Introduction: Navigating the Global Market for molding orange

Succeeding in international manufacturing markets requires strategic decision-making—nowhere is this more evident than in the dynamic sector of molding orange. This vital process underpins the global production of countless industrial and consumer goods, ranging from automotive components to packaging and high-precision electronics. As demand for customized, high-quality molded products accelerates worldwide, buyers across Africa, South America, the Middle East, and Europe face a complex landscape shaped by rapid technological advancements, shifting supply networks, and evolving quality standards.

For business leaders and procurement professionals, understanding the nuances of molding orange is not just a technical requirement—it’s a competitive advantage. The choice of molding type, material selection, supplier capability, and cost predictability directly impact operational efficiency, product durability, and market lead times. Navigating these factors is especially critical for buyers in emerging and diverse markets such as Brazil, Vietnam, Nigeria, and the UAE, where balancing speed-to-market with cost and compliance is paramount.

This guide delivers a comprehensive roadmap for international B2B buyers, providing actionable insights into:

- Types of molding orange: From injection and compression molding to blow and thermoforming processes.

- Material selection: The pros, cons, and applications of steel, aluminum, plastics, and other mold materials.

- Manufacturing and quality control practices: Key considerations for process optimization, consistency, and standards compliance.

- Supplier sourcing: Criteria for evaluating global and regional partners, risk management, and negotiation strategies.

- Cost benchmarking and market trends: Practical tips for budgeting, cost reduction, and analyzing total cost of ownership.

- Frequently Asked Questions: Addressing the most common sourcing and technical queries.

By equipping you with in-depth market intelligence and pragmatic sourcing tools, this guide empowers informed procurement decisions—turning complexity into opportunity and supporting your growth in the competitive world of global molding orange production.

Understanding molding orange Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Injection Molding Orange | High volume, precision shaping, complex geometries | Electronics, automotive, consumer goods | Precise, scalable, but high initial mold costs and longer setup time |

| Compression Molding Orange | Simple shape molding, suited for robust/thicker parts | Industrial seals, gaskets, large enclosures | Lower tooling cost, handles tough materials; slower cycles, less detailed design |

| Blow Molding Orange | Produces hollow, lightweight orange forms | Bottles, packaging, tank linings | Efficient for high volumes, reduced waste; limited to hollow items, less precise |

| Casting Molding Orange | Intricate detailing, applied for complex or metal parts | Machinery components, specialty hardware | Versatile, high-detail output; slower process, possible higher defect rates |

| Thermoforming Orange | Fast forming of thin sheets, low- to mid-volume runs | Trays, clamshells, packaging inserts | Quick prototyping, low-cost for small runs; less durable, design constraints |

Injection Molding Orange

Characteristics: Injection molding orange uses high-pressure systems to force molten material into detailed molds, resulting in highly precise and uniform parts. It supports a wide range of thermoplastics, rubbers, and silicones, making it versatile for numerous industries.

Suitability: Best for large-scale production where consistency, surface finish, and intricate shapes are critical. Frequently chosen by buyers in electronics, automotive, and consumer product sectors.

Key B2B Considerations: Consider the balance between initial tooling investment and per-unit cost. Reliable suppliers should offer robust mold maintenance and clear post-production support. Ensure compatibility with required material specifications and overall project timeline.

Compression Molding Orange

Characteristics: Compression molding encompasses creating parts by compressing material into a heated, cavity-based mold, often yielding thicker and more durable components. Well-suited for rubber and silicone materials.

Suitability: Ideal for industrial buyers needing durable orange components for equipment, such as seals, gaskets, or rigid enclosures.

Key B2B Considerations: Lower upfront mold costs can reduce risks for mid-volume projects. However, longer cycle times can impact lead times. Evaluate supplier capability for consistent part thickness, and confirm quality control procedures for robust part specifications.

Blow Molding Orange

Characteristics: Blow molding focuses on creating hollow forms by inflating heated tube-shaped materials inside a mold. The outcome is lightweight yet sturdy products, mainly in plastics.

Suitability: Widely used by buyers in packaging, beverage, and storage sectors, particularly where high volumes of lightweight, hollow containers are essential.

Key B2B Considerations: Look for suppliers with automated lines for high throughput. Assess secondary finishing capabilities for features like threading or labeling. Recognize the limits of design complexity and prioritize vendors with proven consistency in wall thickness and material usage.

Casting Molding Orange

Characteristics: Casting involves pouring molten material into molds to achieve complex, detailed shapes. Common materials include metals, resins, and certain high-temperature plastics.

Suitability: Suited for custom, high-strength, or high-detail components—typical in specialized machinery or equipment manufacturing.

Key B2B Considerations: Casting makes economic sense for low to mid volumes or where intricate geometry is required. Evaluate the supplier’s expertise with different materials and their defect management capabilities, as casting may be susceptible to porosity or inclusions.

Thermoforming Orange

Characteristics: Thermoforming heats plastic sheets and forms them over a mold, quickly producing thin-walled items. It’s favored for packaging solutions and trays.

Suitability: Perfect for businesses needing fast prototypes or flexible packaging options in low to moderate quantities.

Key B2B Considerations: Thermoforming offers rapid turnaround, making it attractive for seasonal or short-run products. However, buyers should review the trade-offs in part strength and aesthetic quality. Ensuring mold reusability and customization options can enhance procurement flexibility.

Related Video: Lecture 1 Two compartment models

Key Industrial Applications of molding orange

| Industry/Sector | Specific Application of molding orange | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Food & Beverage | Custom packaging and container manufacturing | Enhanced branding, secure fresh produce delivery | Material compliance (FDA/EFSA), customization capability, supply chain reliability |

| Healthcare & Medical | Medical device component production | High precision, biocompatibility, regulatory compliance | Sterility standards, quality certification, lead time management |

| Automotive | Production of high-visibility parts and seals | Durability, color stability, improved safety | UV resistance, consistency of coloration, OEM approval |

| Consumer Goods | Branded promotional items and appliance components | Product differentiation, rapid turnaround | Capability for low/high volume, design flexibility, cost management |

| Industrial Equipment | Safety grips and indicator panels | Enhanced operator safety, ergonomic value | Chemical resistance, durability, color fastness |

Food & Beverage Industry

Molding orange is extensively deployed for custom packaging solutions, especially in the production of fruit crates, juice bottles, and tamper-evident closures. Its striking color helps support brand visibility and differentiate products in competitive markets. For buyers from regions such as Brazil and South Africa, compliance with food safety regulations (like FDA and EFSA), supply reliability, and the ability to deliver bespoke designs to match local market preferences are essential. Quick adaptation to seasonal demand swings is also critical for fresh produce exporters.

Healthcare & Medical Devices

In the medical sector, molding orange is chosen for parts requiring high visibility and compliance, such as handles for diagnostic kits, medication containers, and emergency device components. Its visibility ensures quick identification during urgent situations, while biocompatibility and precision manufacturing meet stringent regulatory standards. B2B buyers in Europe and the Middle East should prioritize suppliers with proven track records in healthcare, holding ISO 13485 or equivalent certification, and robust quality assurance protocols, as regulatory compliance is a major barrier to market entry.

Automotive Manufacturing

Among automotive manufacturers, molding orange is used for safety parts including seals, grommets, and warning components. The color’s high visibility enhances safety in both finished vehicles and during the assembly process. Resistance to UV exposure and chemical degradation are critical, particularly in Latin American and Middle Eastern markets where vehicles face extreme conditions. OEMs and tier suppliers must ensure the molded parts adhere to regional safety standards, and demand certification proofs and stable batch-to-batch coloration.

Consumer Goods

Consumer product brands leverage molding orange for items like kitchenware, appliances, and promotional novelties. Rapid turnaround and branding flexibility enable buyers to adjust to marketing campaigns or trend shifts. For buyers across Africa and Vietnam, sourcing partners should offer a spectrum of design services, mold prototyping, and scalable production runs. Color matching accuracy and the ability to accommodate complex forms will help optimize both aesthetics and function.

Industrial Equipment

In the industrial sector, molding orange is applied to manufacture grips for machinery, emergency stop buttons, and indicator panels. These applications prioritize operator safety through immediate visual recognition. Chemical resistance and abrasion durability must be considered, especially for buyers in heavy industry or resource extraction sectors in Africa and South America. Partners with material science expertise and the ability to certify product longevity under challenging conditions will deliver ongoing operational value.

Related Video: How Injection Molding Works

Strategic Material Selection Guide for molding orange

Comparative Analysis of Leading Materials for Molding Orange

Selecting the appropriate material for molding orange components is crucial for achieving optimal manufacturing performance, long-term reliability, and regulatory compliance. The most prevalent materials used in mold fabrication—steel (typically tool steels), aluminum, and engineering plastics—each bring unique benefits and limitations. Below, we present a practical assessment of these materials for B2B buyers evaluating international suppliers or partners, emphasizing considerations that impact buyers in Africa, South America, the Middle East, and Europe.

Steel (Tool Steels: P20, H13, etc.)

Key Properties:

Steel, especially tool steels such as P20 (pre-hardened) and H13 (hot-work), offers excellent mechanical durability, high wear resistance, and the ability to maintain dimensional accuracy under high temperature and pressure. Hardened steels handle extended production runs and maintain tight tolerances.

Pros:

– Very high durability and lifespan, essential for high-volume production.

– Superior dimensional stability and surface finish quality.

– Excellent resistance to abrasion in continuous, intensive molding cycles.

Cons:

– Upfront cost is significantly higher.

– Machining and fabrication require advanced tooling and expertise.

– Longer lead time for mold manufacturing due to hardening and finishing processes.

Application Impact:

Steel molds are ideal for producing orange-molded parts requiring stringent quality, repeatability, and where projected production exceeds tens of thousands of cycles.

International B2B Considerations:

Steel molds meet or surpass ASTM, DIN, and JIS standards, easing international trade and compliance. Buyers should verify traceability/certification of steel grades and ensure supplier familiarity with regional quality expectations. In countries like Brazil, Vietnam, and across the EU, steel molds are preferred for automotive, industrial, and export-focused production due to consistency with global norms.

Aluminum

Key Properties:

Aluminum alloys used in molding (e.g., 7075, 2024) are valued for their reduced weight, good thermal conductivity, and relatively low machining costs. They are softer and less wear-resistant than steel.

Pros:

– Shorter lead times—faster mold design and iterations.

– Lower initial tooling and material costs.

– Excellent for prototyping, pilot projects, or low- to medium-volume series.

Cons:

– Shorter service life, typically limited to a few thousand molding cycles.

– Prone to wear and damage in high-pressure, high-temperature, or abrasive molding environments.

– Less dimensional stability over prolonged production runs.

Application Impact:

Best for development phases, market testing, or limited-production orange-molded parts where speed and cost outweigh extreme durability.

International B2B Considerations:

Aluminum molds generally comply with industry standards but may not always be accepted for regulated or export-bound goods requiring strict longevity documentation. Buyers in the Middle East and emerging African or South American manufacturing hubs may use aluminum molds for agile market response but should factor in medium-term replacement budgets.

Engineering Plastics (e.g., Epoxy Resin, Polyurethane)

Key Properties:

Advanced plastics like epoxy resins or reinforced polyurethanes are increasingly used for rapid soft tooling, especially for prototyping or short-run orders. They offer quick production and flexible modifications.

Pros:

– Extremely fast turnaround—digital or manual patterning possible.

– Lowest material and fabrication costs.

– Simple to modify, ideal for design revisions and short time-to-market needs.

Cons:

– Very limited lifespan; easily worn by frequent cycles, heat, or high-pressure operation.

– Much lower precision and surface finish quality compared to metal molds.

– Not suitable for high-performance or large-scale series.

Application Impact:

Best suited for conceptual validation, samples, or one-off molding of orange components where cost minimization and speed take precedence.

International B2B Considerations:

Typically used internally or for validation samples—not for external delivery of commercial goods. Regulatory standards may not recognize such soft tools for official production; documentation requirements differ significantly between regions. Use cases in Africa and early-stage enterprises in South America or Southeast Asia may benefit most, but scale-up plans should anticipate migration to metal tooling.

Specialty Alloys (e.g., Beryllium-Copper)

Key Properties:

Some advanced molds leverage copper-based alloys for unique benefits—most importantly, superior thermal conductivity, which speeds cooling and cycle times, enhancing productivity.

Pros:

– Rapid heat dissipation; decreases molding cycle and boosts efficiency.

– Suitable for complex cavities or inserts where cooling is a production bottleneck.

– Resist corrosion and some chemical attack, extending service life for challenging applications.

Cons:

– Material cost is high; beryllium-copper alloys are expensive and require careful handling (e.g., toxicity).

– Limited general use; typically used as inserts or for specialty needs rather than full molds.

Application Impact:

Used strategically to improve productivity in the most demanding orange-molding scenarios, such as precision-engineered plastics or where cycle time is a key costing factor.

International B2B Considerations:

Selected mainly by advanced processors, typically in EU and specialized hubs. Regional regulations (e.g., REACH in Europe) may pose additional documentation/handling compliance requirements for beryllium content. Buyers should confirm local restrictions and disposal protocols.

Summary Table: Comparative Evaluation for Molding Orange

| Material | Typical Use Case for molding orange | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Steel (Tool Steel) | High-volume, long lifespan molds for export or regulated production | Exceptional durability, quality, and repeatability | High initial cost, complex fabrication, longer lead time | High |

| Aluminum | Prototypes, market testing, low/medium-volume production | Cost-effective, rapid turnaround | Shorter mold service life, less suitable for intensive use | Medium |

| Engineering Plastics | Design verification, sample runs, very low volume | Fast, easy, and inexpensive to modify | Very limited production cycles, low precision | Low |

| Beryllium-Copper Alloy | Inserts, specialized fast-cooling or precision molds | Outstanding thermal conductivity, boosts efficiency | High material cost, handling regulations, niche applications | High |

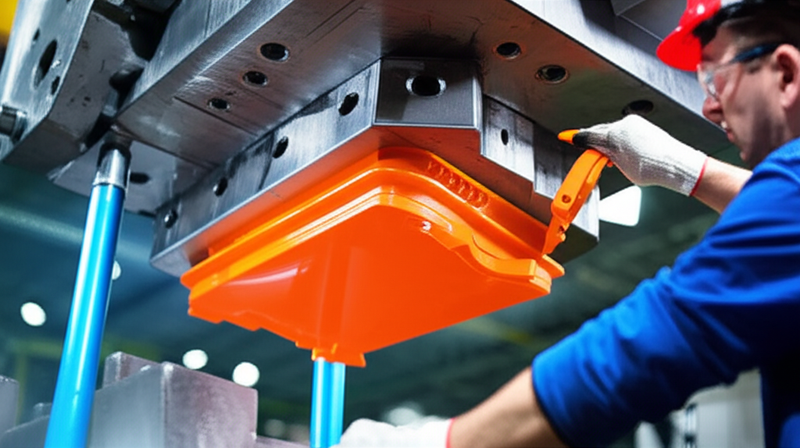

In-depth Look: Manufacturing Processes and Quality Assurance for molding orange

Molding orange products—ranging from brightly colored plastics to silicone or rubber parts—require meticulous manufacturing and thorough quality assurance to meet the rigorous demands of international B2B buyers. This section explores the typical stages, proven techniques, and actionable steps buyers from Africa, South America, the Middle East, and Europe can use to ensure successful partnerships and premium product outcomes.

Core Stages of the Manufacturing Process for Molding Orange

1. Material Selection and Preparation

The journey starts with careful selection of suitable raw materials. For orange molding, thermoplastics (such as ABS, PP, or PVC), silicones, or rubbers are often chosen based on end-use, durability, and compliance requirements. Colorants—specifically orange masterbatch or pigments—must be compatible with the material and stable under processing temperatures.

Before molding, raw materials are validated for purity and dried to prevent surface defects. This preparatory step often includes mixing in anti-oxidants, UV stabilizers, or flame retardants, depending on industry and regional requirements.

2. Forming and Molding Techniques

The predominant forming techniques include:

- Injection Molding: Most prevalent for high-volume, precision parts. Molten orange material is injected into custom steel or aluminum molds. The process is highly repeatable and yields excellent surface finish.

- Compression Molding: Suitable for simpler or larger parts, especially in rubber or silicone. Material is placed in a heated mold, compressed, and cured.

- Blow Molding: Employed for hollow items like bottles and containers, inflating plastic inside the mold to desired shape.

- Thermoforming: Heated orange plastic sheets are formed over custom molds for packaging or low-cost applications.

Each method is selected based on product geometry, application, and production scale. For orange parts, color uniformity and avoidance of streaking or shade variation are crucial KPIs during this stage.

3. Assembly and Secondary Operations

Some products require assembly (joining molded components, adding inserts, or post-molding decorations such as pad printing). Ensuring tight orientation and adhesion is critical—especially when exported to markets with strict regulatory controls. Special attention is given to avoiding contamination and preserving color vibrancy during post-molding operations.

4. Surface Finishing and Packaging

Finishing may include trimming, polishing, painting, or laser marking. These ensure products not only look visually appealing but also comply with regional consumer and safety expectations. Importantly for orange-colored goods, UV-resistant finishes or coatings are applied where outdoor durability is required. The packaging phase emphasizes protective measures to avoid abrasion or color fading during transit.

Quality Assurance: Standards, Checkpoints & Testing

Global Quality Standards and Certifications

- ISO 9001 (Quality Management Systems): The baseline for process control and repeatability worldwide. It mandates documented procedures, consistent traceability, and continual improvement.

- Industry-Specific Certifications:

- CE Marking: Essential for European Union sales, ensures health, safety, and environmental protection.

- API (American Petroleum Institute): For technical molded parts in oil & gas, sometimes involved in Middle East procurement.

- FDA Registration: For food-contact or medical applications, especially relevant to cross-market exports.

- RoHS/REACH: For products destined for the EU, ensures compliance with safety and environmental directives, particularly around dyes and additives.

Knowing market-entry certification requirements is crucial for buyers in Africa, Latin America, and the Middle East, where regulatory harmonization with Europe or the US is common for imported goods.

Key QC Checkpoints

To minimize defects and ensure conformance, leading manufacturers implement:

- Inbound Quality Control (IQC): On arrival, raw materials and masterbatches undergo inspection for purity, color consistency, and certification compliance (e.g., food-safe pigment, anti-UV additives).

- In-Process Quality Control (IPQC): During molding, operators sample parts for color uniformity, dimensional accuracy, and mold release quality. Advanced facilities employ automated vision systems for detecting color streaks or contaminant inclusions.

- Final Quality Control (FQC): Before packaging, finished goods are tested for functional fit, surface quality, shade consistency (using colorimeters), and any customer-specific tolerances.

Common Testing Methods

- Colorimetric Analysis: Ensures uniform orange coloration within tight ΔE (color difference) tolerances.

- Dimensional Gauging: Verifies conformance to technical drawings, using calipers, CMMs, or specialized fixtures.

- Mechanical Testing: For strength, flexibility, hardness—crucial for industrial buyers.

- Aging and UV Tests: Especially for outdoor or automotive applications.

- Chemical Resistance and Migration Testing: Required for food contact or sanitary applications, often backed by lab certifications.

How B2B Buyers Can Verify Supplier Quality

Ensuring a supplier’s QC meets expectations is non-negotiable in international trade. Here are actionable steps:

Supplier Audits

– Conduct on-site audits to verify process maturity, equipment condition, and employee training.

– For distant buyers (Africa, South America), leverage trusted local or international audit agencies familiar with ISO and CE requirements.

QC Documentation and Reporting

– Request batch-level QC reports showing testing results, including color variance, mechanical properties, and full traceability.

– Evaluate if reports meet both local regulatory and destination market requirements—especially for products bound for the EU, where documentation strictness is higher.

Third-Party Inspection Services

– Engage international inspection bodies (SGS, Bureau Veritas, Intertek) for pre-shipment verification. These services can inspect batches at various production stages, conduct random sampling, and issue impartial certificates.

Sample Approval

– Prioritize sample review before mass production. Approve shade, surface finish, and fit/function prototypes under real-world conditions to prevent costly returns and rejections.

Ongoing Performance Monitoring

– Establish regular quality review mechanisms for ongoing orders. Consider third-party lab testing in your own country as a post-delivery safeguard, especially for sectors involving public tenders or regulated goods.

Considerations for B2B Buyers Across Different Regions

Africa:

Local import regulations and infrastructure may vary, so demand detailed Certificates of Conformity (CoC), and prioritize suppliers with proven export track records. Consider language support for technical documentation and import clearance.

South America (e.g., Brazil):

Seek suppliers that comply with regional norms (INMETRO for Brazil), and double-check international test reports are recognized by local authorities. Infrastructure for inspections is robust—consider both local and international inspectors.

Middle East:

Many buyers require dual certification (e.g., European and GCC standards). Prioritize suppliers with flexible documentation and experience in cross-border logistics. Pay close attention to chemical certifications due to increasingly strict regional safety laws.

Europe:

High expectations for CE and REACH compliance. Demand detailed Master Batch Records for colorants and full traceability of supply chain. Sustainability, especially around dyes and additives, is increasingly scrutinized—ensure suppliers can demonstrate compliance with green manufacturing practices.

Final Thoughts: Building a Robust QC Partnership

For buyers across continents, effective quality assurance in molding orange products is based on transparency, documentation, and ongoing verification. Choose suppliers with demonstrable expertise in both process control and international certification. Insist on upfront communication about tolerances, regional regulations, and color requirements, as even minor inconsistencies in appearance or finish can significantly impact market acceptance and regulatory clearance.

By rigorously vetting suppliers, leveraging independent inspections, and keeping a pulse on evolving international standards, buyers can secure both product quality and competitive advantage in the global marketplace.

Related Video: Production Line – FACTORY I/O Scene

Comprehensive Cost and Pricing Analysis for molding orange Sourcing

Understanding the true cost drivers and pricing mechanisms for molding orange components is critical to making competitive, profitable sourcing decisions in global B2B markets. Multiple factors, from raw material selection to international shipping, can dramatically affect your bottom line. Below is a structured analysis tailored for buyers sourcing from or into markets across Africa, South America, the Middle East, and Europe.

Key Cost Components in Molding Orange Sourcing

1. Raw Materials

Material costs represent a significant portion of the total price. Choices between steel, aluminum, and engineering plastics for molds directly impact upfront expenses and ongoing production efficiency. For food-grade or medical-grade orange molding, higher-specification silicone or plastics may command a premium. Commodity price fluctuations and regional material availability also play a role.

2. Labor

Labor costs vary widely depending on manufacturing location. While lower-cost regions can offer savings, variations in skill level and experience can impact defect rates and rework expenses. Evaluate not only hourly rates but also productivity and training.

3. Manufacturing Overhead

This includes facilities, energy, equipment depreciation, and maintenance. Automation and advanced machinery can reduce per-unit overhead over large runs but require upfront investment. In developing markets, power reliability and infrastructure can affect costs.

4. Tooling

Tooling (the mold itself) is typically one of the largest initial investments. Hard tooling (steel molds) offers durability for long runs but higher costs, while soft tooling (aluminum or epoxy molds) is suited for prototyping or short production cycles at lower initial expense. Tool lifespan and required customizations will influence amortized cost per part.

5. Quality Control

For buyers in regulated markets (e.g., EU or GCC), costs for documentation, testing, and certification (ISO, FDA, CE) can be substantial. Demanding applications require stricter QC protocols, which increase inspection and reject handling costs.

6. Logistics and Shipping

Transport, customs duties, insurance, and compliance costs must be included. Incoterm choices (e.g., EXW, FOB, CIF, DDP) affect who bears costs and risks at each stage–critical for importers in Africa or the Middle East facing port or customs challenges.

7. Supplier Margin

Suppliers typically build in a profit margin reflecting their operational costs, market demand, and product complexity. Margins may be negotiable, especially on high-volume or repeat orders.

Primary Price Influencers

- Order Volume & MOQ: Larger orders enjoy economies of scale, reducing per-unit cost. Minimum order quantities (MOQ) may apply, impacting smaller buyers’ pricing power.

- Product Specifications: Customization, precision requirements, and special features raise tooling and production expenses.

- Material Selection: Food safety, heat resistance, or special certifications drive up raw matterial costs and supplier qualification costs.

- Quality & Certification Needs: For markets with high regulatory barriers (e.g., Europe), robust certification requirements can inflate both upfront and ongoing costs.

- Supplier Location & Expertise: Suppliers in Vietnam or Brazil may offer attractive labor rates but consider expertise in molding orange products, which affects both quality and price.

- Currency Fluctuations: Exchange rates can alter landed costs considerably, particularly in volatile economies.

- Incoterms and Delivery Terms: Responsibilities for insurance, freight, and taxes directly affect buyer’s true cost.

Strategic Cost Management Tips for International B2B Buyers

- Negotiate Total Cost, Not Just Unit Price: Request detailed quotes that break down tooling, material, labor, and overhead to identify leverage points.

- Consider Total Cost of Ownership (TCO): Look beyond initial price—factor in mold lifespan, maintenance, waste, defect rates, shipping times, and after-sales support.

- Optimize Volume & Batching: Pooling orders with regional partners or consolidating shipments can reduce MOQs, logistics costs, and unit pricing.

- Tailor Specifications Wisely: Avoid over-specification that unnecessarily raises costs; specify only the critical requirements based on end-use and market regulations.

- Leverage Certifications and Supplier Audits: For access to European or Middle Eastern markets, only source from suppliers with relevant certificates (e.g., ISO 9001, CE, Halal, etc.) to avoid costly compliance surprises.

- Negotiate Incoterms Strategically: For Africa or remote markets, choosing a term like DDP shifts customs risk to the supplier, while FOB or CIF may offer better local control but higher importer responsibility.

- Monitor Market Trends: Track raw material price indices and regional wage changes to time purchases for maximum savings.

Disclaimer: Pricing and cost drivers for molding orange components vary significantly based on project scope, supplier geography, and market dynamics. All cost estimates should be considered indicative and validated with direct quotations and comprehensive due diligence.

By understanding and actively managing each of these factors, international B2B buyers can secure more favorable terms, reduce risk, and enhance cost-efficiency when sourcing molding orange products.

Spotlight on Potential molding orange Manufacturers and Suppliers

This section offers a look at a few manufacturers active in the ‘molding orange’ market. This is a representative sample for illustrative purposes; B2B buyers must conduct their own extensive due diligence before any engagement. Information is synthesized from public sources and general industry knowledge.

10 Orange Processing Companies in the World (essfeed.com)

10 Orange Processing Companies in the World collectively represent some of the leading manufacturers and suppliers within the global orange processing sector. These companies are recognized for their extensive operations in orange-based product manufacturing, including molding orange for use in juices, concentrates, and value-added food products. Many operate large-scale, vertically integrated facilities equipped for end-to-end processing—ranging from raw fruit handling to advanced molding and finishing, ensuring quality and efficiency across supply chains.

Several companies in this group are known to serve international clients across Africa, South America, the Middle East, and Europe, underlining well-established global logistics and customer service capabilities. Although specific certifications may vary by company, industry leaders in this cohort often prioritize compliance with major quality standards such as ISO and HACCP. B2B buyers benefit from robust production capacities, a focus on consistency and food safety, and proven experience meeting diverse regulatory and import requirements. While individual company details may be limited, this selection is widely regarded as a benchmark for reliability and innovation in molding orange solutions.

The 8 Best Orange Manufacturers (www.keychain.com)

The 8 Best Orange Manufacturers stand out as key partners for B2B buyers seeking high-quality “molding orange” products. This group specializes in reliable contract manufacturing and co-packing, with a focus on certification compliance and robust supply chain management. Their processing capabilities cover a variety of molding techniques suited for both large-scale and niche applications, supporting international buyer requirements across diverse markets.

Notably, these manufacturers offer private label opportunities, representing a cost-effective and strategic entry into the molding orange market—private label services contribute to over 5% of market volume and are experiencing over 9% annual growth. While detailed public data on specific certifications and machinery is limited, the manufacturers are recognized for upholding global quality standards and for their experience managing international shipments to Africa, South America, the Middle East, and Europe. Their expertise in supply logistics and product customization makes them valuable for buyers requiring flexibility and market adaptation.

Global leading orange producers 2023/2024 (www.statista.com)

With a commanding presence in the global orange sector, this producer achieved a market-leading output of approximately 16.5 million metric tons in the 2023/2024 season, consolidating its role as a primary supplier for commercial applications such as ‘molding orange’. The company demonstrates significant expertise in supplying high-quality, consistency-graded fresh oranges—an essential factor for buyers seeking reliable raw material for molding processes. Its operational scale and modern horticultural practices enable strong year-round supply continuity, supporting both high-volume and specialized industrial requirements.

This producer has extensive experience with cross-continental distribution, particularly to Africa, South America, the Middle East, and Europe, making it a strategic partner for international B2B buyers. While detailed certifications or bespoke molding technologies are not publicly listed, the organization’s dominant output and global reach suggest robust infrastructure and compliance with major market standards.

Quick Comparison of Profiled Manufacturers

| Manufacturer | Brief Focus Summary | Website Domain |

|---|---|---|

| 10 Orange Processing Companies in the World | Global leaders, orange molding, broad export capacity | essfeed.com |

| The 8 Best Orange Manufacturers | Private label, certified, international orange molding. | www.keychain.com |

| Global leading orange producers 2023/2024 | Global scale, reliable supply, widespread export experience | www.statista.com |

Essential Technical Properties and Trade Terminology for molding orange

Key Technical Specifications in Molding Orange

Understanding the technical properties of molding orange is crucial for international B2B buyers seeking reliable partners and consistent product performance. Here are the main specifications to consider:

-

Material Grade:

Defines the type and quality of material used in the mold—whether it’s a specific polymer, silicone, or metal. High-grade materials ensure better durability, improved part consistency, and compliance with regulatory requirements. When sourcing internationally, always verify the globally recognized standards (e.g., ASTM, ISO) and request certifications to avoid substandard supplies. -

Tolerance:

Tolerance indicates the acceptable dimensional variation in molded parts, typically measured in millimeters or microns. Tight tolerances are vital when components need to fit precisely in assemblies, such as in automotive, medical, or packaging sectors. Specifying exact tolerances in contracts minimizes disputes over quality and reduces rework or rejects in later stages. -

Cycle Time:

This is the amount of time required to complete one molding cycle—from mold closing to part ejection. Shorter cycle times boost batch production efficiency and lower unit costs, but excessive speed can impact quality. Buyers should align their supply chain planning with the supplier’s cycle time capabilities, especially for time-sensitive markets like FMCG. -

Cavity Number:

Indicates how many identical parts can be produced in one molding cycle. Multi-cavity molds accelerate high-volume manufacturing but may require larger initial investments. Understanding a supplier’s cavity setup helps buyers accurately forecast lead times and optimize logistics for bulk orders. -

Surface Finish:

This specification describes the final texture or smoothness of the molded part. Surface finish impacts product aesthetics, functionality, and sometimes regulatory compliance (e.g., food or medical uses). For international buyers, requesting samples or technical sheets of surface finish ensures products meet local customer expectations. -

Shrinkage Rate:

Shrinkage is the percentage decrease in part dimensions as the molded material cools and solidifies. Unmanaged shrinkage can result in parts that don’t fit their intended application. It is crucial to discuss shrinkage values at the quoting stage for precision applications, particularly when sourcing across climate variations.

Common Industry and Trade Terms in Molding

Navigating the global molding trade requires fluency in key industry terms. Here are several essential terms every B2B buyer should understand:

-

OEM (Original Equipment Manufacturer):

Refers to a company that produces parts or products that are rebranded and sold by another company. For buyers, identifying reliable OEMs is essential for securing consistent supplies and negotiating private label arrangements. -

MOQ (Minimum Order Quantity):

The smallest batch size a supplier is willing to produce or sell. MOQs impact inventory levels, pricing, and cash flow. Buyers from Africa or South America, where warehousing or capital is a concern, should negotiate MOQs to match their market demand. -

RFQ (Request for Quotation):

A formal solicitation to suppliers to provide pricing and terms for a specified product or service. A well-crafted RFQ with detailed specs (material grade, cycle time, finish, etc.) enables accurate and competitive quotes, reducing negotiation time and supply risk. -

Incoterms:

International Commercial Terms standardize the allocation of shipping, insurance, and customs responsibilities between buyers and sellers. Understanding terms like FOB (Free on Board), CIF (Cost, Insurance, and Freight), or DDP (Delivered Duty Paid) is critical in cross-border transactions to avoid unexpected costs and delays. -

Lead Time:

The total time from placing an order to receiving goods. Lead times can vary due to tooling changeovers, mold complexity, or international logistics. Buyers need to clarify lead times upfront to synchronize production schedules and customer delivery commitments. -

Tooling:

The mold or set of molds used to manufacture the products. Tooling is a significant investment and is sometimes owned by the buyer or the supplier, depending on the business model. Terms relating to tooling ownership, maintenance, and transfer should be agreed upon to prevent disputes if production needs shift to a new region or supplier.

Mastering these properties and terms mitigates risk, enhances negotiation leverage, and ensures alignment with international suppliers—an essential foundation for effective B2B sourcing and long-term business growth in diverse global markets.

Navigating Market Dynamics, Sourcing Trends, and Sustainability in the molding orange Sector

Global Market Overview and Key Sourcing Trends

The “molding orange” sector—encompassing precision molding of orange plastics or silicones for industrial applications—is experiencing rapid transformation, largely driven by advancements in manufacturing technologies and heightened global demand. International B2B buyers, especially from regions such as Africa, South America (notably Brazil), the Middle East, and Europe (including supply-chain powerhouses like Vietnam), are leveraging these shifts to diversify supply chains, reduce costs, and improve product innovation.

Key global drivers include growing demand for complex molded components in sectors like automotive, healthcare, packaging, and consumer goods. Injection molding remains the dominant production method due to its scalability, repeatability, and material flexibility. For international buyers, an important trend is the adoption of hybrid tooling strategies (balancing soft and hard tooling) to enable rapid prototyping and agile production for both low and high-volume needs.

B2B sourcing trends reflect a significant move toward nearshoring and multi-sourcing strategies, especially in response to recent global logistics disruptions. Buyers are seeking suppliers capable of not only producing high-quality, precision-molded orange components but also demonstrating transparency in lead times and the ability to process a range of materials (from durable thermoplastics to eco-friendly silicones).

Emerging technologies such as digital mold design (CAD/CAM), automated quality inspection, and IoT-enabled manufacturing are improving supply reliability and product consistency. These innovations enable tighter tolerances, shortened development cycles, and more competitive pricing. Smart vendors are also offering co-development services, assisting buyers from concept through to commercialization—particularly appealing for B2B customers requiring bespoke solutions.

Regional market dynamics highlight varying requirements: African and South American buyers may emphasize cost-efficiency, scalability, and robust logistics solutions due to infrastructure challenges. Middle Eastern and European buyers often focus on process certification, material traceability, and compliance with increasingly stringent regulatory standards—all of which impact supplier selection and contractual terms.

Sustainability and Ethical Sourcing Imperatives in Molding Orange

Environmental considerations and ethical sourcing are now central to B2B purchasing in the molding sector. As global regulations tighten and consumer preferences shift, buyers must prioritize suppliers demonstrably committed to sustainable manufacturing and transparent supply chains.

Key environmental impacts in molding include energy use, waste production, and the lifecycle of raw materials. Forward-thinking manufacturers are shifting to low-emission machinery, closed-loop water cooling, and recycling of offcuts or scrap materials. For orange-colored components, using eco-friendly dyes and low-VOC (volatile organic compound) materials is increasingly standard. International buyers should look for vendors with proven reduction in carbon footprint and minimal hazardous waste output.

Ethical supply chains are equally vital. Buyers should prioritize supplier partners who adhere to global labor standards, practice responsible sourcing of polymers, and deliver full traceability from material origin to finished part. Third-party certifications—such as ISO 14001 (environmental management), FSC (for biopolymers), or regional equivalents—offer tangible proof of a supplier’s green and ethical credentials.

Green certifications and materials are a competitive differentiator. Many B2B buyers now require evidence of recycled or bio-based feedstocks, especially for applications targeting sustainability-conscious markets. An increasing number of suppliers are investing in “green molding compounds,” derived from renewable sources or containing post-consumer recycled content, which satisfy both regulatory and market expectations. Transparent communication about environmental impact, verified through Life Cycle Assessments (LCAs) or equivalent audits, strengthens supplier–buyer relationships and supports corporate sustainability goals.

Brief Evolution and Strategic Transformation

Modern molding practices have evolved considerably over the past few decades. Traditionally, orange molded products were manufactured using labor-intensive, low-precision methods, making scale and customization difficult. The digital revolution has brought about integrated mold design, high-precision CNC machining, and process automation, enabling mass customization without sacrificing quality or efficiency.

Today’s suppliers operate with global reach, supported by robust supply chains and advanced manufacturing ecosystems that bridge continents. For B2B buyers, staying informed about these transformations—not only in manufacturing technology but also in global trade dynamics and sustainability benchmarks—is critical to maintaining a resilient, responsive, and future-ready sourcing strategy.

Related Video: THINK GLOBAL CONFERENCE 2021 – The basics of international trade compliance

Frequently Asked Questions (FAQs) for B2B Buyers of molding orange

-

How should I vet and select reliable molding orange suppliers internationally?

To ensure supplier reliability, start by evaluating their industry reputation and track record in molding production. Look for verifiable business licenses, international certifications (such as ISO 9001), and references from clients in similar regions. Conduct a factory audit, either virtually or through a third-party, to assess production capacity, quality control processes, and compliance with international standards. Request product samples to evaluate quality before placing large orders. Utilize trade platforms with trusted verification systems or consult regional trade organizations familiar with the supplier landscape. -

What customization options are available for molding orange, and how do I communicate my specifications?

Customization for molding orange typically includes specific dimensions, shapes, colors, branding elements, and material choices. Define your requirements using detailed drawings, CAD files, or prototypes. Clear communication is crucial—share precise technical specifications and quality expectations upfront. Utilize regular digital meetings and request design confirmations or pre-production samples. If language or regulatory differences exist, consider working with a local sourcing agent or translator to ensure all details are properly understood and executed. -

What are common minimum order quantities (MOQs) and typical lead times for molding orange?

MOQs for molding orange can vary depending on the supplier’s capacity and the complexity of customization, but they often start around 1,000–5,000 pieces for standard designs, and may be higher for bespoke projects. Lead times typically range from 3 to 8 weeks, accounting for mold fabrication, material sourcing, and quality checks. To minimize delays, confirm timelines in the contract and monitor production milestones. Discuss options for expedited production if urgent delivery is needed, though this may incur additional costs. -

What payment terms are standard when sourcing molding orange from overseas suppliers?

International suppliers often request a 30–50% deposit upfront, with the balance due before shipment or upon receipt of the bill of lading. Secure payment methods, such as Letters of Credit (LC), escrow services, or bank transfers, are advised to minimize transaction risks. Negotiate for flexible terms as your relationship strengthens, and always clarify what is included in the payment (e.g., mold ownership, post-delivery support). Retain all transaction documentation for potential customs or dispute queries. -

Which international quality assurance and certification standards should I require for molding orange?

Prioritize suppliers compliant with globally recognized standards like ISO 9001 (quality management) and relevant regional safety certifications (e.g., CE for Europe). For food-contact or medical-grade products, look for additional certifications such as FDA or SGS reports. Request comprehensive product documentation, including material data sheets, test reports, and conformity declarations. Independent third-party inspections before shipment can add an extra layer of assurance, allowing you to detect quality issues early. -

What logistics and shipping considerations are critical for large-volume international orders?

Assess shipping methods (sea, air, land) and incoterms (such as FOB, CIF, or DDP) to determine responsibility for costs and risks. Work with freight forwarders experienced in your region to navigate documentation, customs clearance, and import duties. For Africa, South America, and the Middle East, consider any unique import regulations or port infrastructure challenges in your target country. Establish clear packaging and labeling requirements to avoid damage or customs delays. Tracking and insurance should be standard for high-value orders. -

How should I manage supply chain risks, including disputes or non-conformance with molding orange suppliers?

Mitigate risks by formalizing contracts with detailed product specifications, quality standards, delivery schedules, and dispute resolution procedures. Insist on pre-shipment inspections and maintain ongoing communication through production. If non-conformance occurs, document the issue clearly with photos and test reports, and refer to your contract for remedies such as replacement, repair, or compensation. For disputes, mediation through trade bodies or use of international arbitration (e.g., ICC) may be preferable to local courts. -

Are there regional procurement practices or regulations I should be aware of when sourcing molding orange?

Yes, buyer obligations and import rules can differ significantly across Africa, South America, the Middle East, and Europe. Understand local certifications, documentation (such as certificates of origin or conformity), and labeling requirements. Some countries impose tariffs or require registration of foreign suppliers. Partnering with local legal, customs, or procurement experts can smooth the import process. Stay updated on trade agreements or restrictions that may affect costs or supply continuity. Regularly review regulatory changes to avoid unplanned delays or expenses.

Strategic Sourcing Conclusion and Outlook for molding orange

Strategic sourcing of molding orange components requires a deep understanding of material properties, manufacturing processes, and supplier capabilities. Key takeaways for international B2B buyers include the critical importance of matching mold materials and tooling approaches—such as choosing between durable steel for high-volume runs or cost-effective aluminum for shorter projects—to production requirements and budget constraints. Buyers should carefully evaluate supplier expertise, QC measures, and production scalability to ensure the consistency and reliability essential for long-term business success.

For companies based in Africa, South America, the Middle East, and Europe, leveraging global supply chains offers access to advanced technologies and competitive pricing but also demands a robust approach to risk management, quality assurance, and transparent communication. Collaborative supplier partnerships and precise technical specifications are essential for navigating regulatory requirements and achieving on-time deliveries in diverse markets.

Looking ahead, the dynamic landscape of mold manufacturing—driven by process innovation, sustainable materials, and digital integration—presents significant opportunities for forward-thinking buyers to build resilient, agile sourcing strategies. Investing in supplier development, exploring automation, and prioritizing adaptability will help buyers from emerging and established regions gain a strategic edge. Now is the time for procurement leaders to foster stronger relationships, embrace continuous improvement, and drive their organizations toward lasting competitiveness in the molding orange supply market.