Introduction: Navigating the Global Market for 3d printed metal parts

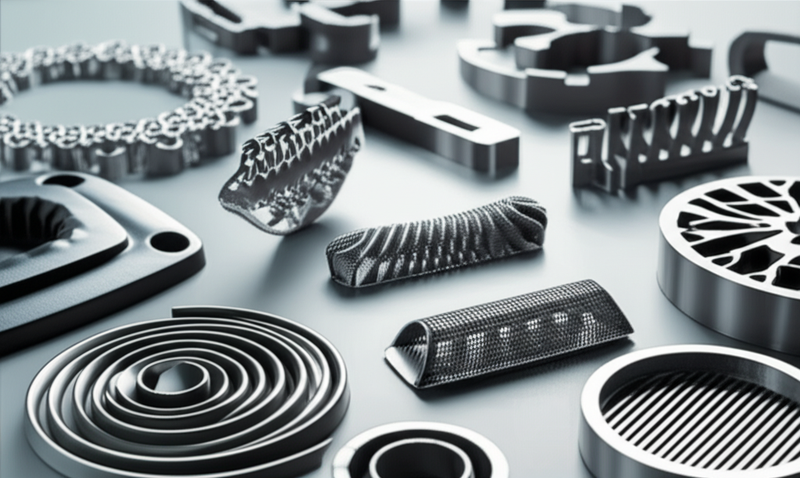

Metal additive manufacturing is transforming supply chains and enabling new opportunities for B2B buyers worldwide. As industries from automotive to aerospace, energy, and healthcare face increasing demands for innovation, flexibility, and speed, 3D printed metal parts have emerged as a critical enabler. By leveraging digital designs and advanced printing processes, companies can bypass the traditional constraints of tooling, achieve highly complex geometries, and dramatically reduce lead times. For buyers in rapidly developing economies such as Kenya or established industrial leaders like Germany, this technology offers a strategic edge—whether it’s shortening prototyping cycles, responding to urgent maintenance needs, or localizing production to minimize risk and logistics costs.

This comprehensive guide is designed with the international buyer in mind, especially those operating in diverse markets across Africa, South America, the Middle East, and Europe. It unpacks the full landscape of 3D printed metal parts, starting with an exploration of key manufacturing technologies—such as DMLS, binder jetting, and metal extrusion—and the range of materials available, from stainless steels to advanced alloys. Readers will gain clear insights into critical aspects of quality control, post-processing, and certification requirements, as well as practical benchmarks for cost and lead times in global sourcing scenarios.

Crucially, this guide addresses both opportunities and challenges unique to various regional markets, guiding buyers through considerations for selecting the right supplier and technology fit, ensuring traceability, and navigating logistics and compliance barriers. With actionable FAQs, market analysis, and best-in-class sourcing strategies, decision-makers will be well-equipped to make confident, informed procurement choices that power competitiveness in a fast-moving global marketplace.

Understanding 3d printed metal parts Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Direct Metal Laser Sintering (DMLS) / Selective Laser Melting (SLM) | Layer-by-layer fusion of metal powder using high-powered lasers; high resolution | Aerospace, medical devices, complex engineering | + Excellent mechanical properties, complex geometries – Higher cost, requires support structures |

| Binder Jetting | Metallic powder bound by liquid binder, then sintered in furnace; scalable | Automotive, low-volume industrial, prototyping | + Fast build rates, scalable for batches – Porosity, post-processing needed |

| Metal Material Extrusion (Bound Metal Deposition) | Metal powder in polymer filament extruded and then sintered | Tooling, jigs/fixtures, replacement parts | + Lower equipment cost, office-friendly – Lower density, more shrinkage |

| Direct Energy Deposition (DED) | Powder or wire melted by focused energy source and deposited directly | Repair of large parts, aerospace, oil & gas | + Repair/retrofit capability, large geometries – Less fine detail, rougher surface finish |

| Ultrasonic Additive Manufacturing | Ultrasonic welding of thin metal foils, then CNC finish | Electronics, multi-material structures, embedded sensors | + Unique material combinations, low temp – Slower, limited part size |

DMLS / SLM

This technology utilizes lasers to selectively melt and fuse fine layers of metal powder, enabling unparalleled design freedom and high mechanical performance. It is ideal for industries where part complexity and strength are critical—such as aerospace, healthcare, and advanced engineering. Buyers should consider that while DMLS/SLM parts deliver excellent accuracy and properties similar to or exceeding those of cast metals, the capital investment and operating costs are significant. Careful evaluation of vendor support, qualification standards, and part validation processes is advisable for firms new to this technology.

Binder Jetting

Binder jetting is known for its scalability and fast print speeds. By binding metal powders together and later sintering them, it enables efficient production of multiple parts simultaneously, making it suitable for prototyping, limited-run automotive components, and industrial jigs. However, parts may exhibit higher porosity and require substantial post-processing to achieve full density and desired finish. B2B buyers should assess post-processing capabilities, batch consistency, and design suitability (e.g., for non-critical load applications) before adopting binder jetting suppliers.

Metal Material Extrusion

Bound metal deposition uses filaments containing metal powder and polymer binders, offering a safer, more accessible entry point to metal 3D printing. This method is ideal for custom tools, fixtures, and medium-complexity spare parts, especially in environments like maintenance shops or small factories. Key purchasing considerations include understanding part shrinkage in sintering, achieving needed mechanical properties, and validating the materials supplied. The tradeoff is lower resolution and possible reduced density compared to powder bed fusion methods.

Direct Energy Deposition (DED)

DED is particularly well-suited for large-scale parts or the repair and restoration of existing metal components, such as turbine blades or oil & gas equipment. By melting and depositing metal directly onto substrates, it provides flexibility for both new builds and overlays. Buyers should consider DED when part size or repair is a priority, but must account for rougher surfaces, less intricate detail, and typically higher post-processing needs. Evaluation of equipment footprint and operator expertise is essential for successful integration.

Ultrasonic Additive Manufacturing

This specialized process forges ultra-thin metal foils together using ultrasonic waves, followed by optional CNC machining for tight tolerances. The technology stands out for multi-material capabilities—embedding sensors or electronics inside metal parts. For applications in electronics, lightweight structures, and advanced engineering, this approach enables innovative solutions not possible via other means. Procurement teams should weigh cycle times, size limitations, and supplier proprietary technology when considering ultrasonic additive for niche, high value-add projects.

Related Video: How 3D Printed Metal Parts Are Made | DMLS (Direct Metal Laser Sintering)

Key Industrial Applications of 3d printed metal parts

| Industry/Sector | Specific Application of 3d printed metal parts | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Aerospace & Defense | Lightweight, complex engine components & brackets | Weight reduction, fuel efficiency, rapid prototyping, part consolidation | Compliance with aerospace standards, material traceability, fatigue performance |

| Automotive & Transport | Rapid tooling, custom fixtures, functional prototypes | Shorter lead times, lower tooling costs, design flexibility | Dimensional accuracy, surface finish, ability to scale volume |

| Oil & Gas/Energy | Corrosion-resistant valves, impellers, downhole tools | Enhanced material performance, tailored geometries, reduced downtime | Material selection for corrosion/pressure, adherence to industry specs |

| Medical Devices | Patient-specific implants, surgical instruments | Personalized solutions, faster product development, improved patient outcomes | Biocompatibility, regulatory approval, precision |

| Industrial Machinery | Spare parts on demand, optimized heat exchangers | Reduced inventory, minimized downtime, improved thermal efficiency | Material durability, part certification, delivery timelines |

Aerospace & Defense

In aerospace and defense, 3D printed metal parts are revolutionizing the design and manufacture of lightweight and complex components such as turbine blades, brackets, and housings. Weight reduction translates directly into fuel savings and increased payload capacity, critical for both commercial and defense aviation sectors. For buyers in regions like Europe and the Middle East, meeting rigorous aerospace standards (e.g., EN, ASTM, or NADCAP certifications) and ensuring reliable supply chains for certified materials are essential. Close collaboration with suppliers experienced in aerospace applications is key to managing regulatory requirements and quality assurance.

Automotive & Transport

Automotive manufacturers are leveraging 3D printed metal parts for rapid tooling, custom manufacturing aids, and functional prototyping. This dramatically accelerates product development cycles and enables cost-effective, low-volume production of specialized components—highly beneficial in emerging markets across Africa and South America where supply chains can be unpredictable. Buyers must prioritize vendors capable of delivering high-accuracy parts with repeatable quality and surface finishes that minimize post-processing. Scalability is another factor; the ability to transition from one-off prototypes to small batch or serial production is increasingly vital for regional mobility solutions providers.

Oil & Gas/Energy

In the oil, gas, and broader energy sectors, metal 3D printing is used for manufacturing corrosion-resistant valves, high-performance impellers, and bespoke downhole drilling tools. These parts benefit from enhanced geometries—such as internal channels for fluid flow—and can be produced on demand, reducing the risks and costs of extended downtime. For buyers in the Middle East, South America, and Africa, sourcing materials with superior resistance to extreme pressures and corrosive environments is crucial. Selection criteria should include supplier capability for specialized alloys (e.g., Inconel, titanium), and adherence to local and international standards (such as API).

Medical Devices

Patient-specific implants, orthopedic devices, and dental prosthetics exemplify the medical sector’s use of 3D printed metal parts. These solutions enable custom-fit implants based on medical imaging, improving patient outcomes and reducing surgery time. European and international B2B buyers must ensure compliance with stringent biocompatibility and regulatory requirements (ISO 13485, CE marking), as well as precise tolerances for safety. Rapid iteration and the ability to create low-volume, custom parts make 3D printing especially advantageous for medical device OEMs and hospitals in markets with growing demands for personalized care.

Industrial Machinery

Industrial sectors are increasingly using metal additive manufacturing for spare parts, tooling, and components with optimized thermal or mechanical properties such as heat exchangers. This approach minimizes downtime due to spare part shortages and supports just-in-time manufacturing philosophies gaining traction in regions like Europe and North Africa. Buyers are advised to assess suppliers’ capabilities for producing robust, long-lasting components and certifying their conformity to relevant machinery standards. Fast delivery, especially in remote or underserved areas, is often a decisive sourcing factor for buyers aiming to maximize plant uptime and operational efficiency.

Related Video: 6 Advanced FDM 3D Printing Tips When Adding Metal Parts to Your Build

Strategic Material Selection Guide for 3d printed metal parts

Common 3D Printed Metals: Properties, Pros & Cons, and B2B Considerations

Selecting the most appropriate metal for 3D printing is a foundational step in ensuring optimal performance, cost-efficiency, compliance, and suitability for global markets. Below are analyses of four of the most widely utilized metals for 3D printed components, with attention to property profiles, business impacts, and region-specific considerations relevant to international B2B buyers.

Stainless Steel (e.g., 316L/17-4PH)

Key Properties

Stainless steels such as 316L and 17-4PH are prized for excellent corrosion resistance, good mechanical strength, and relatively high temperature tolerance. They remain stable across varying pressure and temperature conditions, making them broadly applicable in demanding industrial environments.

Pros & Cons

Pros: High corrosion resistance, widely accepted by international standards (ASTM A276, DIN 1.4404), and easy to process with common 3D printing methods like DMLS, SLM, and Binder Jetting. Cons: Stainless steel can have moderate-to-high material and processing costs versus basic carbon steels; some grades may require specific heat treatments post-printing to achieve desired mechanical properties.

Impact on Application

Ideal for chemical processing, oil & gas, medical devices, and food industry applications, particularly where hygiene and resistance to harsh media are critical.

International B2B Considerations

Stainless steel grades such as 316L are globally recognized, making it easier to comply with export/import, regulatory, and end-user customer requirements in regions like the EU, Middle East, East Africa, and South America. Always validate the specific grade against local certification preferences (ASTM vs. DIN, etc.), especially for pressure equipment or health applications.

Titanium Alloys (e.g., Ti6Al4V/Grade 5)

Key Properties

Titanium alloys stand out for their exceptional strength-to-weight ratio, corrosion resistance (even in marine and aggressive chemical environments), and biocompatibility. Ti6Al4V is the most commonly used for 3D printing.

Pros & Cons

Pros: Lightweight yet very strong, excellent fatigue and crack resistance, biocompatible for implants, and can operate at elevated temperatures. Cons: High material and processing costs—titanium is expensive to source and print, and typically needs tightly controlled environmental conditions (inert atmosphere) during 3D printing.

Impact on Application

Preferred for aerospace, automotive, energy, and high-end medical applications where weight savings, longevity under stress, and regulatory compliance are non-negotiable.

International B2B Considerations

Conforms well to global standards (ASTM F1472, EN 10204), easing certification for critical sectors. It can be subject to export restrictions and supply chain variability, particularly in regions like Africa or the Middle East; B2B buyers should ensure a stable supply chain and local certification capability.

Aluminum Alloys (e.g., AlSi10Mg)

Key Properties

Aluminum alloys such as AlSi10Mg combine low density, moderate strength, and good thermal conductivity. They are highly suitable for components where material weight and fast dissipation of heat are important, but where extreme load or corrosion resistance is less critical.

Pros & Cons

Pros: Lightweight, excellent for intricate geometries and rapid prototyping, relatively low-cost material, and decent mechanical properties post-heat treatment. Cons: Lower fatigue strength compared to titanium or high-grade steel, and limited corrosion resistance unless coated or anodized.

Impact on Application

Ideal for automotive parts, lightweight structural components, and consumer electronics. Not recommended for highly corrosive or high-pressure environments without additional surface protection.

International B2B Considerations

Aluminum alloys are globally ubiquitous and standards such as ASTM B209 and EN AW-6061 are widely referenced. Cost and availability are favorable in Europe and the Americas; in Africa and the Middle East, confirm availability of quality feedstock and proper post-processing (e.g., surface finishing) capabilities.

Inconel (e.g., Inconel 625, 718)

Key Properties

Inconel superalloys are renowned for their ability to retain mechanical properties at extremely high temperatures (up to ~700°C or more) and for outstanding resistance to oxidation and corrosion in aggressive industrial environments.

Pros & Cons

Pros: Excellent for high-temperature, pressure, and corrosive service—such as chemical plants and power generation. High lifecycle value in demanding applications. Cons: Among the most expensive alloys to buy and process; requires precision additive manufacturing and can be difficult to machine post-print.

Impact on Application

Used extensively in aerospace turbine parts, oil & gas, and energy. Inconel is often specified when failure would result in catastrophic outcomes or significant unplanned downtime.

International B2B Considerations

Standards such as ASTM B443 and DIN 2.4856 are frequently cited. High cost and limited supply can be challenges in price-sensitive or remote markets (e.g., parts of Africa or South America). Ensure robust supplier relationships for consistent quality and documentation.

Comparative Table of Common 3D Printed Metals

| Material | Typical Use Case for 3d printed metal parts | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Stainless Steel (316L, 17-4PH) | Chemical/food processing components, general engineering, medical instrumentation | Corrosion resistance, globally standardized, versatile | Moderate-to-high cost, may require post-processing | Medium |

| Titanium Alloys (Ti6Al4V) | Aerospace, high-end medical implants, performance automotive parts | Strength-to-weight ratio, excellent fatigue/corrosion resistance, biocompatible | High cost, complex processing, supply chain challenges | High |

| Aluminum Alloys (AlSi10Mg) | Lightweight automotive/aerospace parts, electronics housings | Lightweight, good thermal properties, cost-effective | Lower strength/corrosion resistance, needs finishing for harsh environments | Low |

| Inconel (625, 718) | Turbine components, oil & gas parts, chemical industry hardware | Outstanding high-temp/corrosion resistance, performance in extreme conditions | Expensive material/process, post-process machining difficulty | High |

In-depth Look: Manufacturing Processes and Quality Assurance for 3d printed metal parts

Metal 3D printing has revolutionized precision manufacturing for global industries, but to confidently source high-quality 3D printed metal parts, it is crucial for B2B buyers to understand both the manufacturing workflow and the quality assurance mechanisms underpinning these products. Below is a detailed breakdown of the main manufacturing stages, key additive techniques, and effective approaches to overseeing and verifying quality control—tailored especially to the needs of international buyers from diverse markets such as Africa, South America, the Middle East, and Europe.

Overview of the Metal 3D Printing Workflow

Successful production of metal 3D printed components hinges on a multi-step process that balances design flexibility with rigorous quality controls. The core stages typically include:

- Material Selection and Preparation

- Additive Manufacturing/Forming

- Post-Processing and Surface Finishing

- Inspection and Testing

Each stage involves specific techniques and checkpoints to ensure every part meets demanding B2B usage requirements.

1. Material Selection and Preparation

Material Quality is Paramount:

For 3D metal printing, the process starts with raw material—usually high-grade metal powders or specially formulated filaments. Key factors to evaluate are particle size distribution, material purity, and moisture content, as these can significantly affect print accuracy and final mechanical properties.

- Common Metals Used: Stainless steel, titanium alloys, aluminum, nickel-based superalloys, and tool steels.

- Supplier Checks: Always request certificates of analysis and verify whether the supplier sources materials from reputable, internationally recognized producers.

Actionable Insight for Buyers:

Ask for traceability documentation on powder batches, especially if purchasing for regulated sectors (aerospace, medical, oil & gas).

2. Additive Manufacturing/Forming

The forming stage is where the chosen design is transformed into a physical component, layer by layer, using advanced 3D printing techniques. The most prominent technologies include:

-

Direct Metal Laser Sintering (DMLS) / Selective Laser Melting (SLM):

A high-powered laser fuses metallic powder to form dense, complex parts. Popular for critical aerospace, medical, and automotive components. -

Binder Jetting:

A binding agent glues layers of metal powder, which then undergo thermal sintering to achieve full density. Suitable for larger batch sizes. -

Metal Material Extrusion (Bound Metal Deposition):

Similar to FDM but uses metal-filled filaments. After printing, the “green” part is debound and sintered, resulting in a solid metal item. This method is cost-effective for prototyping and small-batch manufacturing. -

Direct Energy Deposition (DED):

Focused energy sources (like lasers or electron beams) melt powder or wire as it’s deposited, ideal for repairing or adding features to existing components.

Key Process Controls:

– Layer thickness and deposition rate monitoring

– Environmental controls (temperature, humidity, oxygen level in build chamber)

– In-process sensors for detecting print anomalies

For International B2B Buyers:

Ensure that your supplier’s process choice aligns with your end-use application—for example, demanding medical or aerospace jobs typically call for SLM/DMLS due to their high density and mechanical integrity.

3. Post-Processing and Surface Finishing

Critical for Performance and Appearance:

Raw 3D printed parts often require several finishing steps to achieve optimal mechanical properties, dimensional accuracy, and surface quality.

- Common Post-Processing Steps:

- Support Removal: Dismantling support material added during printing

- Heat Treatment: Enhancing strength, relieving stresses, or improving ductility

- Machining/Grinding: Achieving tight tolerances or smooth finishes

- Surface Treatments: Sandblasting, polishing, coating, or passivation for specific performance or cosmetic criteria

Buyer Action:

Request detailed post-processing protocols from suppliers and, for critical applications, ask for surface roughness (Ra) and dimensional tolerances documentation.

4. Assembly (if applicable) and Integration

Some parts may be produced in segments or require integration with traditionally manufactured elements.

- Process Considerations:

- Seamless fit and assembly verification

- Joint integrity testing (especially for hybrid assemblies)

International buyers should confirm whether sub-assembly or full assembly services are available, and what checks are in place (e.g., functional tests or torque checks).

Quality Assurance: Methods, Standards, and Global Best Practices

Quality assurance underpins B2B confidence in any international supply arrangement. Comprehensive QC encompasses:

International and Industry-Specific Standards

- ISO 9001: The global benchmark for general quality management systems. Ensure your supplier is certified.

- ISO/ASTM 52900, 52901, 52921: Standards specific to additive manufacturing, covering terminology, general principles, and process requirements.

- Industry Certifications:

- CE Marking (EU, for relevant industries),

- API (American Petroleum Institute, oil & gas),

- AS9100 (Aerospace),

- ISO 13485 (Medical devices).

Actionable Buyer Tip:

Require up-to-date copies of supplier certificates and verify their authenticity with issuing bodies. Both African and South American buyers should prioritize ISO 9001 and relevant local certifications for government or large-scale industrial tenders.

QC Checkpoints Throughout Production

-

Incoming Quality Control (IQC):

Verifies incoming materials—critical for powder quality and traceability. -

In-Process Quality Control (IPQC):

Real-time monitoring of print parameters (temperature, laser power, deposition accuracy). Leading suppliers use machine logs, in-situ cameras, and thermal imaging. -

Final Quality Control (FQC):

Comprehensive inspection of finished parts, including: - Dimensional checks via CMM (Coordinate Measuring Machine)

- Visual inspection for surface defects

- Non-destructive testing (NDT): X-ray or CT scanning, ultrasonic, dye penetrant, or magnetic particle inspection for internal flaws

- Mechanical/property testing: Hardness, tensile/compression, fatigue tests

Regional Insight:

European buyers may expect stricter documentation, while buyers in Kenya or Saudi Arabia can close the gap by insisting on third-party certification and increased process transparency.

Verification and Auditing Strategies for B2B Buyers

-

Audit Supplier Facilities:

Onsite or virtual audits provide first-hand insight into process controls, environmental conditions, and employee training. -

Review Inspection Reports:

Request batch-specific inspection documents, including raw data and summary certificates. -

Third-Party Inspections:

Especially valuable for high-value or safety-critical parts. Qualified international agencies can dispatch inspectors, ensuring impartial QC verification before shipment. -

Sample Orders:

For new suppliers, consider ordering initial sample batches subjected to full testing before proceeding with large-scale procurement.

Navigating International QC Requirements

International trade in 3D printed metal components introduces further complexity:

-

Varying Standards:

Buyers from Germany (EU) must ensure CE marking and RoHS compliance; those from the Middle East or Africa may have specific government procurement requirements. -

Import/Export Documentation:

Ensure shipping paperwork includes all relevant QA documents and certificates to clear customs and facilitate after-sales support. -

Cross-Border Traceability:

Insist on digital record-keeping of batch numbers and testing history—beneficial in case of warranty or product liability issues. -

Language and Communication:

Agree on clear QC documentation standards, ideally in English and your local language. This reduces misunderstandings and speeds up resolution if defects arise.

Summary: Best Practices for B2B Buyers

- Always verify supplier certifications and process documentation.

- Define QC requirements clearly in purchase contracts and RFQs.

- Insist on transparency for every phase: material sourcing, production, finishing, and final inspection.

- Leverage third-party audits and inspections when in doubt, especially for critical applications.

- Stay updated on evolving international regulations relevant to your industry and geography.

By mastering these manufacturing and quality assurance fundamentals, B2B buyers globally can confidently source advanced 3D printed metal parts, securing the performance, reliability, and regulatory compliance essential for their specific markets.

Comprehensive Cost and Pricing Analysis for 3d printed metal parts Sourcing

Key Cost Components in Sourcing Metal 3D Printed Parts

International B2B buyers must consider a range of cost components when sourcing 3D printed metal parts. These generally include:

- Raw Materials: The choice of metal—such as stainless steel, titanium, aluminum, or tool steels—has a direct impact on unit price. Powder or filament costs vary significantly based on grade and alloy, often representing 30–60% of a part’s total cost.

- Labor: While automation lowers labor inputs compared to traditional manufacturing, skilled operators are needed for setup, post-processing, and quality assurance—especially for complex or regulated parts.

- Manufacturing Overhead: This covers machine depreciation, maintenance, energy, and facility costs. High-end printers (e.g., DMLS/SLM systems) have higher overheads but deliver superior resolution and performance.

- Tooling and Fixtures: Unlike CNC or casting, 3D printing requires minimal tooling, which reduces upfront investment—an advantage for prototyping or low-to-medium-volume runs.

- Quality Control and Certification: Non-destructive testing (NDT), dimensional inspection, and third-party certifications (ISO, AS9100, etc.) add to cost, especially for highly regulated sectors like aerospace or medical.

- Logistics and Shipping: Costs depend on supplier location, import duties, and the choice of Incoterms. Shipping metal parts internationally—especially to/from Africa, South America, or emerging regions—may involve complex customs handling and higher insurance.

- Supplier Margin: This reflects not only profit but also risk, validation, and after-sales support. Margins tend to be higher for low-volume/custom projects and for suppliers providing end-to-end engineering value.

Main Pricing Influencers

Several factors directly shape the final price B2B buyers pay:

- Order Volume and Minimum Order Quantity (MOQ): Larger production runs reduce per-part costs due to machine utilization and spread of overhead. Some suppliers may enforce MOQs for less-common materials or complex designs.

- Technical Specifications and Customization: Demands for tight tolerances, intricate features, or specific surface finishes (e.g., polishing, coating) increase complexity and cost.

- Material Type and Availability: Exotic or certified materials (e.g., medical-grade titanium, Inconel) are priced at a premium. Buyers from regions with less access to refined materials may face import surcharges.

- Quality Standards and Certification Requirements: Compliance with sector-specific standards raises both QC and documentation costs, particularly for buyers in Europe or industries with strict traceability.

- Supplier Factors: Location, technical expertise, installed capacity, and digital workflow integration influence pricing. European and North American suppliers tend to command higher prices but may offer advanced quality assurance and engineering support.

- Incoterms Selection: Whether prices are quoted FOB, CIF, DAP, or EXW impacts the buyer’s total landed cost. This is especially relevant for buyers in Africa and South America, where infrastructure and customs processes may affect transit times and insurance needs.

Practical Tips for Cost-Efficient Global Sourcing

- Request Transparent Cost Breakdowns: Ask suppliers for itemized quotes, detailing material costs, process steps, QC, shipping, and certification. This enables better benchmarking and negotiation.

- Optimize Design for Additive Manufacturing (DfAM): Redesign legacy parts to minimize material usage, avoid unnecessary supports, and streamline post-processing—reducing both unit cost and lead time.

- Leverage Local and Regional Suppliers: For buyers in Africa or South America, localizing part of your supply chain (e.g., post-processing, final QC) can cut shipping costs, taxes, and lead times.

- Negotiate MOQ, Lead Time, and Payment Terms: Flexibility here can improve cash flow, mitigate risk, and secure better per-part pricing, especially when establishing long-term relationships.

- Consider Total Cost of Ownership (TCO): Evaluate not just unit price but also costs for rework, logistics, customs, warranty, and potential production downtime. Sometimes higher up-front prices from reputable suppliers result in lower lifetime costs.

- Understand Regional Pricing Nuances: European suppliers may price in EUR and expect compliance with REACH/CE standards; Middle Eastern buyers should account for possible VAT/import taxes; African and Latin American buyers must scrutinize logistics pipelines for hidden costs.

- Document Requirements Clearly: Providing clear CAD files, material certifications, and expected standards reduces the risk of costly errors and delays.

Disclaimer: All cost and pricing insights above are indicative. Actual prices will vary based on supplier quotations, market conditions, and specific project requirements. Always request and compare detailed proposals from multiple qualified suppliers.

By breaking down these factors and applying strategic sourcing practices, international B2B buyers can more effectively secure both competitive pricing and reliable quality in metal 3D printed parts procurement.

Spotlight on Potential 3d printed metal parts Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘3d printed metal parts’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

The Top Metal 3D Printer Manufacturers in 2025 (www.3dnatives.com)

Based on the latest industry analysis, this group encompasses leading manufacturers at the forefront of metal 3D printing innovation. Their core focus includes advanced technologies such as Direct Metal Printing (DMP), Powder Bed Fusion, Directed Energy Deposition, and emerging methods like Cold Spray and Inkjet-based processes. These producers are recognized for delivering high-precision, industrial-grade 3D printed metal parts suitable for end-use applications across demanding sectors. Many report adherence to international quality standards and invest in R&D, driving adoption globally—including in Europe, Africa, the Middle East, and South America. Their broad portfolio allows buyers to source specialized solutions tailored to diverse industrial requirements, from prototyping to serial production. Public details on specific certifications or company structures are limited; however, market prominence and a track record of deploying scalable, cutting-edge metal AM solutions reinforce their value to international B2B buyers.

In3Dtec (www.in3dtec.com)

In3Dtec is a recognized provider of industrial-grade 3D printed metal parts, catering to global B2B markets with a strong emphasis on advanced additive manufacturing. The company’s offerings center on precision metal component production for sectors including aerospace, automotive, medical, and industrial tooling. In3Dtec’s capabilities span multiple cutting-edge 3D printing technologies, such as Direct Metal Laser Sintering (DMLS), enabling the realization of complex geometries and high-performance custom parts. The company is committed to stringent quality assurance, adhering to international standards relevant to demanding industries, though specific certifications are not explicitly listed. With a track record of supplying clients across Europe, the Middle East, Africa, and South America, In3Dtec demonstrates agility in handling export logistics and diverse technical requirements. The firm distinguishes itself with flexible production volumes, rapid prototyping, and solutions tailored to unique industry needs.

10 Metal 3D Printing Companies in 2024 by Revenue (all3dp.com)

Representing the industry’s top performers, the “Top 10 Metal 3D Printing Companies by Revenue in 2024” includes global leaders such as EOS, BLT, Nikon SLM Solutions, 3D Systems, Colibrium Additive, DMG Mori, Farsoon Technologies, Desktop Metal, EPlus3d, and H3D. These manufacturers drive innovation with a diverse range of advanced additive manufacturing solutions, focusing on precision metal parts for demanding industrial applications. The group is recognized for expertise across multiple technologies—including DMLS, SLM, binder jetting, and extrusion—enabling tailored production at various scales. Many of these firms maintain rigorous quality standards and have extensive international footprints, serving aerospace, automotive, healthcare, and energy sectors worldwide. Their robust supply chains and support for global customers make them strategic partners for B2B buyers seeking high-quality 3D printed metal components.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| The Top Metal 3D Printer Manufacturers in 2025 | Leading-edge industrial metal 3D printing platforms. | www.3dnatives.com |

| In3Dtec | Precision metal 3D parts, global B2B focus. | www.in3dtec.com |

| 10 Metal 3D Printing Companies in 2024 by Revenue | Global leaders, advanced metal AM solutions. | all3dp.com |

Essential Technical Properties and Trade Terminology for 3d printed metal parts

Critical Technical Properties of 3D Printed Metal Parts

When sourcing 3D printed metal parts internationally, decision-makers must prioritize certain technical specifications to ensure product quality, functional performance, and long-term reliability. The following properties consistently impact project success, procurement cost, and downstream compatibility with assembly or end-use requirements:

-

Material Grade:

This indicates the specific metal or alloy composition used in the printing process (e.g., 316L stainless steel, Inconel 625, Ti6Al4V titanium). Material grade directly affects strength, corrosion resistance, thermal stability, and regulatory acceptance in sectors such as aerospace, automotive, energy, and medical devices. For B2B buyers, specifying an internationally recognized material grade ensures alignment with global quality standards and facilitates cross-border compliance. -

Dimensional Tolerance:

Tolerance defines the allowable variation in a part’s dimensions compared to the design specifications (commonly ±0.05 mm or as specified). Achieving consistent tight tolerances is a strength of advanced metal additive manufacturing. For manufacturers and OEMs in regions like Europe or the Middle East, precise tolerances are critical for fit, assembly, and interchangeability with existing components. -

Surface Finish (Roughness):

Surface finish, typically measured in micrometers (µm Ra), refers to the texture quality of the part’s exterior after printing or any post-processing. A smoother finish is crucial for parts involved in fluid flow (such as pumps or pipes), or for components where appearance and touch are important. Certain applications—such as medical implants or aerospace components—demand additional finishing to meet regulatory and functional expectations. -

Mechanical Properties:

Key mechanical properties to request include yield strength (the stress at which a material begins to deform), ultimate tensile strength (maximum stress before failure), and elongation at break (ductility). These dictate how the printed part will perform under real operational loads—especially relevant for buyers in construction, transportation, or heavy machinery industries. -

Porosity & Density:

Unlike cast or machined parts, 3D printed metal components can exhibit internal pores if process parameters or post-processing are suboptimal. Low porosity and high density are generally desired for improved mechanical integrity, fluid tightness, and corrosion resistance. Buyers should request data on part density, especially for mission-critical parts or when replacing conventional metal components. -

Heat Treatment Status:

Many metal printed parts require post-print heat treatment (such as annealing) to optimize mechanical properties and relieve internal stresses from the printing process. It is essential for B2B purchasers to confirm whether quoted prices and lead times include these steps, and whether the delivered parts comply with the necessary performance certifications.

Key Industry and Trade Terminology

International procurement of 3D printed metal components introduces sector-specific jargon in addition to standard trade and logistics terms. Understanding these will streamline communication and prevent costly misunderstandings:

-

OEM (Original Equipment Manufacturer):

Refers to companies that produce finished products or assemblies, usually under their own brand, often requiring high-quality, specification-driven component supply. For B2B buyers, clarifying whether your business is an OEM or a supplier influences negotiations on quality documentation, intellectual property, and after-sales support. -

MOQ (Minimum Order Quantity):

The lowest number of units a manufacturer will accept in a single order. Since 3D printing enables low-volume production, MOQs are often lower than traditional manufacturing but can still vary by supplier. Always confirm order minimums, especially for pilot projects or spare parts. -

RFQ (Request for Quotation):

An official inquiry process where buyers request detailed pricing, lead times, and technical responses from suppliers. Including all key part specifications, quantities, and delivery terms in the RFQ improves quote accuracy and comparative analysis. -

Incoterms (International Commercial Terms):

Standardized trade terms (such as FOB, DDP, or EXW) that define the responsibilities and risks of buyers and sellers during international transport. Selecting the correct Incoterm is vital to determine costs, duties, and insurance obligations—especially when importing parts into Africa or South America with variable customs environments. -

CNC Machining (Computer Numerical Control):

Often mentioned in conjunction with 3D printing, CNC machining refers to subtractive post-processing (e.g., milling or turning) used to achieve finer tolerances or finishes on printed parts. Clarify if the supplier provides integrated CNC services or if secondary finishing needs to be arranged locally. -

ITAR/EU Export Compliance:

Regulations such as ITAR (International Traffic in Arms Regulations, USA) or relevant EU dual-use rules may restrict export of certain high-performance metal parts. For international buyers, especially in regions outside the EU and US, verifying export compliance early in negotiations can prevent legal and logistical complications.

By mastering these technical properties and industry terms, B2B decision-makers across global markets can negotiate confidently, ensure supplier alignment, and secure 3D printed metal parts that are fit-for-purpose, compliant, and competitively priced.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the 3d printed metal parts Sector

Global Market Overview and Key Sourcing Trends

The 3D printed metal parts sector is undergoing rapid transformation, fueled by advancements in additive manufacturing technologies and an expanding global demand for high-performance, customized, and lightweight components. Growing adoption across industries such as aerospace, automotive, energy, medical, and tooling is broadening the commercial landscape—especially as manufacturers seek out supply chain agility and cost-effective alternatives to traditional metalworking. For international B2B buyers in regions such as Africa, South America, the Middle East, and Europe, this means both opportunity and increased competition.

Key market drivers include the need for accelerated prototyping, on-demand production, and the creation of complex geometries that are difficult or impossible to achieve through subtractive methods (e.g., CNC machining or metal casting). Technologies like Direct Metal Laser Sintering (DMLS), Selective Laser Melting (SLM), binder jetting, and metal material extrusion are increasingly prevalent due to their scalability and material versatility. European countries such as Germany are leveraging these innovations for high-precision, regulated sectors, while emerging markets like Kenya are exploring 3D printed metal parts to leapfrog infrastructural constraints and localize supply.

Sourcing trends reflect a shift toward digital supply networks—buyers are prioritizing partners with advanced design and simulation expertise, traceable digital workflows, and agile manufacturing capabilities. Collaborative relationships with contract manufacturers and service bureaus are becoming standard, reducing capital outlay and enabling buyers to focus on innovation. Global platforms and cross-border partnerships are challenging the historic concentration of capacity in Europe and North America, opening access for buyers in Africa and South America to world-class production, diverse material portfolios, and just-in-time delivery.

For B2B buyers, staying competitive requires evaluating suppliers not only for cost and lead time, but also for technical capabilities such as multi-material printing, post-processing, and batch scalability. Stability of powder supply, compliance with regional standards (e.g., ISO, ASTM), and access to proprietary alloys are key differentiators. As governments increasingly push for digital transformation and industrial resilience, early engagement with vetted suppliers and clear alignment with application needs will ensure strategic sourcing in this rapidly evolving sector.

Sustainability and Ethical Sourcing Considerations

Sustainability has moved to the forefront of B2B procurement decisions for 3D printed metal parts. Additive manufacturing intrinsically enables reduced material waste compared to conventional subtractive methods, as parts are built layer by layer with precision, minimizing scrap and resource usage. This material efficiency is especially relevant for industries with high-cost or difficult-to-source metals.

However, the environmental profile of 3D printed metal parts is influenced by several factors: energy-intensive lasers or furnaces, safe handling and recycling of metal powders, and supply chain transparency. Responsible buyers are increasingly demanding suppliers adhere to globally recognized environmental management systems (such as ISO 14001), utilize recycled or sustainably sourced metal feedstock, and provide detailed lifecycle assessments of printed parts.

Ethical sourcing extends to labor practices in powder production, conflict minerals compliance, and the traceability of raw materials. European buyers, for example, often require suppliers to meet strict regulations around the provenance of metals and corporate social responsibility standards. Middle Eastern and African buyers are factoring in local impacts—such as water and energy consumption—when assessing partners for critical infrastructure or energy projects.

A growing number of suppliers are pursuing certifications and third-party validation to signal compliance with both green and ethical sourcing standards. Look for partners invested in closed-loop recycling processes for powders, use of renewables to power printing operations, and transparent reporting on workforce and material sourcing practices. Cooperative industry initiatives and digital platforms are making it easier for buyers from South America to the EU to verify supplier credentials and environmental performance, de-risking procurement decisions in a dynamic sector.

Brief Evolution and Relevance for B2B Buyers

The foundations of metal 3D printing trace back to the late 1980s, when breakthrough laser-sintering technologies enabled the direct fabrication of metal objects from digital files. Initially adopted for specialized prototyping in aerospace and defense, the sector has since matured in both hardware capability and material diversity. The last decade has seen the emergence of binder jetting, metal extrusion, and new post-processing innovations, driving down costs and making custom metal part production accessible to a wider range of industries and regions.

For today’s B2B buyers, this evolution means that sourcing 3D printed metal parts is no longer limited to niche applications or major markets. Mature ecosystems, comprehensive service providers, and a globalized network of suppliers mean that organizations in Kenya, Brazil, Saudi Arabia, or Germany can now leverage advanced metal printing for everything from spare parts to highly engineered components. The trajectory of technological advancement—toward greater precision, scalability, and sustainability—will continue to shape competitive differentiation and procurement strategy for forward-thinking international buyers.

Related Video: Made in the world: Better understanding global trade flows

Frequently Asked Questions (FAQs) for B2B Buyers of 3d printed metal parts

- How should we vet and select a reliable supplier for 3D printed metal parts across international markets?

Begin by checking the supplier’s certifications (e.g., ISO 9001 for quality systems, specific additive manufacturing certifications), production history, and client references from similar industries. Assess their technical capabilities—such as access to various metal 3D printing technologies (DMLS, binder jetting, metal extrusion)—and material options. Request sample parts or case studies. Reliable suppliers typically offer transparency around processes, materials sourcing, and quality assurance protocols. For international buyers, consider supplier reputation in export logistics and responsiveness to inquiries. Conduct video calls, arrange virtual factory tours, and leverage third-party audits when possible, especially for suppliers in new or emerging markets.

- Can metal 3D printed parts be customized for our application or regional requirements?

3D printing excels at customization. Buyers can collaborate directly with suppliers on engineering drawings and digital models to achieve complex geometries, unique features, or adaptations for local/regional standards—whether automotive, industrial, or healthcare. Specify requirements related to material properties, surface finish, certifications, or post-processing needs. Early and clear communication ensures alignment on technical details and regulatory considerations (such as CE marking in Europe or local certifications in Africa and South America). Most reputable providers have engineering support to guide modifications, rapid prototyping, and adaptive manufacturing to match your exact business needs.

- What are typical minimum order quantities (MOQ), lead times, and accepted payment terms when ordering internationally?

MOQs for 3D printed metal parts are often low, with some suppliers supporting single-piece prototypes or small batch runs—a significant benefit over traditional manufacturing. Lead times generally range from 7–21 days depending on part complexity, volumes, and post-processing requirements, although this can be longer based on capacity, supply chain, and shipping logistics. International buyers should expect variable payment terms—commonly 30% upfront, 70% after delivery, or net 30-60 days for repeat clients. Ensure clarity about incoterms, local taxes, and whether suppliers accept payment in international currencies or via escrow for risk mitigation.

- How is product quality and compliance with international standards ensured?

Professional suppliers use rigorous inspection protocols, including dimensional checks (using CMM), non-destructive testing (NDT), and surface finish measurement. Ask for quality documentation, such as material certificates, inspection reports, and international compliance certifications (e.g., ISO, ASTM, EN standards). For regulated sectors like aerospace or medical, verify whether they hold specific industry approvals. Consider requesting third-party testing or appointing a local inspection agency before shipment. Any reputable exporter should be willing to share full traceability and consistent quality documentation, especially for compliance-critical applications in Europe, the Middle East, or Africa.

- What logistics and shipping options are available for delivering 3D printed metal parts internationally?

International shipments typically use air or sea freight, with smaller or high-value parts sent by air for speed. Reputable suppliers partner with global logistics companies and can provide door-to-door DDP (Delivered Duty Paid), CIF, or FOB options. Packaging for 3D printed metal parts should protect against moisture, corrosion, and impact. Consider local regulations regarding import duties, VAT/GST, and restrictions on specific alloys. Establish who is responsible for customs clearance and insurance. Fast and transparent communication about shipment tracking, documentation, and estimated delivery dates is key to minimizing delays.

- How do we resolve disputes or issues such as damaged parts, delays, or non-conformity?

Dispute resolution starts with a clear, mutually agreed contract outlining specifications, inspection criteria, returns policy, and recourse actions. Most global suppliers offer a window for claims (typically 7–14 days upon receipt), requiring photographic evidence and supporting documentation. Ensure there is an escalation pathway, including management contacts or mediation options. For larger or recurring orders, consider using internationally recognized arbitration clauses or partnering with trade organizations. Payment via secure channels (e.g., escrow) can also provide buyers added protection in case of significant non-conformance or shipment issues.

- Which documents and certifications should accompany a shipment of 3D printed metal parts?

Critical documents include a commercial invoice, packing list, bill of lading or airway bill, certificate of origin, and applicable export/import permits. For technical assurance, request quality certificates (such as material traceability, heat treatment records, inspection reports), and any industry-required certifications (CE, RoHS, ISO, ASTM, or local standards). Ensure all HS codes and product descriptions are accurate to avoid customs disputes. In some regions, engaging a customs broker familiar with additive-manufactured goods can expedite clearance and prevent costly delays.

- Are there region-specific risks or considerations for buyers in Africa, South America, the Middle East, or Europe?

Each region presents unique challenges. African and South American buyers should plan for longer lead times due to logistics and customs infrastructure, and may need to address currency fluctuations. Middle Eastern buyers may encounter stringent material restrictions and local certification needs. European buyers often face strict product conformity (CE, REACH) and data privacy requirements. Build strong communication channels with suppliers to address risks, clarify responsibilities for taxes and duties, and ensure local regulatory standards are met. Whenever possible, work with partners experienced in your region’s trade environment and seek references from similar international projects.

Strategic Sourcing Conclusion and Outlook for 3d printed metal parts

Key Takeaways for International B2B Buyers

Metal 3D printing has emerged as a transformative solution for procuring tailored, high-performance parts—offering unparalleled design freedom, reduced lead times, and competitive total cost of ownership compared to traditional manufacturing methods. Strategic sourcing goes beyond simply comparing prices; it empowers buyers to leverage a global supplier ecosystem, balance local and international capabilities, and mitigate risks related to logistics, material availability, and compliance. For organizations across Africa, South America, the Middle East, and Europe, this means unlocking rapid prototyping, agile production, and market differentiation even in regions where traditional manufacturing infrastructure may be limited.

The Value of Strategic Partnerships

Building robust relationships with vetted 3D printing partners is vital to quality, scalability, and innovation. Prioritizing suppliers with proven expertise in relevant technologies (DMLS/SLM, binder jetting, extrusion), adherence to international standards, and established support networks can sharply reduce operational risks and facilitate technology transfer. Engaging in transparent, long-term partnerships enables buyers to benefit from ongoing advances in additive manufacturing, diversify sourcing options, and adapt quickly to shifting market demands.

Looking Ahead: Your Next Steps

The strategic sourcing of 3D printed metal parts is set to play an integral role in driving industrial competitiveness and supply chain resilience worldwide. As the technology matures and regional capabilities expand, B2B buyers are positioned to shape the future of manufacturing in their sectors. Now is the time to assess your sourcing strategies, engage with trusted additive manufacturing experts, and pilot projects that harness the full potential of metal 3D printing. By staying proactive, your organization can gain a sustainable edge—turning advanced manufacturing into a key growth driver in the evolving global landscape.