance, though these are less common with living hinges due to the need for continued flexibility.

Critical Quality Assurance Practices

International Standards and Certifications

- ISO 9001:

Widely recognized and often required for suppliers serving global B2B markets. Certification indicates a systematic approach to process control, documentation, and continuous improvement. - Industry-Specific Certification:

Depending on end-use, additional standards may apply: - CE Marking: Required for many products entering the EU, signaling conformity with health, safety, and environmental protection standards.

- ASTM/ISO Standards: Such as ISO 80369 (small-bore connectors, medical) or ASTM D638 (tensile properties for plastics).

- Other Regional Norms: For example, UKCA (UK), GSO (Gulf), or INMETRO (Brazil) for market entry.

Buyer Guidance:

When evaluating suppliers, always request up-to-date compliance certificates and inquire about experience with destination-specific regulatory requirements.

Core QC Checkpoints

Quality control for living hinges is typically divided into three main phases:

-

Incoming Quality Control (IQC)

– Material Verification: Checking resin certificates, batch numbers, and visual/aesthetic inspection.

– Moisture Content Testing: Crucial for polyolefin resins. -

In-Process Quality Control (IPQC)

– Dimensional Checks: Measuring critical hinge geometry—thickness, length, radii, and attachment points.

– Cycle Testing: Evaluation of flex life (e.g., 10,000+ cycles).

– Monitor Process Stability: Tracking injection parameters against control charts or digital logs. -

Final Quality Control (FQC)

– Visual Inspection: Identifying surface defects, flash, voids, or color inconsistency.

– Functional Testing: Ensuring proper hinge movement, absence of cracking, and correct assembly fit.

– Mechanical Testing: Tensile and fatigue tests to confirm durability.

Common Testing Methods

- Fatigue Life Testing:

Specialized fixtures repeatedly flex the hinge until failure; results are compared to specifications. - Tensile Strength Measurement:

Samples are pulled to failure to assess material and design adequacy. - Environmental Simulation:

Accelerated aging, chemical exposure, and temperature cycling to check weather/chemical resistance (especially important in Africa and the Middle East). - Dimensional Scanning:

High-precision vision systems or laser scanners to ensure all tolerances are met.

Note: For medical, food, or high-purity applications, further chemical and particulate testing (e.g., FDA or REACH compliance) may be required.

Supplier Quality Verification Strategies for Global Buyers

Buyers from emerging regions and advanced economies alike must minimize risk and ensure transparency:

-

Factory Audits:

Conduct on-site or virtual audits to review manufacturing, QA/QC processes, and documentation. Evaluate calibration logs, staff competency, and equipment maintenance schedules. -

Batch Quality Reports:

Insist on comprehensive reports with every shipment. These should include material certificates, inspection records, and test results for critical parameters. -

Third-Party Inspections:

Engage independent inspection agencies (e.g., SGS, Intertek, TÜV) for pre-shipment or in-process inspection, especially when importing into highly regulated markets (Europe, UK, GCC). -

Continuous Monitoring:

For long-term contracts, implement supplier KPIs and demand regular process performance data (Cp, Cpk, defect rates).

Regional Nuances:

– Africa/South America:

Emphasize clear documentation and training to bridge language or technical knowledge gaps. Confirm that imported goods meet local labeling and packaging regulations.

– Middle East:

Ensure compliance with Gulf Cooperation Council (GCC) conformity standards and consider local climate testing, as high temperatures can affect plastic longevity.

– Europe/UK:

Demand full traceability, RoHS/REACH certification, and environmentally responsible manufacturing protocols. For the UK, verify UKCA marking post-Brexit.

– Vietnam and ASEAN:

Localize requirements to Vietnamese/ASEAN standards and evaluate logistics for timely delivery and effective after-sales support.

Practical B2B Recommendations

-

Request and Review DFM Documentation:

Insist on “Design for Manufacturability” reviews and pilot samples before mass production. Validate hinge geometry, cycle life, and material selection. -

Standardize QC Specs:

Supply detailed specifications, including performance criteria, test methods, and reporting templates to streamline supplier communication. -

Plan for Regulatory Changes:

Maintain awareness of evolving regional standards (such as updates to EU green directives or local registration laws). Build flexibility into contracts to accommodate these shifts. -

Engage in Ongoing Supplier Development:

Cultivate transparent, long-term relationships with preferred suppliers. Support process improvements and co-develop solutions for market-specific challenges.

Robust manufacturing and quality assurance are the backbone of durable, high-value living hinge products. B2B buyers who rigorously vet supplier processes, insist on thorough quality documentation, and stay attuned to regional regulatory landscapes secure the best performance and lowest total cost over the product lifecycle.

Related Video: How Millions of Door Hinges are Produced in a Chinese Stainless Steel Factory

Comprehensive Cost and Pricing Analysis for living hinges Sourcing

Key Cost Components in Living Hinge Sourcing

A transparent understanding of the cost structure behind living hinge procurement is critical for making informed B2B decisions. Costs broadly break down into the following components:

- Raw Materials: Polypropylene remains the industry standard for living hinges due to its flexibility, resilience, and cost-effectiveness. However, alternative engineering plastics or additives for enhanced chemical/UV resistance will increase material costs.

- Labor: Labor overhead reflects the region of manufacture, process automation, and required expertise. Countries with advanced automation may offset higher wages through productivity, whereas low-labor-cost regions might have quality trade-offs.

- Manufacturing Overhead: Facility costs, energy, equipment depreciation (particularly for precision injection molding), and production line setup contribute here. This element varies based on plant efficiency and local utility rates.

- Tooling and Molds: Initial investment in high-precision molds is significant—spread across production volume. For custom or intricate hinge designs, tooling can be a major upfront expense, especially with low initial volumes.

- Quality Control and Certifications: Robust QC protocols and internationally recognized certifications (such as ISO or food-grade compliance) increase costs but are vital for global trade, end-use suitability, and brand reputation.

- Packaging and Logistics: Export packaging must protect products during intercontinental shipping, and global freight rates can fluctuate sharply. Incoterms (e.g., FOB, CIF, DAP) will determine which party bears which logistics costs.

- Supplier Margin: Manufacturers establish margins based on capacity utilization, market positioning, and risk appetite.

Primary Price Influencers for B2B Buyers

Living hinge pricing is shaped by a mix of project-specific and market-driven factors:

- Order Volume & MOQ: Higher volumes typically secure better per-unit pricing, as tooling and setup costs are amortized more efficiently. Insist on clarity around minimum order quantities and discount tiers.

- Customization & Design Complexity: Unique geometries, special tolerances, and tailored material blends drive up mold design and cycle time costs. Simple, standard patterns always cost less.

- Material Selection: Engineering-grade plastics, color matching, additives (for antimicrobial or flame-retardant properties), or recycled content can each add to costs, but may be required for regulatory or branding reasons.

- Supplier Credentials: Providers with relevant certifications (ISO 9001, RoHS, REACH, FDA where applicable) may charge a premium, but often deliver greater reliability and easier export processes.

- Geographic Factor: Manufacturing location affects not only base price but import tariffs, shipping duration, and international payment terms. For buyers in Africa, South America, or the Middle East, proximity to supplier or key shipping hubs can mitigate lead times and costs.

- Incoterms and Payment Terms: Be sure to determine whether the quoted price is ex-works, FOB, CIF, or DAP, as this impacts both risk allocation and the true landed cost.

Actionable Tips for International B2B Buyers

- Seek Total Cost of Ownership (TCO) Clarity: Beyond unit pricing, account for all hidden and secondary costs—tooling amortization, logistics, duties, defect rates, and after-sales support.

- Supplier Verification: Vet factories for quality certifications and a track record in your application segment to reduce risk in international transactions.

- Leverage Volume and Long-Term Agreements: Negotiate price breaks or rebates based on annual volume projections, not just one-off contracts.

- Standardize Where Feasible: Opt for standard living hinge profiles and materials to reduce both direct manufacturing and QC costs.

- Factor in Local Trade Conditions: Be aware of country-specific tariffs, currency fluctuations, and regulatory requirements, which can all materially influence the true landed cost.

- Negotiate Incoterms: For emerging-market buyers, negotiate DAP (Delivered At Place) or DDP (Delivered Duty Paid) terms to minimize customs and logistics complexity—even if unit price appears higher, the simplicity can yield total savings.

- Collaborate Early on Design for Manufacturability: Engage suppliers during the design phase to optimize for mass manufacturing processes, avoiding expensive redesigns or production hiccups.

Disclaimer: The above analysis is intended as a general industry overview. Final prices may fluctuate based on current raw material markets, global shipping trends, exchange rates, and contract-specific discussions with suppliers. Always obtain a formal, itemized quote before committing to an order.

Understanding these cost drivers and negotiating strategically will enable buyers in Africa, South America, the Middle East, and Europe to achieve optimal pricing, supplier reliability, and long-term savings when sourcing living hinges for industrial or consumer applications.

Spotlight on Potential living hinges Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘living hinges’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

10 Door Hinge Manufacturers for Quality Hinges (www.maxavegroup.com)

With a strong presence among global hinge suppliers, this company stands out for delivering a diverse portfolio of door hinges—including solutions suitable for living hinge applications. Their manufacturing capabilities encompass both standard models and custom-engineered products, reflecting a dedication to flexible design and tailored B2B services. Known for supporting international buyers across Europe, the Middle East, Africa, and South America, they emphasize scalable production and technical support for high-volume orders. While public details on specific quality certifications are limited, the group’s broad international reach and focus on both OEM and project-based supply highlight reliable logistics and business adaptability. Buyers benefit from technical consultation and assistance in material selection, making them a noteworthy partner for professional-grade hinge requirements.

100 Hinge Manufacturers in 2025 (ensun.io)

100 Hinge Manufacturers in 2025 is an aggregated platform showcasing a diverse range of global hinge producers, many of whom have expanded expertise in living hinges for furniture and industrial applications. The collective network encompasses companies from key innovation centers such as India, the US, and Europe, focusing not only on conventional metal hinges but also advanced polymer-based living hinges. Some featured suppliers on the list are recognized for customizing hinges to meet specific OEM and regulatory demands, including projects for high-volume consumer goods and demanding industrial environments. Buyers benefit from options covering mass production, tailored solutions, and notable compliance with quality benchmarks (e.g., ISO 9001). While individual supplier details may vary, the directory caters to international sourcing requirements, with reach into emerging markets and established trade routes across Africa, South America, the Middle East, and European territories.

10 Door Concealed Hinge Manufacturers in the World Buyers Guide (sdhhardware.com)

10 Door Concealed Hinge Manufacturers in the World Buyers Guide is a comprehensive resource profiling leading global suppliers specializing in concealed, invisible, and European hinge solutions. The guide highlights manufacturers offering fully hidden hinge systems, designed to deliver a seamless appearance for residential and commercial doors. Emphasis is placed on products like the Anselmi-170 3D Concealed Door Hinge, known for its 180-degree opening, complete concealment, and adaptability for timber or aluminum frames. These manufacturers typically offer advanced adjustability, durable materials (such as zamak alloys), and elegant finishes, catering to high-end architectural applications. While certifications and precise manufacturing locations are not detailed, the resource targets international B2B buyers, providing a curated selection for sourcing quality living hinges across diverse geographic markets.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| 10 Door Hinge Manufacturers for Quality Hinges | Global supplier with custom living hinge options | www.maxavegroup.com |

| 100 Hinge Manufacturers in 2025 | Global directory of living hinge suppliers | ensun.io |

| 10 Door Concealed Hinge Manufacturers in the World Buyers Guide | Global guide to fully concealed hinge suppliers | sdhhardware.com |

Essential Technical Properties and Trade Terminology for living hinges

Critical Technical Properties for Living Hinges in B2B Trade

When sourcing living hinges for manufacturing or product integration, a precise understanding of their technical properties is essential for ensuring product durability, reliability, and cost-efficiency. The following parameters are the most critical for international B2B buyers to specify, discuss, and verify with suppliers or manufacturers:

1. Material Grade and Resin Type

The primary factor in living hinge performance is the selected polymer. Polypropylene (PP) is the industry standard due to its superior fatigue resistance and flexibility. For higher mechanical strength or chemical resistance, grades of polyethylene (PE), acetal (POM), or specialty engineered plastics may be chosen. Specifying the exact grade (e.g., PP homopolymer vs. copolymer) directly impacts hinge longevity, environmental suitability (e.g., temperature range, humidity, UV resistance), and regulatory compliance.

2. Hinge Thickness and Flex Zone Dimensions

Typical living hinges rely on a reduced thickness “flex zone” (often between 0.25 and 0.5mm) to permit repeated bending. The relationship between this zone’s width and thickness is a decisive quality measure: too thick risks snapping, too thin increases the chance of tearing. International buyers should validate or request design drawings that indicate these dimensions—critical for product samples and mass production consistency.

3. Cycle Life (Durability Under Repeated Use)

Cycle life expresses how many open/close movements a hinge can sustain before mechanical failure. This is determined via standardized testing (often 10,000+ cycles in quality-grade products). Buyers seeking products for demanding environments (e.g., industrial packaging, medical devices) should request data on tested cycle life, not merely an estimated value.

4. Tolerance and Molding Precision

Living hinges are typically formed in one-piece injection molding. Tight tolerances for hinge thickness, width, and gate placement are vital, as minor deviations can lead to misalignments or premature failure. Reviewing supplier capabilities for injection molding precision, along with certification (such as ISO 9001), helps minimize quality risks during international transactions.

5. Environmental and Chemical Resistance

Depending on the end-use application—such as outdoor products or food-contact items—properties like UV stability, food grade certification, and resistance to oils/solvents may be required. Buyers should clarify environmental exposure expectations to ensure the correct material formulation and any necessary post-processing (e.g., additives for UV resistance).

6. Color Consistency and Surface Finish

For consumer-facing or branded products, uniform color and a flawless surface finish are essential. These attributes depend on the supplier’s color batching process and quality control. B2B buyers should review samples and, if necessary, request supplier adherence to international color matching systems (like Pantone or RAL).

Fundamental Trade Terms and Industry Jargon

In addition to technical properties, international B2B buyers will encounter specific terms in trade documentation and negotiations. Understanding these is vital for a smooth procurement process:

OEM (Original Equipment Manufacturer):

Refers to a company that produces parts or subsystems to be marketed by another manufacturer. When ordering living hinges, specifying whether you require OEM parts or standard catalog items can clarify quality and compatibility expectations.

MOQ (Minimum Order Quantity):

The smallest production batch a manufacturer will accept. MOQ for living hinges can vary—custom-molded parts often have higher MOQs due to setup costs. Knowing the MOQ impacts inventory planning and cash flow, especially for new product lines or pilot programs.

RFQ (Request for Quotation):

A formal process where the buyer invites suppliers to provide price quotes based on detailed product specifications (material, dimensions, cycle life, etc.). Precise RFQs yield more competitive bids and reduce misunderstandings, especially across diverse languages and markets.

Tolerance:

The allowable deviation in a physical dimension, crucial for components like living hinges where fit and function depend on exact measurements. This term will appear in both technical drawings and supplier guarantees—buyers should confirm tolerances meet the product’s use-case needs.

Incoterms (International Commercial Terms):

Global standard terms that define buyer and seller responsibilities for shipping, insurance, and customs (e.g., FOB, CIF, DDP). Selecting the right Incoterm can prevent costly surprises and align shipping expectations, particularly in Africa, South America, the Middle East, and Europe.

Lead Time:

The period from order confirmation to delivery. For living hinges, lead time accounts for mold setup, production, and transit. Accounting for lead time—especially when synchronizing with global supply chains—prevents delays in assembly or final product launches.

Actionable Takeaway:

For international B2B buyers, specifying the right technical properties and using accurate trade terminology is critical to reducing misunderstandings, minimizing defective shipments, and optimizing total cost of ownership. Ensure all requirements are documented and aligned with suppliers from the quoting process through to final delivery.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the living hinges Sector

Global Market Overview and Key Sourcing Trends

The living hinges sector has grown from a niche solution in consumer packaging to a critical component across global industries, including automotive, medical devices, electronics, and industrial consumer goods. Demand is primarily driven by manufacturers’ push for cost-effective, high-durability, and maintenance-free componentry. As globalization expands manufacturing footprints, B2B buyers—particularly those operating in Africa, South America, the Middle East, and Europe—are increasingly evaluating suppliers beyond traditional locations, seeking both quality and efficiency.

Key market dynamics include:

- Cost and Design Efficiency: Living hinges reduce part count and assembly time while boosting durability. This appeals to manufacturers aiming to streamline operations and lower total cost of ownership, especially in price-competitive markets like fast-moving consumer goods and electronics.

- Expansion Beyond Plastics: Polypropylene (PP) remains the dominant material for living hinges, but demand for engineered plastics with higher chemical and temperature resistance—such as polyethylene (PE) and thermoplastic elastomers (TPE)—is rising in sectors like healthcare and automotive.

- Automated Manufacturing: Injection molding remains the core technology, but advancements in CNC machining and industrial 3D printing are opening the door for faster prototyping, small-batch customization, and on-demand manufacturing. This is especially relevant for buyers in regions with developing industrial ecosystems who require flexibility in lead times and volumes.

- Supplier Diversification: Buyers in the Middle East and Africa are actively searching for alternate sourcing hubs in Southeast Asia and Europe—motivated by supply chain resilience, shipping cost rationalization, and new trade agreements. This decentralized approach helps protect against disruptions while promoting competitive pricing.

Emerging trends include tighter collaboration on design-for-manufacturing (DFM), robust digital quoting and collaboration platforms, and transparent vendor vetting processes to ensure quality and consistency globally. For buyers in growth regions, leveraging platforms that connect them directly with audited international suppliers is becoming a crucial competitive advantage.

Sustainability and Ethical Sourcing Considerations

Sustainability has moved from a compliance checkbox to a decisive procurement requirement for many international buyers. Living hinges, by their nature, already contribute to environmental goals: they often reduce the number of components and overall material usage in assemblies, leading to lighter, more efficient products. However, the choice of materials and manufacturing partners has become equally critical.

Environmental impact factors include:

- Material selection: Preference is given to recyclable plastics, such as polypropylene, or bio-based alternatives to reduce lifecycle emissions. For export markets in the EU and UK, compliance with REACH and RoHS regulations is a growing expectation for all components, including hinges.

- Waste reduction: Modern manufacturing methods (e.g., injection molding with optimized gate placement) minimize material waste. Advanced simulation tools help optimize hinge geometry, further cutting scrap and energy consumption.

- Green certifications: International buyers increasingly require ISO 14001, Green Seal, or eco-label certifications from suppliers, particularly for components entering regulated or consumer-facing markets.

- Ethical supply chains: Traceability and transparency in sourcing are now critical. Buyers must ensure ethical labor practices, fair wages, and responsible material sourcing throughout the hinge supply chain. This is particularly pressing for buyers in the Middle East, Europe, and Africa aiming to meet both regulatory and customer expectations.

Actions for B2B buyers include integrating sustainability criteria into RFQs, conducting supplier audits for environmental compliance, and favoring suppliers that demonstrate genuine commitments to reducing their carbon and resource footprints.

A Brief Evolutionary Context

The living hinge traces its roots back to the mid-20th century with the rise of injection-molded plastics. Early applications appeared in disposable consumer packaging, quickly expanding to industrial and automotive uses due to compelling cost and functional advantages over conventional metal hinges. Today’s living hinges merge robust engineering with sustainability and design precision, facilitating innovation across multiple sectors and geographies.

For B2B buyers, understanding this evolution highlights why living hinges have become synonymous with lean manufacturing, streamlined supply chains, and smart product design—making them a strategic lever for both cost leadership and sustainable growth.

Related Video: Tariffs will cause ‘massive shock’ to U.S. cost of living and will reshape global trade: Expert

Frequently Asked Questions (FAQs) for B2B Buyers of living hinges

-

How should international buyers vet potential living hinge suppliers to ensure quality and reliability?

Thorough supplier vetting is essential for mitigating risks in global sourcing. Begin by requesting certifications such as ISO 9001 and documented track records of supplying to your industry. Review case studies, customer references, and sample products for both material quality and hinge durability. Conduct video audits when in-person visits are not feasible. For African, South American, Middle Eastern, or European buyers, prioritize partners with transparent communication channels, multilingual support, and an established export history to your region. Strong after-sales support and responsiveness to inquiries are also key indicators of a reliable supplier. -

What customization options are typically available for living hinges in B2B procurement?

Manufacturers commonly offer extensive customization, including bespoke geometries (flat, double, butterfly, bi-stable), material selection (e.g., polypropylene, polyethylene), hinge thickness, length, and cycle-life specifications. Consider involving your supplier early in the design phase for optimal manufacturability and compliance with local regulations. For specialized markets (such as medical or automotive), communicate precise tolerances, chemical resistance, and color requirements. It is important to clarify intellectual property boundaries and sign NDAs when sharing proprietary designs, particularly in cross-border deals. -

What are standard minimum order quantities (MOQ), lead times, and payment terms for international living hinge orders?

MOQs vary widely, typically starting at a few thousand units for injection-molded parts, but can be negotiated for prototypes or lower-volume projects. Lead times range from 2–8 weeks depending on part complexity, tooling requirements, and order size. International payment terms often include 30% upfront with 70% on shipment, or use of letters of credit. Be sure to clarify Incoterms (FOB, CIF, DDP) to define responsibilities for duties, taxes, and insurance. Engaging established suppliers can sometimes secure more flexible terms, especially for buyers from regions with developing import processes. -

Which quality assurance measures and certifications should buyers require when sourcing living hinges?

Request evidence of comprehensive quality management systems, such as ISO 9001 or IATF 16949 for automotive parts. Insist on material traceability, inspection reports (such as First Article Inspection or PPAP), and performance test data for hinge cycle life and flexibility. For applications with regulatory oversight (such as food contact or medical devices), ensure materials comply with FDA, EU 10/2011, or equivalent certifications. Consider third-party pre-shipment inspections or lab testing, especially when sourcing from regions with unfamiliar regulatory frameworks. -

How can international buyers address logistics and shipping challenges related to living hinge imports?

Work with suppliers experienced in exporting to your country, who can assist with documentation (commercial invoice, packing list, certificate of origin), and advise on optimal shipping methods (air, sea, courier) based on urgency and cost. For African and South American buyers, clarify port infrastructure and customs clearance timelines in advance. Negotiate insurance coverage to protect against damages and agree on tracking procedures. Build in contingency time for holidays or port congestion, and consider consignment or bonded warehouse models for high-volume, ongoing needs. -

What are best practices for managing disputes and ensuring supplier accountability in international transactions?

Secure clear, legally binding contracts covering product specifications, delivery timelines, quality standards, and remedies for non-conformance. Utilizing escrow services or letters of credit helps safeguard payment until obligations are met. Specify procedures for returns, replacements, or refunds, and include dispute resolution clauses (arbitration, governing law, and jurisdiction). Maintain meticulous documentation of all communications and transactions. Where practical, work with suppliers who have local agents or representatives for easier issue resolution. -

How should buyers assess and request samples or prototypes before committing to bulk orders?

Always request pre-production samples or prototypes for functional and quality verification, paying attention to hinge flexibility, fatigue resistance, and overall fit within your final product. Negotiate on sample costs—many suppliers offset or refund these against first bulk orders. For highly customized designs, consider rapid prototyping methods like 3D printing or CNC machining for initial validation before investing in costly tooling. Solicit clear timelines for sample delivery and provide detailed feedback to optimize the final production batch. -

What factors should buyers from Africa, South America, the Middle East, or Europe consider when sourcing living hinges internationally?

Evaluate local import regulations, applicable tariffs, and required certifications early in the process. Factor in language barriers, currency fluctuations, and the stability of trade relations with the supplier’s country. Seek suppliers with a proven export record to your region and leverage local trade offices or chambers of commerce for due diligence. Inquire about post-sale technical support and after-market service. Establishing trusted relationships with logistics providers familiar with living hinges and plastic components can further smooth the import process and reduce unexpected delays.

Strategic Sourcing Conclusion and Outlook for living hinges

As living hinges continue to reshape product design and manufacturing efficiency on a global scale, forward-thinking B2B buyers have an opportunity to leverage their many advantages. Durability, low maintenance, streamlined assembly, and strong cost-effectiveness distinguish living hinges as a compelling choice for diverse industries—from packaging to automotive components.

When sourcing living hinges internationally, several critical factors underpin long-term value. Selecting manufacturers with proven expertise in living hinge design, modern production capabilities (such as advanced injection molding or CNC machining), and a clear track record of quality assurance is essential. Prioritize transparent supplier communication, request detailed technical documentation, and consider suppliers who integrate design for manufacturability (DFM) principles—these practices reduce risk and ensure consistent part performance. For regions seeking robust supply chain resilience, cultivating diverse supplier relationships across multiple geographies can safeguard against local market disruptions and bring cost advantages.

Looking ahead, living hinges are poised for even greater adoption as industries in Africa, South America, the Middle East, and Europe innovate in response to changing consumer and regulatory demands. Now is the time for international buyers to reassess their sourcing strategies, engage with trusted, forward-looking partners, and capitalize on the flexibility that living hinges offer. Harnessing these strategic sourcing approaches will not only optimize your product offerings but also position your business competitively in an evolving global market.