Introduction: Navigating the Global Market for polypropylene vs nylon

In today’s rapidly evolving global marketplace, the choice between polypropylene and nylon is more than a technical detail—it’s a pivotal factor shaping product reliability, market acceptance, and long-term competitiveness. For international B2B buyers across Africa, South America, the Middle East, and Europe, such as those sourcing materials for industries from packaging to automotive to high-performance outdoor gear, the stakes have never been higher. Selecting the right polymer can directly influence production costs, regulatory compliance, environmental impact, and ultimately, customer trust.

Both polypropylene and nylon offer distinct advantages and trade-offs. Polypropylene is celebrated for its light weight, moisture resistance, and appealing price point—qualities that suit cost-sensitive, moisture-prone applications. In contrast, nylon is renowned for high tensile strength, abrasion resistance, and dependability under dynamic or safety-critical loads, making it the professional’s material of choice for robust, long-lasting products. Yet, the decision goes far beyond technical datasheets; it requires an integrated understanding of supply chain realities, end-use performance, and the fast-changing landscape of sustainability standards and regulations, such as Extended Producer Responsibility (EPR) and EU eco-labeling requirements.

This comprehensive guide is designed to serve B2B buyers who demand actionable insights for material selection and global sourcing. It covers:

– Material profiles and key differences

– Application-specific use cases

– Manufacturing, quality control, and compliance considerations

– Supplier evaluation across major global regions

– Cost structure analysis and procurement strategies

– Evolving market trends and regulatory frameworks

– Frequently asked questions for international buyers

By demystifying the complex trade-offs and offering region-specific sourcing strategies, this guide empowers buyers to make informed, future-ready decisions—optimizing both product performance and bottom-line results in a competitive global market.

Understanding polypropylene vs nylon Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Standard Polypropylene | Lightweight, water- and mildew-resistant, lower strength | Packaging straps, bag handles, disposable components | Affordable, excellent in moist environments; limited strength and wear resistance |

| Heavy-Duty Polypropylene | Thicker, reinforced formulation for increased durability | Cargo tie-downs, outdoor furniture, marine equipment | Better wear and load capacity than standard; still lower than nylon for stress loads |

| Standard Nylon | High tensile strength, abrasion-resistant, moderate elasticity | Climbing gear, safety harnesses, load-bearing straps | Superior strength, long lifespan; higher price, absorbs moisture |

| Nylon 6,6 | Enhanced molecular structure for maximum strength/temperature | Industrial lifting slings, safety-critical equipment | Withstands extreme loads and temperatures; costliest option, requires UV protection |

| Solution-Dyed Nylon | Color integrated into fiber, excellent UV/chemical resistance | Branded outdoor gear, automotive interiors, uniforms | Consistent color, fade-resistant; slightly more expensive than regular nylon |

Standard Polypropylene

Standard polypropylene is a staple for B2B buyers seeking cost-effective, moisture-resistant solutions. Its lightweight nature and hydrophobic properties suit products often exposed to water or humid climates, such as packaging straps, disposable bag handles, or low-stress outdoor fixtures. Key considerations for procurement include evaluating strength limitations (typically up to 600 lbs/inch for webbing) and recognizing its tendency to fray with repeated abrasion. For buyers in tropical regions or the Middle East, its resilience against mold and chemicals provides an added advantage for basic, high-turnover applications.

Heavy-Duty Polypropylene

Engineered for environments demanding improved performance, heavy-duty polypropylene offers a thicker, more robust construction than the standard grade. Although it surpasses basic polypropylene in durability, it still falls short for applications with severe mechanical stresses or continuous abrasion. This variation is especially valuable for commercial marine gear, temporary cargo tie-downs, and ruggedized outdoor furniture. Buyers should assess whether enhanced longevity justifies the slight increase in cost, especially where weight savings and water resistance remain priorities.

Standard Nylon

Standard nylon is renowned for its exceptional strength, abrasion resistance, and moderate elasticity—qualities vital for safety-critical industries. Used extensively for climbing equipment, harnesses, and workwear, its performance shines under dynamic loads and in demanding field conditions. While the material can absorb moisture and requires consideration for drying, its superior load tolerance (typically upwards of 4,200 lbs/inch for webbing) makes it a top choice for buyers who prioritize product reliability over initial cost. It is especially relevant for brands operating in Europe, where safety standards are rigorous.

Nylon 6,6

Nylon 6,6 stands apart for its advanced structural integrity, offering maximum tensile strength and resistance to both high temperatures and chemicals. This makes it indispensable for industrial slings, automotive safety equipment, and heavy-duty technical webbing. While this premium material involves a higher acquisition cost, its ability to maintain integrity under prolonged stress and temperature extremes provides unmatched assurance for B2B buyers in industries like oil & gas or advanced manufacturing. Ensuring anti-UV treatments may be necessary for products used in sun-exposed regions.

Solution-Dyed Nylon

Solution-dyed nylon incorporates pigments at the fiber production stage, resulting in uniform color penetration, excellent fade resistance, and improved chemical stability. Highly suitable for outdoor gear, automotive components, and uniform textiles, this variant helps B2B buyers uphold branding consistency even under prolonged sunlight or chemical exposure. Although marginally pricier than standard nylon, the total cost of ownership can be lower thanks to its durability and colorfastness—a factor particularly valuable for international buyers in regions with high UV exposure or strict brand presentation requirements.

Related Video: Lecture 1 Two compartment models

Key Industrial Applications of polypropylene vs nylon

| Industry/Sector | Specific Application of polypropylene vs nylon | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Outdoor & Sporting Goods | Webbing for straps, harnesses, and gear | Balances weight, durability, and moisture resistance vs. load-bearing safety | Required tensile strength, abrasion resistance, UV stability, finish & dyeability |

| Automotive & Transport | Interior components, clips, under-hood parts | Chemical and heat resistance, cost-effectiveness vs. structural reliability | Thermal performance, compliance with standards, moldability, lifecycle impacts |

| Packaging & Containers | Reusable containers, flexible packaging, hinges | Lightweight, chemical inertness (PP) vs. toughness & wear (nylon) | Food safety compliance, recyclability, impact strength, sealing capabilities |

| Medical Devices | Sterilizable components, tubing, face mask fibers | Reliable sterility, chemical resistance, cost vs. higher durability (nylon) | Biocompatibility, sterilization method compatibility, regulatory certification |

| Industrial Manufacturing | Conveyor belts, bushings, wear strips | Moisture/chemical resistance (PP) vs. strength & friction resistance (nylon) | Operating environment, load requirements, maintenance, friction & abrasion factors |

Outdoor & Sporting Goods

In the manufacture of outdoor equipment—such as backpacks, safety harnesses, and tent straps—the choice between polypropylene and nylon webbing is crucial. Polypropylene is lightweight, cost-effective, and ideal for gear exposed to frequent moisture, as it resists mildew and absorbs minimal water. However, for load-bearing or safety-critical gear (e.g., climbing harnesses, rescue straps), nylon is preferred for its superior tensile strength, abrasion resistance, and long-term durability. International B2B buyers should specify application performance thresholds (e.g., min. breaking strength) and request UV-resistant grades for sun-exposed goods, ensuring products meet safety certifications relevant to export markets.

Automotive & Transport

Both polypropylene and nylon see extensive use in automotive interiors and under-the-hood components. Polypropylene offers excellent chemical resistance and is cost-efficient for non-structural parts like trim panels, battery casings, and clips, providing stability amidst temperature swings and exposure to oils. Nylon is deployed when higher strength, heat resistance, or friction durability are needed—such as in gears, cable ties, brackets, and under-hood fasteners. Buyers in fast-growing automotive sectors, like those in South America and Africa, should evaluate environmental conditions and compliance with ISO or OEM-specific material specifications, as requirements may differ by region and supplier.

Packaging & Containers

Polypropylene is commonly chosen for rigid and flexible packaging—bottles, reusable food containers, and living hinges—thanks to its chemical inertness, food safety profile, and excellent moisture barrier properties. Nylon’s toughness and resistance to repeated flexing suit it for specialty film layers or packaging encountering high wear or demanding sealing needs (such as vacuum packaging). B2B buyers focusing on regulatory regimes in Europe or the Middle East must confirm compliance with food contact and recycling directives, while weighing lifecycle costs and container durability for multi-use logistics scenarios.

Medical Devices

In medical sectors, material choice determines both patient safety and regulatory approval. Polypropylene’s sterilizability and chemical resistance support its use in disposable syringes, tubing, medical trays, and certain protective equipment, while nylon offers exceptional durability and is suited for repeated-use items like surgical instruments, catheter sheaths, or mask headbands. Buyers must scrutinize supplier certifications (like ISO 10993 for biocompatibility), compatibility with preferred sterilization methods (e.g., steam, gamma irradiation), and traceability—especially when exporting into the EU or Gulf countries with strict medical regulations.

Industrial Manufacturing

Bulk material handling systems, such as conveyor belts, wear strips, and bushings, demand robust polymers. Polypropylene components perform reliably where moisture, oils, and chemicals are present but mechanical stresses are moderate. For applications with significant abrasion or repetitive load cycles, nylon’s wear and friction resistance make it indispensable—helping to extend intervals between replacement and reduce downtime. Buyers from markets with high humidity or aggressive chemicals (e.g., processing industries in Africa or Latin America) should verify that the chosen material matches local environmental demands, prioritizing sourced grades that optimize performance and total cost of ownership.

Related Video: Polypropylene (PP) Production Process Overview

Strategic Material Selection Guide for polypropylene vs nylon

Polypropylene (PP)

Polypropylene is a lightweight, semi-crystalline thermoplastic favored in applications where cost efficiency and moisture resistance are essential. Its natural hydrophobicity makes it especially suitable for equipment and components exposed to humid or wet environments—bag handles, accessory straps, packaging webbing, and certain piping. Polypropylene boasts solid chemical resistance, tolerating a wide range of acids, bases, and oils, which is advantageous in industries such as agro-processing or chemical handling.

Pros:

– Competitive pricing and low raw material cost.

– Excellent resistance to moisture, mildew, and many chemicals.

– Lightweight, which reduces shipping costs.

– Easy to process via common methods (extrusion, injection molding).

Cons:

– Lower tensile strength and abrasion resistance compared to nylon; not ideal for heavy-duty or safety-critical products.

– Limited UV resistance, requiring additives for prolonged sunlight exposure.

– Lower temperature capability—tends to soften above 100°C.

Application Impact:

Works well in short-life, cost-driven components or parts primarily exposed to water. However, for dynamic, high-load, or mission-critical gear, its performance is limited.

International B2B Considerations:

Widely available globally and generally meets basic international requirements (ASTM, ISO), though product-specific standards may vary. In regions with extreme temperatures (e.g., parts of Africa or the Middle East), confirm grade suitability to avoid deformation. UV stability is a must for outdoor use in sun-drenched markets.

Nylon (Nylon 6/6, Nylon 6)

Nylon, particularly Nylon 6 and Nylon 6/6, is synonymous with strength, durability, and versatility, making it the material of choice for high-performance, long-life applications. Its high tensile strength (4,200–5,500 lbs/in for webbing), superb abrasion resistance, and moderate elasticity provide both toughness and shock absorption. This profile suits safety harnesses, heavy-duty straps, climbing gear, high-strength fasteners, and other demanding industrial products.

Pros:

– Exceptional mechanical strength and longevity under cyclic loads.

– Excellent wear and abrasion resistance, prolonging service life in harsh environments.

– Performs reliably over a broad temperature range (from -80°C to 250°C).

Cons:

– Absorbs water (up to 3-4%), which can temporarily reduce strength and cause dimensional changes.

– Susceptible to UV degradation without stabilizers.

– Higher cost compared to polypropylene and requires careful process control for dyeing/finishing.

Application Impact:

Ideal for safety- or load-critical applications where failure is not an option. Its toughness justifies the premium price where reliability earns customer trust and regulatory approval.

International B2B Considerations:

Meets worldwide safety and performance standards (ASTM, DIN, ISO). In humid or wet climates (e.g., tropical Africa, Amazonian South America), manage moisture absorption with proper drying and conditioning. For heavy outdoor use in southern Europe or the Middle East, specify UV-stabilized grades.

Polyethylene (HDPE, included for benchmarking)

High-density polyethylene (HDPE) is often considered as a middle ground or substitute in certain applications. Known for its robust chemical resistance and stability in water-exposed conditions, HDPE is routinely used in heavy packaging, containers, and some piping. Its mechanical strength is lower than nylon’s but comparable to or slightly greater than polypropylene, though with less flexibility.

Pros:

– Excellent chemical, water, and impact resistance.

– Good performance in cold and moderate climates.

– Low cost and easy manufacturability.

Cons:

– Less durable under sustained dynamic stress than nylon.

– Not suitable for applications needing high tensile strength or abrasion resistance.

– Deforms at lower temperatures compared to nylon.

Application Impact:

Suited to static or mildly dynamic components where chemical resistance and low cost matter more than ultimate strength—e.g., water tanks, industrial liners.

International B2B Considerations:

Commonly certified to ASTM, ISO, and DIN standards. In warmer locations (colder climates less of an issue), confirm that temperature limits are compatible with intended use. Less optimal when long-term physical durability or compliance with stringent safety standards is mandatory.

Polyester (PET, included for completeness)

Polyester (typically PET or PBT) webbing and molded parts provide yet another option for industrial buyers. Its strength and chemical resistance exceed polypropylene’s and approach, though generally do not match, nylon’s. Polyester’s standout feature is its UV resistance, making it a frequent choice for outdoor uses.

Pros:

– Very good strength and abrasion resistance.

– Low water absorption and excellent dimensional stability.

– Superior resistance to UV and most chemicals.

Cons:

– Higher material cost than polypropylene; lower than nylon, but varies by region.

– Slightly less flexible than nylon.

– Not as resilient to high dynamic loads as top-grade nylon.

Application Impact:

Ideal for outdoor applications—cargo straps, seatbelts, or marine webbing—where UV and weathering are primary concerns.

International B2B Considerations:

Conforms to major standards (EN, ISO, ASTM). UV stability is a plus in high-sunlight regions (Colombia, Mediterranean Europe, North Africa). Pricing and availability are generally solid worldwide, but always confirm supply chain reliability when targeting emerging markets.

Summary Table

| Material | Typical Use Case for polypropylene vs nylon | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polypropylene (PP) | Moisture-prone, lightweight, low-stress applications (e.g., bag handles, simple webbing, packaging) | Low cost; excellent water and chemical resistance | Limited strength & abrasion resistance; poor UV stability | Low |

| Nylon (Nylon 6/6, 6) | Safety-critical, heavy-duty, or high-wear applications (e.g., harnesses, industrial webbing, climbing gear) | Very high strength and durability | Absorbs water; sensitive to UV unless stabilized; higher cost | High |

| Polyethylene (HDPE) | Chemical tanks, liners, light-duty webbing, packaging | Good chemical and impact resistance; low cost | Lower strength/abrasion than nylon; deforms under heat | Low to Medium |

| Polyester (PET) | Outdoor webbing, cargo/transport straps, seatbelts | Outstanding UV/weather resistance; strong and stable | Slightly less strong than nylon; lower flexibility | Medium |

In-depth Look: Manufacturing Processes and Quality Assurance for polypropylene vs nylon

Key Manufacturing Procedures: Polypropylene vs. Nylon

Selecting polypropylene or nylon for your B2B applications requires more than understanding final product specs; it’s crucial to grasp each stage of the manufacturing pipeline and how quality is assured throughout. Process differences impact not just costs and efficiencies, but ultimately, the performance and reliability your clients rely upon.

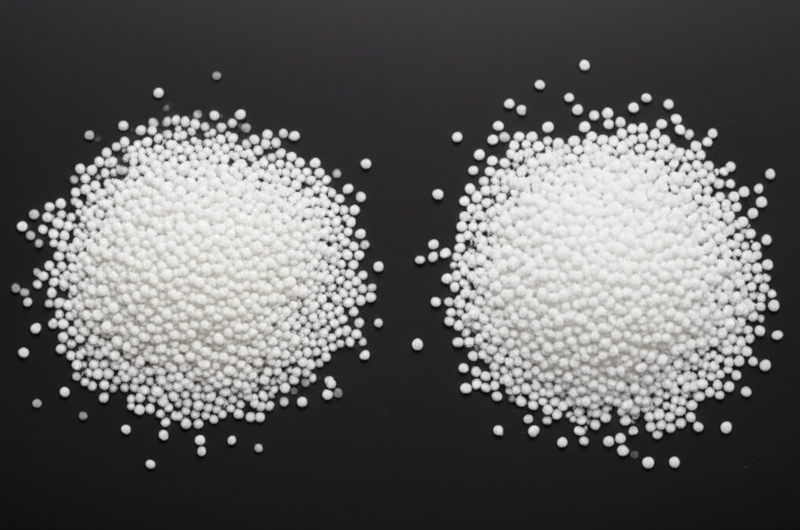

Polypropylene Manufacturing Workflow

- Material Preparation

– Raw polypropylene resin, often delivered in pellet form, is dried to remove residual moisture that can adversely affect molding quality. Additives (stabilizers, colorants, UV protectants) may be blended to meet specific application needs. - Forming Techniques

– Injection Molding: Dominant for components demanding intricate shapes or high-volume runs, such as appliance parts and lightweight containers.

– Extrusion: Widely employed for continuous profiles (webbing, straps, pipe), this process forces melted resin through a die, producing uniform cross-sections at high speed.

– Blow Molding: Key for hollow items like bottles and tanks.

– Weaving (for Webbing): Polypropylene tapes, after melting and drawing, are woven into webbing for applications like bag straps. - Assembly

– Parts may be ultrasonically welded, stitched, or riveted, depending on end-use and mechanical requirements. - Finishing

– Surface treatments can include cutting, heat-setting for dimensional stability, printing, or specialized chemical coatings to enhance UV or chemical resistance.

Nylon Manufacturing Workflow

- Material Preparation

– Nylon granules are carefully dried, as nylon’s hygroscopic nature means excess moisture can severely affect processability and product strength. Select grade and additives based on application: e.g., impact modifiers for outdoor gear. - Forming Techniques

– Injection Molding: Especially for precision-engineered or load-bearing components, such as gears or safety-critical harness fixtures.

– Extrusion and Drawing: Used for producing strong fibers and webbing; nylon filaments are drawn to orient polymer chains, maximizing tensile strength.

– Weaving/Braiding: For industrial and outdoor webbing, tightly controlled weaving or braiding is used to enhance abrasion resistance and load distribution. - Assembly

– Nylon’s strength and toughness allow options like bar-tacking, reinforced stitching, heat welding, or specialized adhesives. - Finishing

– Dyeing and UV protective coatings are common, as nylon is easily colored and often used in environments where color retention and protection from sunlight matter.

– Additional heat setting improves dimensional integrity, particularly after weaving or molding.

Quality Assurance Practices Across the Value Chain

With international B2B trade, rigorous and visible quality assurance (QA) is essential—not only to guarantee consistent performance, but also to navigate a patchwork of national and international regulations.

International and Industry-Specific Standards

- ISO 9001: Universally recognized for quality management systems. Suppliers with ISO 9001 certification demonstrate commitment to consistent quality processes, traceability, and documented corrective actions—a baseline requirement for serious buyers in Europe, Africa, Middle East, and South America.

- ISO 14001: Increasingly relevant for environmental control, especially with EU and EMEA buyers prioritizing sustainability and compliance in their supply chains.

- Industry-Specific Certifications: Depending on application:

- CE Marking: Required for products sold in the European Economic Area—critical for safety, health, and environmental protection.

- REACH Compliance: Especially for buyers in Europe, verifying chemical safety and registration.

- API, ASTM, EN, or regional equivalents: For technical or safety-critical components (e.g., automotive, industrial equipment).

Core QC Checkpoints

Quality control for polypropylene and nylon manufacturing typically includes several structured checkpoints:

-

Incoming Quality Control (IQC)

– Inspection and testing of raw resin and additives for purity, melt flow index, and contaminant levels.

– Verification against purchase and technical specifications. -

In-Process Quality Control (IPQC)

– Continuous monitoring of process parameters (temperature, pressure, cycle times) in molding/extrusion and weaving stages.

– In-line measurements for key dimensions (width, thickness, length), color consistency, and absence of visible defects (bubbles, streaking, fraying).

– Spot tensile tests or abrasion tests on early production lots for critical webbing or load-bearing components. -

Final Quality Control (FQC)

– Full product inspections against all key characteristics: strength, appearance, marking, dimension, and final function.

– Lot-based destructive testing (tensile, elongation, UV exposure, chemical resistance).

– Retesting for dye/finish uniformity (if relevant).

Common Testing Methods

- Tensile Testing: Standardized (ASTM D5034, ISO 13934) to ensure claimed load-bearing capacities, essential for webbing used in safety or outdoor markets.

- Abrasion Resistance: Methods like Taber test or Martindale, especially pertinent to nylon’s application in demanding environments.

- Weather and Chemical Resistance: UV aging tests, hydrolytic stability checks, and exposure to oils/chemicals.

- Dimensional Verification: Measurement tools (micrometers, vision systems) enforce tight tolerances, especially for assembly compatibility.

- Color Fastness/Dye Transfer: Evaluated for finished nylon items, notably those for consumer or visible end-use.

Ensuring Supplier Quality: Best Practices for International B2B Buyers

Robust Quality Verification Steps

International buyers—especially those in regulated or high-visibility sectors in Africa, South America, the Middle East, and Europe—should not rely solely on self-declared claims. Consider these actionable approaches:

-

Supplier Audits

– On-site audits—either directly or via a trusted local agent—are critical. Assess not only documentation but observe real-time production, cleanliness, workflow discipline, and calibration of in-line measurement tools.

– For remote relationships, insist on extensive digital audit trails: real-time video walk-throughs, sample production runs, access to batch QC records. -

QC Documentation and Reporting

– Require suppliers to provide certified batch-by-batch QC reports, preferably linked to international standard formats (ISO, ASTM, EN).

– Request complete traceability: resin lot numbers, process parameters, test records.

– For custom products, pre-approve a Golden Sample and require shipments to match these reference standards.

-

Third-Party Inspection Services

– Engage independent inspection agencies (e.g., SGS, Bureau Veritas, Intertek) for pre-shipment and random in-production checks.

– Especially valuable for buyers without local presence or for high-value/high-risk shipments. -

Ongoing Performance Feedback Loops

– Implement a process for field-performance data feedback (warranty claims, returns, customer complaints).

– Use these insights to push for continuous improvement, corrective action, and compensatory measures from suppliers if trends emerge.

Certification and Compliance Nuances by Region

- European Union: High bar for regulatory and environmental compliance, thorough documentation, and traceability. REACH and CE compliance are non-negotiable for many product classes.

- Middle East & Africa: Preference for proven, documented performance and durability due to harsh climate situational factors (e.g., UV, heat, humidity). Request region-specific certification (e.g., SASO in Saudi Arabia) as needed.

- South America: Buyers in countries like Colombia increasingly seek environmental compliance documentation and evidence of international certifications—key for premium market access.

- Cross-border Commerce: Ensure packaging, labeling, and documentation (shipping certificates, test results, compliance declarations) meet destination country customs and regulatory requirements to avoid costly shipment delays.

Strategic Takeaways for B2B Buyers

- Prioritize suppliers with demonstrable process control and international certifications, notably ISO 9001, to ensure consistent PP or nylon product quality.

- Mandate robust QC at every stage—from incoming material to final inspection—including transparent sharing of all test data and audit reports.

- Consider third-party verification for critical or high-volume orders, especially if local regulatory compliance or market reputation is paramount.

- Leverage technical standards appropriate to your end-market for both performance validation and regulatory approval.

Careful attention to process and quality assurance not only secures product consistency and safety, but also enhances your ability to compete—and deliver confidence—across diverse international markets.

Related Video: Nylon production

Comprehensive Cost and Pricing Analysis for polypropylene vs nylon Sourcing

Breaking Down the True Cost of Sourcing Polypropylene vs Nylon

Understanding the real cost profile behind polypropylene (PP) versus nylon sourcing is pivotal for international B2B buyers mitigating risk and optimizing ROI. While listed price per kilogram is important, your total landed and operational cost depends on a spectrum of variables—from raw material volatility to logistics and certification requirements. Here’s a comprehensive breakdown tailored to the realities faced by buyers across Africa, South America, the Middle East, and Europe.

Key Cost Components

-

Raw Material Costs

– Polypropylene: Typically cheaper and less volatile than nylon due to widespread global production and simpler feedstock. Sourcing is generally straightforward, with less price fluctuation.

– Nylon (typically 6 or 6,6): More processing steps, higher global demand for technical applications, and greater dependency on oil byproducts drive nylon’s baseline cost significantly above PP. -

Labor and Manufacturing Overhead

– Polypropylene: Lower melt temperatures and simpler molding/extrusion processes reduce energy consumption and labor hours.

– Nylon: Requires higher process temperatures, careful moisture management, and often more quality checks, pushing overheads up. -

Tooling and Setup

– Both materials require molds and dies, but nylon parts—often for safety-critical or high-stress applications—tend to need tighter tolerances and more robust tools, increasing initial CapEx. -

Quality Control and Certifications

– Polypropylene: Typically sufficient with basic QC for low-risk applications; certification costs are lower.

– Nylon: Frequently needed in regulated industries (automotive, PPE, medical) where durability, strength, or compliance certificates (e.g., ISO, REACH, RoHS) are critical—factoring heavily into total project cost. -

Logistics and Shipping

– PP is lighter per volume but, since it is often sold in higher volumes, shipping can offset cost advantages. Nylon’s higher value density may allow more cost-effective air or consolidated shipments, but care is needed to protect from moisture uptake in transit. -

Supplier Margin and Markup

– Markups vary by region and supplier reputation. Direct factory sourcing in Asia or the Middle East may deliver more competitive base pricing, but European suppliers could include certifications and stricter QC processes in the price.

Factors That Influence Final Pricing

- Order Volume & MOQ

- Higher volumes typically unlock significant discounts, particularly for lower-margin commodities like PP. For nylon, MOQ may be shaped by specialty grades or color matching.

- Customization and Specifications

- Custom colors, UV resistance, anti-static properties, or reinforced composites drive complexity—and cost—especially for nylon.

- Consistent Quality & Certifications

- Expect increased unit costs if your use-case requires traceable batches, audits, or third-party certifications, all more typical with nylon.

- Supplier Region & Stability

- Political, logistical, and foreign exchange vulnerabilities can sharply impact total cost. For African and South American buyers, choosing suppliers with established export experience and flexible Incoterms (FOB vs. CIF) can mitigate these risks.

- Incoterms & Shipping Terms

- Ex-works (EXW) may be cheaper per box but exposes buyers to hidden costs. DDP or DAP, preferred by many EU or Middle Eastern buyers, shifts more cost certainty to the supplier but increases the landed price.

Actionable Tips for Cost-Efficient Sourcing

- Negotiate Total Value, Not Just Unit Price: Insist on itemized quotes that reveal material, QC, tooling, minimum quantity, and certification costs. Leverage volume or long-term order commitments where possible.

- Assess Total Cost of Ownership: Calculate not just FOB/CIF price but also tariffs, logistics, storage, likelihood of returns, and warranty liabilities—especially essential for cross-continental trade.

- Request Material Certifications Proactively: For critical applications in automotive, medical, or food contact uses, ask for compliance proofs up front to avoid costly delays at customs or in-market recalls.

- Factor in Lead Times and Supply Chain Resilience: Nylon supply chains can be more fragile due to reliance on specialty chemicals and global transport, so weigh the cost of potential outages or expedited shipments.

- Adapt Material Choice to Application Needs: For cost-sensitive, light-duty, or moisture-heavy applications, PP often yields better ROI. For lifespan, strength, or safety-critical deliverables, pay the premium for high-grade nylon.

- Benchmark Regularly: Material costs are closely linked to oil market trends and regional supply-demand. Regularly survey regional and global sources to ensure competitiveness.

Disclaimer: All cost indications and material trends provided are for general guidance only. Actual prices can fluctuate due to global supply dynamics, geopolitical factors, resin indexes, and local regulatory changes. Always request up-to-date quotes and consult qualified sourcing or trade professionals before committing.

By applying a holistic, data-driven approach to cost analysis, international buyers can avoid hidden expenses and ensure the right material choice for both performance and budget targets.

Spotlight on Potential polypropylene vs nylon Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘polypropylene vs nylon’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

Polypropylene vs. Nylon: How These Materials Compare (www.xometry.com)

Polypropylene vs. Nylon: How These Materials Compare is a resource provided by Xometry, a well-established global manufacturing marketplace known for its digital platform that connects B2B buyers with a wide range of industrial materials and processes. Xometry specializes in advanced manufacturing solutions—including 3D printing, CNC machining, and injection molding—with extensive expertise in both polypropylene and nylon component production. Their platform enables international buyers to access instant quoting, technical material guidance, and on-demand production, which streamlines procurement processes for diverse industries such as automotive, medical devices, and consumer goods.

Xometry’s strengths include deep technical support for polymer selection, data-driven material comparison, and scalable production from prototyping to full manufacturing. While specific certifications are not highlighted, they typically adhere to rigorous industry quality standards expected for global supply chains. The company’s robust digital infrastructure, combined with its wide reach across Europe, the Middle East, Africa, and South America, positions them as a versatile partner for buyers seeking optimal material choices and efficient sourcing for both polypropylene and nylon solutions.

Kemalmfg (www.kemalmfg.com)

Kemalmfg positions itself as an in-depth resource and manufacturer for businesses comparing polypropylene and nylon for industrial applications. The company demonstrates particular expertise in advising and supplying materials based on performance-driven requirements, systematically outlining the unique strengths and application differences between these polymers. Kemalmfg is recognized for supporting B2B clients with tailored recommendations—guiding buyers toward optimal choices for durability, moisture-resistance, or load-bearing needs. Although detailed public certifications and manufacturing process information are limited, their website suggests a comprehensive knowledge base with content aimed directly at international B2B buyers seeking material clarity, especially in sectors spanning Africa, South America, the Middle East, and Europe. Kemalmfg’s approach appeals to businesses prioritizing informed material selection and reliable supply partnerships in the polypropylene and nylon product spectrum.

Polypropylene vs. Nylon: Which One to Choose? (unionfab.com)

Unionfab positions itself as an industry resource dedicated to advanced polymer solutions, with a strong emphasis on the comparative evaluation and supply of polypropylene (PP) and nylon for diverse applications. The company’s expertise spans technical consultancy and material selection, supporting manufacturers in fields ranging from automotive and industrial equipment to packaging and consumer products. Unionfab analyzes the properties, advantages, and environmental considerations of both polymers, enabling B2B buyers to make data-driven decisions tailored to performance, regulatory, or sustainability needs. While direct details about manufacturing infrastructure or certifications are limited, Unionfab’s in-depth material assessments and sector-specific insights suggest a focus on quality guidance for international markets, including Europe, Africa, South America, and the Middle East. Their content-driven approach positions them as a knowledge partner for organizations seeking optimized polymer choices.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| Polypropylene vs. Nylon: How These Materials Compare | Digital manufacturing, polymer expertise, global reach | www.xometry.com |

| Kemalmfg | Polypropylene vs. nylon expertise for global B2B buyers | www.kemalmfg.com |

| Polypropylene vs. Nylon: Which One to Choose? | Polymer selection consulting and supply expert | unionfab.com |

Essential Technical Properties and Trade Terminology for polypropylene vs nylon

Key Technical Properties: Polypropylene vs. Nylon

When evaluating polypropylene (PP) and nylon (commonly Nylon 6 or Nylon 6,6) for B2B sourcing, understanding the essential material properties is vital for aligning product performance, regulatory compliance, and cost-effectiveness with your business objectives. Below are the most critical technical properties to consider:

-

Tensile Strength:

This measures the maximum load a material can withstand while being stretched. Nylon exhibits markedly higher tensile strength (typically 4,200–5,500 lbs/in for 1-inch webbing) compared to polypropylene (~600 lbs/in). For applications requiring structural integrity or safety (e.g., load-bearing straps, harnesses), nylon is the preferred choice. Polypropylene suffices for lighter, non-critical applications such as packaging straps or accessory loops. -

Abrasion Resistance:

How well a material withstands repetitive friction or rubbing is a key determinant of longevity. Nylon offers outstanding abrasion resistance, enabling long service life in products exposed to continual wear. Polypropylene, while more resistant to chemicals and moisture, is prone to fraying and premature wear under abrasive conditions. -

Moisture Absorption & Resistance:

Polypropylene is naturally hydrophobic, resisting water, mildew, and many chemicals, making it the superior option in wet or humid environments. Nylon, on the other hand, absorbs some moisture, which can temporarily reduce its strength, but regains performance once dry. -

Elasticity (Elongation at Break):

Nylon has moderate elasticity, allowing it to absorb dynamic loads and shocks, a pivotal advantage in applications like safety harnesses or climbing gear. Polypropylene is less elastic, and therefore suited for products where dimensional stability is key and flex is not needed. -

Temperature Performance:

Nylon maintains its mechanical properties in a wide range of temperatures (from extreme cold up to 250°C), making it reliable in varied climates. Polypropylene’s operational window is more limited, and it can become brittle in low temperatures, impacting product lifespan in colder regions. -

Chemical & UV Resistance:

Both materials have good chemical resistance, but polypropylene excels in environments exposed to acids, bases, and organic solvents. For products used outdoors, note that nylon requires UV stabilization to prevent degradation under prolonged sunlight, while polypropylene has naturally better UV resistance.

For B2B buyers, these specifications are not mere technicalities; they directly impact product reliability, brand reputation, and after-sales liability. Always align your sourcing criteria with the intended application and market-specific environmental factors.

Common B2B Trade Terms & Jargon Explained

Navigating international procurement means encountering a specialized vocabulary. Understanding these common industry terms ensures clear communication, minimizes risk, and supports effective negotiations:

-

OEM (Original Equipment Manufacturer):

Refers to companies that produce parts or products which are then marketed by another company under its own brand. Sourcing webbing or components from a reputable OEM can guarantee consistent quality and compliance with global standards. -

MOQ (Minimum Order Quantity):

The smallest quantity a supplier is willing to sell. Knowing the MOQ is essential for cash flow management and storage planning, especially when trialing new materials or entering unfamiliar markets. -

RFQ (Request for Quotation):

An RFQ is a formal invitation sent to suppliers to submit pricing and terms for supplying a product or component. Precise RFQs (specifying technical grades, tolerances, finishes) yield more accurate bids and prevent costly misunderstandings. -

Incoterms (International Commercial Terms):

Standard trade terms published by the International Chamber of Commerce to clarify the responsibilities of buyers and sellers in international transactions (e.g., CIF, FOB). Mastery of Incoterms protects against unexpected logistics costs, insurance gaps, or customs delays. -

Material Grade:

Designation of composition and quality (e.g., “Virgin Nylon 6,6” or “Recycled Polypropylene”). The grade determines mechanical properties, regulatory compliance, and price, impacting both functionality and marketability. -

Tolerance:

Permissible deviation in product dimensions or properties. Specifying tight tolerances is crucial for components that must fit precisely or undergo secondary processes, reducing rework and rejection rates in manufacturing.

By understanding both the technical material properties and the trade-specific terminology, international buyers not only secure the most suitable material but also optimize supply chain operations, ensure regulatory compliance, and strengthen commercial negotiations across global markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the polypropylene vs nylon Sector

Market Overview & Key Trends

The polypropylene (PP) and nylon (polyamide, PA) markets continue to experience diverse and dynamic shifts, driven by a combination of global supply chain evolution, technological advancements, and regional demand patterns. For B2B buyers across Africa, South America, the Middle East, and Europe, these changes present both challenges and opportunities.

Global Drivers: The growing demand for lightweight, durable materials in automotive, packaging, agricultural, and textile industries continues to fuel consumption of both polymers. Polypropylene’s popularity stems from its competitive cost structure and moisture resistance, making it a staple for high-volume packaging, hygiene products, and low-intensity industrial components. Nylon, on the other hand, is increasingly favored for applications demanding higher strength, abrasion resistance, and safety, such as industrial belting, construction materials, high-performance apparel, and automotive parts.

Emerging Sourcing Trends:

– Digital Platforms and Direct Sourcing: The proliferation of digital B2B marketplaces is enabling buyers from Colombia, Nigeria, France, and the UAE to bypass traditional intermediaries, directly connecting with manufacturers for more competitive pricing and enhanced supply chain visibility.

– Customization and Performance Differentiation: Buyers are increasingly specifying polymer grades and fabric constructions tailored to climatic or regulatory needs—humidity resistance for tropical South America, UV stability for Middle Eastern sun exposure, or specific REACH conformity for European markets.

– Resilience and Diversification: Recent disruptions have prompted buyers to diversify sourcing strategies, balancing imports from Asia with growing domestic or regional production capacities in Europe and North Africa. This shift is especially pertinent where port logistics or currency fluctuations have impacted materials availability.

Market Dynamics: Polypropylene’s price volatility, heavily tied to oil markets, can expose B2B buyers to fluctuations in total cost of ownership. Nylon’s higher price point is offset by superior longevity in demanding applications, offering a compelling value proposition for industries prioritizing durability and user safety. Additionally, trade regulations and tariffs are increasingly shaping procurement strategies, with buyers seeking suppliers that can demonstrate compliance with local content or environmental standards.

Sustainability & Ethical Sourcing in B2B

Sustainability considerations are now central to procurement decisions in the polypropylene and nylon sectors. Stakeholders face mounting regulatory pressure in regions such as the EU with mandates around recycled content, Extended Producer Responsibility (EPR), and carbon footprint disclosures. Similar regulatory trends are gaining traction in South America and select African markets, pushing buyers to reevaluate material selection.

Environmental Impact Highlights:

– Polypropylene: Generally boasts a lower energy input for production compared to nylon, but its shorter application lifespan and challenges in closed-loop recycling can offset these gains. PP’s hydrophobicity reduces mold risks but makes recycling streams more complex.

– Nylon: Higher production energy requirements and greater moisture uptake, but its longer lifespan and advanced recycling methods (such as chemical depolymerization) are unlocking more circular business models. In demanding applications, nylon’s durability yields a favorable use-phase environmental profile.

Ethical Supply Chain and Green Certifications:

– Certifications and Standards: International buyers are increasingly seeking supply partners with third-party certifications—such as Global Recycled Standard (GRS), Bluesign®, or ISO 14001. These not only assure responsible production and traceability but help future-proof brands against tightening regulations.

– Supplier Verification: Due diligence is critical. Transparent supply chain mapping, labor practices, and verified environmentally responsible sourcing are valued not just by European buyers but also by rapidly modernizing industries in Africa and South America, where multinational investment is growing.

– Life Cycle Assessment (LCA): Adoption of LCA practices allows buyers to compare true environmental costs, optimizing specification not just for price or performance but also for emissions, resource consumption, and end-of-life solutions.

Evolution and Historical Context

Both polypropylene and nylon have distinct synthetic heritages shaping their roles in today’s markets. Nylon, first commercialized in the 1930s as the world’s premier synthetic fiber, revolutionized industries from apparel to wartime applications. Over decades, nylon’s mechanical superiority has underpinned its dominance in high-strength and safety-critical uses.

Polypropylene, introduced later in the mid-20th century, rapidly gained market share due to lower raw material costs, ease of processing, and versatile properties. Its proliferation in mass-market flexible packaging and consumer goods made it a go-to choice for cost-efficient manufacturing.

Today, as B2B buyers seek materials balancing performance, cost, and responsibility, the evolutionary strengths of both polymers continue to shape procurement strategies across global industries. Buyers who understand these material legacies and the current direction of market and regulatory trends will be best positioned for resilient, forward-looking sourcing decisions.

Related Video: Trump Confirms China Trip After ‘Very Good’ Call With Xi Jinping On Trade Deal | WION News | WION

Frequently Asked Questions (FAQs) for B2B Buyers of polypropylene vs nylon

-

How can I effectively vet international suppliers of polypropylene and nylon materials?

When assessing overseas suppliers, prioritize established manufacturers with a proven track record in your target markets. Verify third-party quality certifications (such as ISO, REACH, or SGS reports), request client references (ideally from your region), and perform factory audits—either virtually or via trusted local agents. Evaluate their responsiveness, clarity in documentation, and ability to answer technical queries. For added assurance, use reputable sourcing platforms or engage local procurement consultants with regional expertise in Africa, South America, the Middle East, or Europe. -

What levels of customization are available for polypropylene and nylon products?

Both polypropylene and nylon lend themselves to a high degree of customization in dimensions, color, weave density, finish (e.g., UV-resistance for nylon), and labeling or branding. Reputable suppliers can match industry- or region-specific standards, enabling you to maintain consistent product performance and branding. Always provide precise technical drawings or specifications, and consider requesting material samples for validation before placing full-scale orders, especially if your applications demand specific mechanical or environmental properties. -

What are the typical Minimum Order Quantities (MOQs), and how do they impact lead times and pricing?

MOQs for polypropylene and nylon products typically range from 500 to 2,000 meters/pieces, though some suppliers may offer flexibility for trial orders or custom runs. Smaller MOQs may incur higher per-unit costs due to setup and material procurement overheads. Lead times generally vary between 3-6 weeks, depending on customization, raw material availability, and shipping. Plan ahead for extended production or transit times, particularly if sourcing from Asia to Africa or South America, and always confirm production schedules in writing. -

How do payment terms and international transaction methods typically work?

Standard payment practices include T/T (bank transfer), L/C (letter of credit), and occasionally PayPal or Escrow for smaller or first-time orders. Many suppliers require a 30% deposit with the balance payable against shipping documents. Letters of credit offer greater buyer protection but may cost more to process. Ensure all payment terms are clearly defined in the Proforma Invoice and sales contract, and be cautious of unfamiliar payment requests. Use currency hedging strategies if sourcing in volatile markets or across multiple currencies to manage exchange risk. -

Which quality assurance (QA) practices and certifications should I expect from suppliers?

Expect suppliers to offer material data sheets, batch-specific test reports, and compliance documents relevant to your region (e.g., EU REACH, RoHS, or regional fire retardancy standards). Best-in-class manufacturers follow robust QA processes including incoming resin inspection, in-process quality checks, and final mechanical property tests (tensile strength, abrasion resistance). Request documentation confirming traceability from raw material to finished product and, if possible, schedule periodic third-party inspections or random sampling prior to shipment. -

What logistics considerations are critical for international shipments of polypropylene and nylon goods?

For most B2B shipments, products ship via sea freight (LCL or FCL) or air for urgent orders. Clarify Incoterms (e.g., FOB, CIF, DAP) to determine responsibility for customs clearance, insurance, and inland transport. Polypropylene and nylon have different volumetric weights and packaging needs; specify requirements for palletization, moisture protection, and labeling for customs. Account for potential port delays, especially in regions with evolving trade or import regulations (e.g., Latin America, North Africa), and verify all shipping documentation before goods depart. -

How can buyers handle disputes or product non-conformance with overseas suppliers?

Mitigate disputes by establishing clear product specifications, quality expectations, and acceptance criteria within your purchase contract. Insist on pre-shipment inspection reports and retain samples for quality benchmarks. If issues arise, document defects thoroughly with photos, reports, and third-party assessments. Attempt to resolve amicably via negotiation—reputable suppliers often offer replacement, rework, or partial refunds. For unresolved cases, escalation options include mediation via trade associations, international arbitration, or legal action, though these processes can be time-consuming and costly. -

What sustainability and regulatory issues should buyers consider when sourcing polypropylene vs. nylon?

Sustainability is increasingly important; request suppliers’ Life Cycle Assessment (LCA) data to compare environmental impacts such as energy use, carbon footprint, and recyclability. Confirm compliance with relevant regional regulations—like EU Extended Producer Responsibility, plastic taxes, or labeling mandates—since these are evolving rapidly in Europe and beyond. Some suppliers offer recycled or bio-based material options, which can support your corporate social responsibility and ESG initiatives. Ensure all environmental and regulatory declarations are backed by verifiable data and third-party certification where possible.

Strategic Sourcing Conclusion and Outlook for polypropylene vs nylon

Polypropylene and nylon each present distinct advantages and limitations, demanding careful alignment with your product’s requirements, end-user safety, and market expectations. For cost-sensitive, moisture-rich, and light-duty applications, polypropylene’s excellent chemical resistance and affordability often make it the pragmatic choice. Its utility in packaging, accessory straps, and non-critical components is well proven—particularly where weight reduction and water resistance matter most. However, when long-term durability, tensile strength, and safety-critical performance are required—such as in load-bearing outdoor equipment or automotive components—nylon stands unrivaled, delivering superior resilience, abrasion resistance, and consistent performance across challenging environments.

B2B buyers from regions such as Africa, South America, the Middle East, and Europe must factor in local climatic conditions, regulatory landscapes, and customer expectations when approaching strategic sourcing. Selecting the appropriate polymer goes beyond immediate costs—it safeguards your brand reputation, ensures regulatory compliance, and positions your business for sustainable growth. Integrating Life Cycle Assessment (LCA) into procurement processes is increasingly essential, enabling buyers to transparently weigh sustainability, regulatory, and operational impacts.

Strategic sourcing decisions today directly influence operational reliability, customer trust, and competitive positioning tomorrow. Remain agile by regularly reassessing supplier networks, monitoring regulatory changes, and investing in materials knowledge. As global markets push toward higher performance and tougher sustainability standards, proactive, data-driven sourcing will set industry leaders apart. Now is the time to act decisively and future-proof your supply chain by choosing the optimal material for your business objectives and regional markets.